- China

- /

- Personal Products

- /

- SZSE:300957

Fewer Investors Than Expected Jumping On Yunnan Botanee Bio-Technology Group Co.LTD (SZSE:300957)

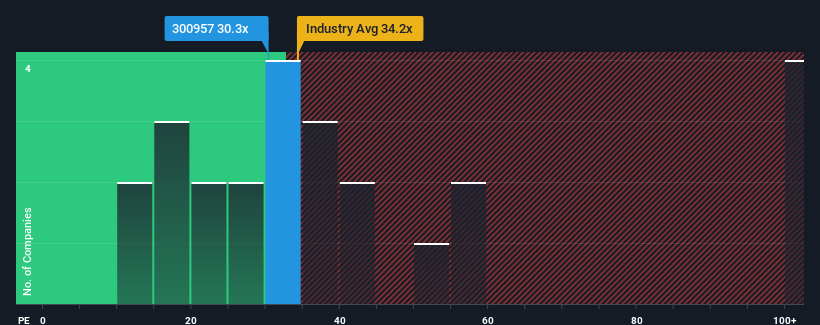

Yunnan Botanee Bio-Technology Group Co.LTD's (SZSE:300957) price-to-earnings (or "P/E") ratio of 30.3x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 35x and even P/E's above 68x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Yunnan Botanee Bio-Technology GroupLTD has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Yunnan Botanee Bio-Technology GroupLTD

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Yunnan Botanee Bio-Technology GroupLTD would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 46%. The last three years don't look nice either as the company has shrunk EPS by 19% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 61% as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 38%, which is noticeably less attractive.

With this information, we find it odd that Yunnan Botanee Bio-Technology GroupLTD is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Yunnan Botanee Bio-Technology GroupLTD's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Yunnan Botanee Bio-Technology GroupLTD currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You always need to take note of risks, for example - Yunnan Botanee Bio-Technology GroupLTD has 3 warning signs we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300957

Yunnan Botanee Bio-Technology GroupLTD

Engages in the research, development, production, and sale of cosmetics in China and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026