Stock Analysis

- China

- /

- Healthtech

- /

- SZSE:300253

Spotlight On 3 Chinese Growth Companies With Insider Ownership Above 17%

Reviewed by Simply Wall St

Amid fluctuating global markets, China's economic landscape presents a mixed picture with signs of recovery in the property sector despite overall market retreats. In such an environment, examining growth companies with substantial insider ownership could offer valuable insights into firms that potentially have aligned interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 24.8% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| Fujian Wanchen Biotechnology Group (SZSE:300972) | 15.3% | 75.9% |

| UTour Group (SZSE:002707) | 24% | 33.1% |

| Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Ningbo Deye Technology Group (SHSE:605117)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ningbo Deye Technology Group Co., Ltd. operates in the manufacturing and sale of heat exchangers, inverters, and dehumidifiers across regions including China, the United Kingdom, the United States, Germany, and India with a market capitalization of CN¥42.50 billion.

Operations: The company generates revenue primarily through the manufacture and sale of heat exchangers, inverters, and dehumidifiers across various global markets.

Insider Ownership: 24.8%

Ningbo Deye Technology Group, with a P/E ratio of 26x below the Chinese market average of 30.1x, is positioned attractively in terms of value. The company's earnings are expected to grow by 28.4% per year, outpacing the Chinese market forecast of 22.8%. Despite high volatility in its share price recently, it maintains a strong projected return on equity at 34.1%. However, its dividend coverage is weak due to insufficient cash flows from operations. Recent financial results show a decline in quarterly net income and revenue compared to the previous year.

- Click here and access our complete growth analysis report to understand the dynamics of Ningbo Deye Technology Group.

- The analysis detailed in our Ningbo Deye Technology Group valuation report hints at an inflated share price compared to its estimated value.

Naruida Technology (SHSE:688522)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Naruida Technology Co., Ltd. is a Chinese company specializing in the manufacture and sale of polarized multifunctional active phased array radars, with a market capitalization of approximately CN¥10.06 billion.

Operations: The company generates revenue primarily through the production and sales of radar products, amounting to CN¥208.86 million.

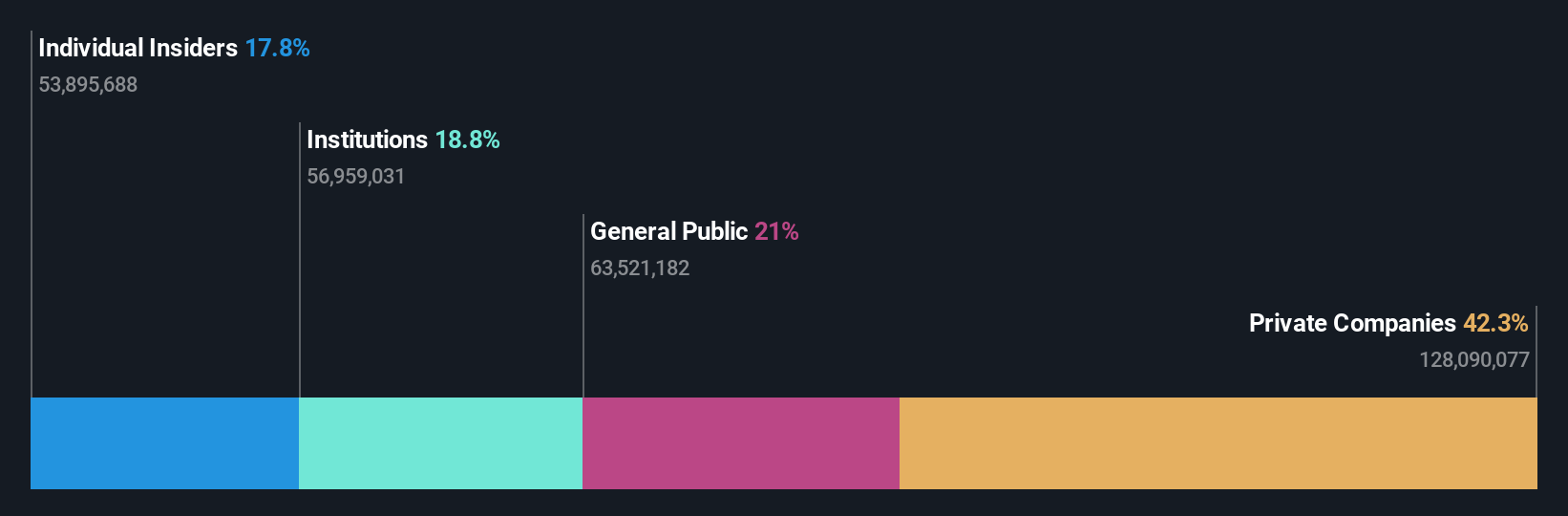

Insider Ownership: 17.8%

Naruida Technology is poised for significant growth with expected annual earnings increasing by 58.5% and revenue by 52.3%, both well above the Chinese market averages of 22.8% and 13.9%, respectively. Despite its high volatility in share price, the company maintains a robust profit margin though reduced from last year, at 28.3%. Recent events include a stock split and regular dividend payout, indicating active management engagement amidst its rapid growth trajectory.

