- China

- /

- Medical Equipment

- /

- SZSE:300562

Guangdong Transtek Medical Electronics Co., Ltd (SZSE:300562) Soars 26% But It's A Story Of Risk Vs Reward

Guangdong Transtek Medical Electronics Co., Ltd (SZSE:300562) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The annual gain comes to 127% following the latest surge, making investors sit up and take notice.

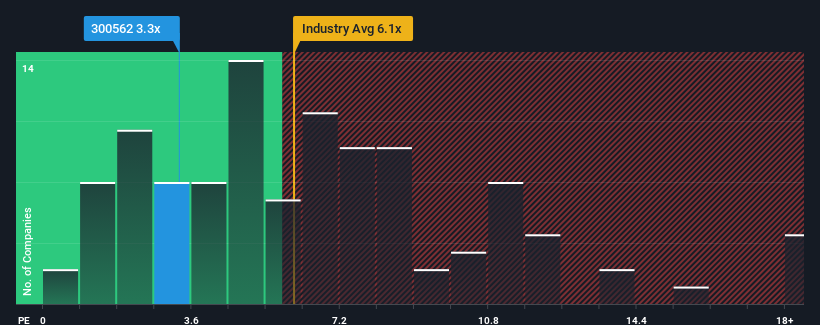

In spite of the firm bounce in price, it would still be understandable if you think Guangdong Transtek Medical Electronics is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 3.3x, considering almost half the companies in China's Medical Equipment industry have P/S ratios above 6.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Guangdong Transtek Medical Electronics

How Has Guangdong Transtek Medical Electronics Performed Recently?

With revenue growth that's superior to most other companies of late, Guangdong Transtek Medical Electronics has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guangdong Transtek Medical Electronics.Is There Any Revenue Growth Forecasted For Guangdong Transtek Medical Electronics?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Guangdong Transtek Medical Electronics' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 42% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 40% over the next year. That's shaping up to be materially higher than the 24% growth forecast for the broader industry.

In light of this, it's peculiar that Guangdong Transtek Medical Electronics' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift Guangdong Transtek Medical Electronics' P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Guangdong Transtek Medical Electronics' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Guangdong Transtek Medical Electronics (1 doesn't sit too well with us!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300562

Guangdong Transtek Medical Electronics

Provides smart wearables and mobile medical care products in China and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives