- China

- /

- Household Products

- /

- SZSE:301327

Shenzhen Hello Tech Energy Co., Ltd.'s (SZSE:301327) Share Price Could Signal Some Risk

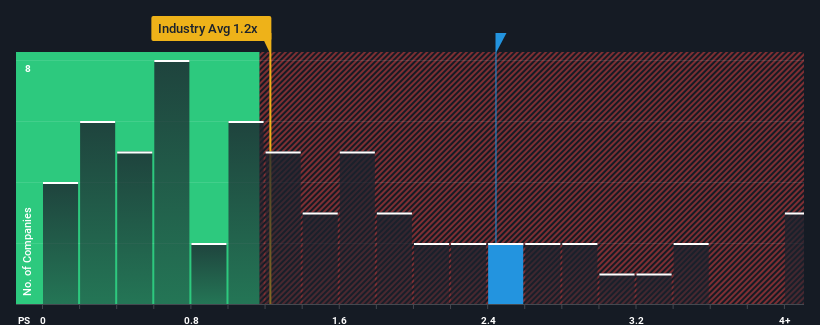

When close to half the companies in the Household Products industry in China have price-to-sales ratios (or "P/S") below 1.8x, you may consider Shenzhen Hello Tech Energy Co., Ltd. (SZSE:301327) as a stock to potentially avoid with its 2.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Shenzhen Hello Tech Energy

What Does Shenzhen Hello Tech Energy's Recent Performance Look Like?

Shenzhen Hello Tech Energy has been struggling lately as its revenue has declined faster than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Shenzhen Hello Tech Energy's future stacks up against the industry? In that case, our free report is a great place to start.How Is Shenzhen Hello Tech Energy's Revenue Growth Trending?

Shenzhen Hello Tech Energy's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. Still, the latest three year period has seen an excellent 139% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 17% over the next year. With the industry predicted to deliver 16% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Shenzhen Hello Tech Energy's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Shenzhen Hello Tech Energy's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Shenzhen Hello Tech Energy currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

Before you take the next step, you should know about the 1 warning sign for Shenzhen Hello Tech Energy that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301327

Shenzhen Hello Tech Energy

Engages in the research and development, manufacture, and sale of portable power products in China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026