- Click here to discover the nuances of Naruida Technology with our detailed analytical future growth report.

- Our valuation report here indicates Naruida Technology may be overvalued.

Winning Health Technology Group (SZSE:300253)

Simply Wall St Growth Rating: ★★★★☆☆

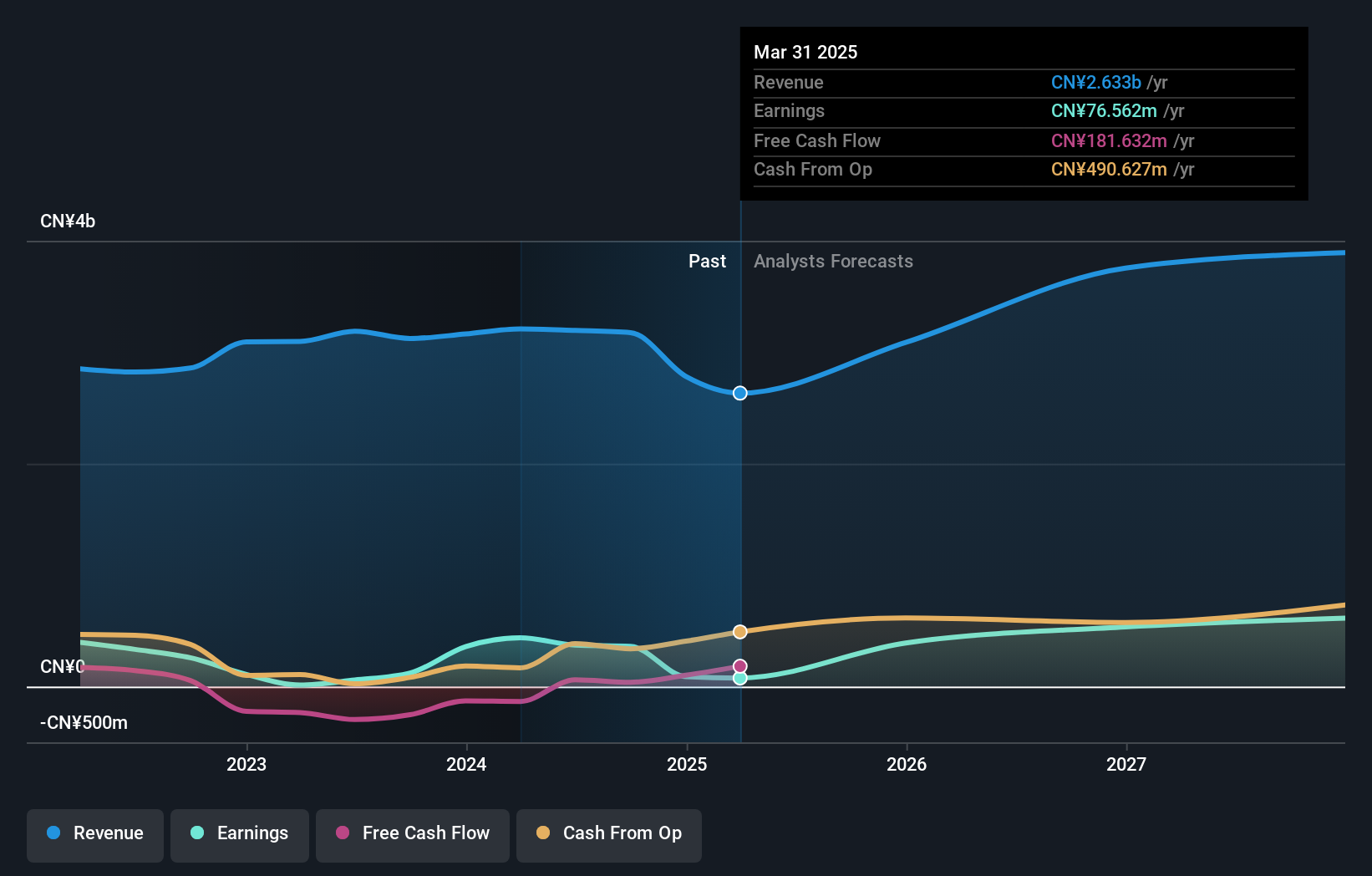

Overview: Winning Health Technology Group Co., Ltd. operates in the healthcare technology sector, providing integrated solutions and services, with a market capitalization of approximately CN¥13.30 billion.

Operations: The company generates revenue through its integrated healthcare technology solutions and services.

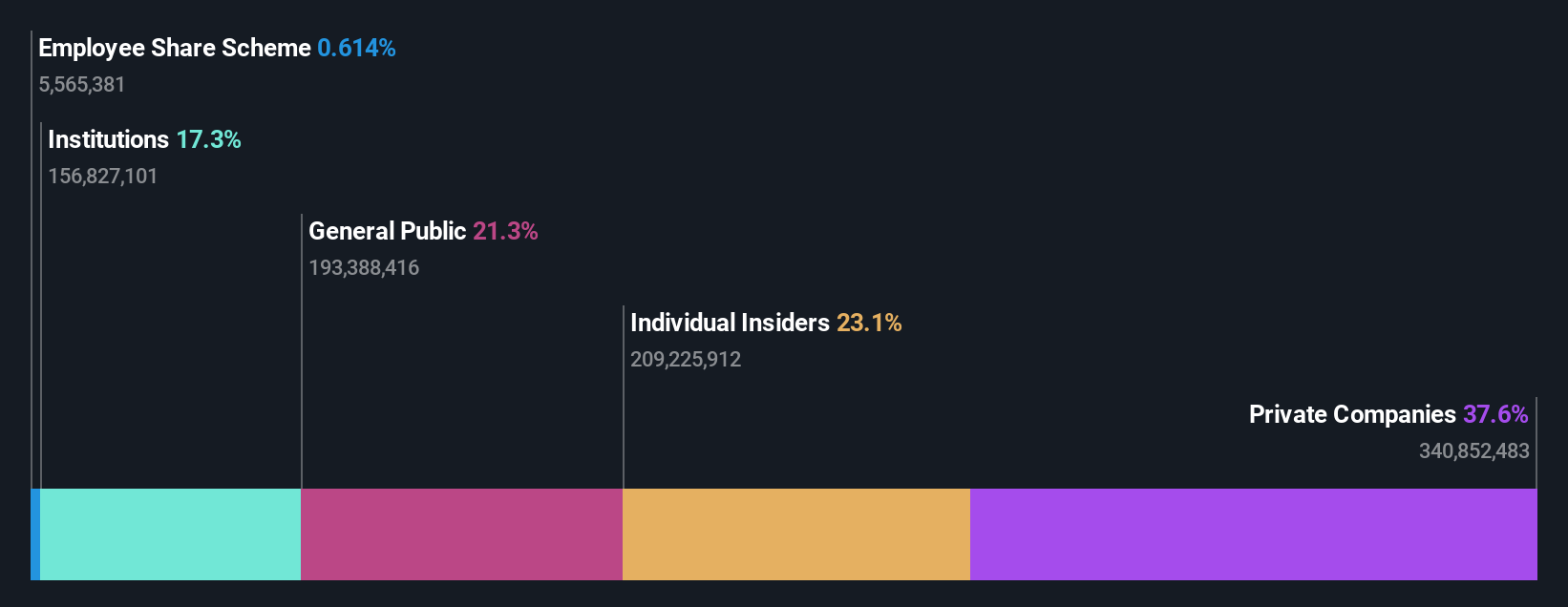

Insider Ownership: 22.7%

Winning Health Technology Group, a Chinese healthcare firm, demonstrates promising growth with an earnings forecast increase of 25.6% annually, outpacing the market's 22.8%. Despite a low forecasted return on equity of 10.4%, the company has high insider ownership and no substantial insider selling reported in the past three months. Recent financials show a significant turnaround with net income reaching CNY 357.96 million from CNY 108.64 million last year, supported by robust sales growth to CNY 3.16 billion.

- Delve into the full analysis future growth report here for a deeper understanding of Winning Health Technology Group.

- Upon reviewing our latest valuation report, Winning Health Technology Group's share price might be too optimistic.

Seize The Opportunity

- Click here to access our complete index of 385 Fast Growing Chinese Companies With High Insider Ownership.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Winning Health Technology Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300253

Winning Health Technology Group

Winning Health Technology Group Co., Ltd.

Reasonable growth potential with adequate balance sheet.