- China

- /

- Medical Equipment

- /

- SZSE:300206

Undiscovered Gems In Asia Top Stocks To Watch October 2025

Reviewed by Simply Wall St

As the Asian markets continue to show resilience amid global economic shifts, investors are keenly observing small-cap stocks that have been gaining traction, particularly in technology and manufacturing sectors. In this dynamic environment, a good stock is often characterized by strong fundamentals and the ability to capitalize on emerging market trends, making it an intriguing prospect for those looking to diversify their portfolios with under-the-radar opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Kyoritsu Electric | 3.87% | 6.01% | 17.16% | ★★★★★★ |

| Kanro | NA | 7.15% | 36.82% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 1.64% | 15.30% | ★★★★★★ |

| Thai Steel Cable | NA | 4.17% | 18.81% | ★★★★★★ |

| Green World Fintech Service | 5.27% | 9.27% | 14.30% | ★★★★★★ |

| Jiangsu Longda Superalloy | 19.49% | 17.75% | -5.32% | ★★★★★☆ |

| Dura Tek | 1.52% | 68.54% | 50.63% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

| HannStar Board | 96.47% | -3.24% | -4.55% | ★★★★☆☆ |

| Li Ming Development Construction | 170.96% | 14.13% | 22.83% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Dongguan Aohai Technology (SZSE:002993)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dongguan Aohai Technology Co., Ltd. engages in the design, research, development, production, and sales of consumer electronics products both domestically and internationally with a market capitalization of CN¥13.18 billion.

Operations: Aohai Technology generates revenue through the production and sales of consumer electronics products. The company has a market capitalization of CN¥13.18 billion.

Aohai Technology seems to be an intriguing player in Asia's tech scene, boasting a price-to-earnings ratio of 25.2x, which is favorable compared to the broader CN market at 45.3x. The company reported sales of CNY 5.19 billion for the first nine months of 2025, up from CNY 4.55 billion last year, and net income rose to CNY 358.58 million from CNY 300.53 million in the same period last year, reflecting its strong performance trajectory with earnings growth surpassing industry averages at 33.1%. Additionally, Aohai has repurchased over a million shares worth CNY 44.99 million this year, indicating confidence in its valuation and future prospects despite recent share price volatility.

- Navigate through the intricacies of Dongguan Aohai Technology with our comprehensive health report here.

Learn about Dongguan Aohai Technology's historical performance.

Edan Instruments (SZSE:300206)

Simply Wall St Value Rating: ★★★★★★

Overview: Edan Instruments, Inc. is involved in the research, development, manufacture, and service of medical electronic equipment and in vitro diagnostic products both in China and globally, with a market cap of CN¥8.10 billion.

Operations: Edan Instruments generates revenue primarily from its medical electronic equipment and in vitro diagnostic products. The company's financial performance is reflected in its market capitalization of CN¥8.10 billion.

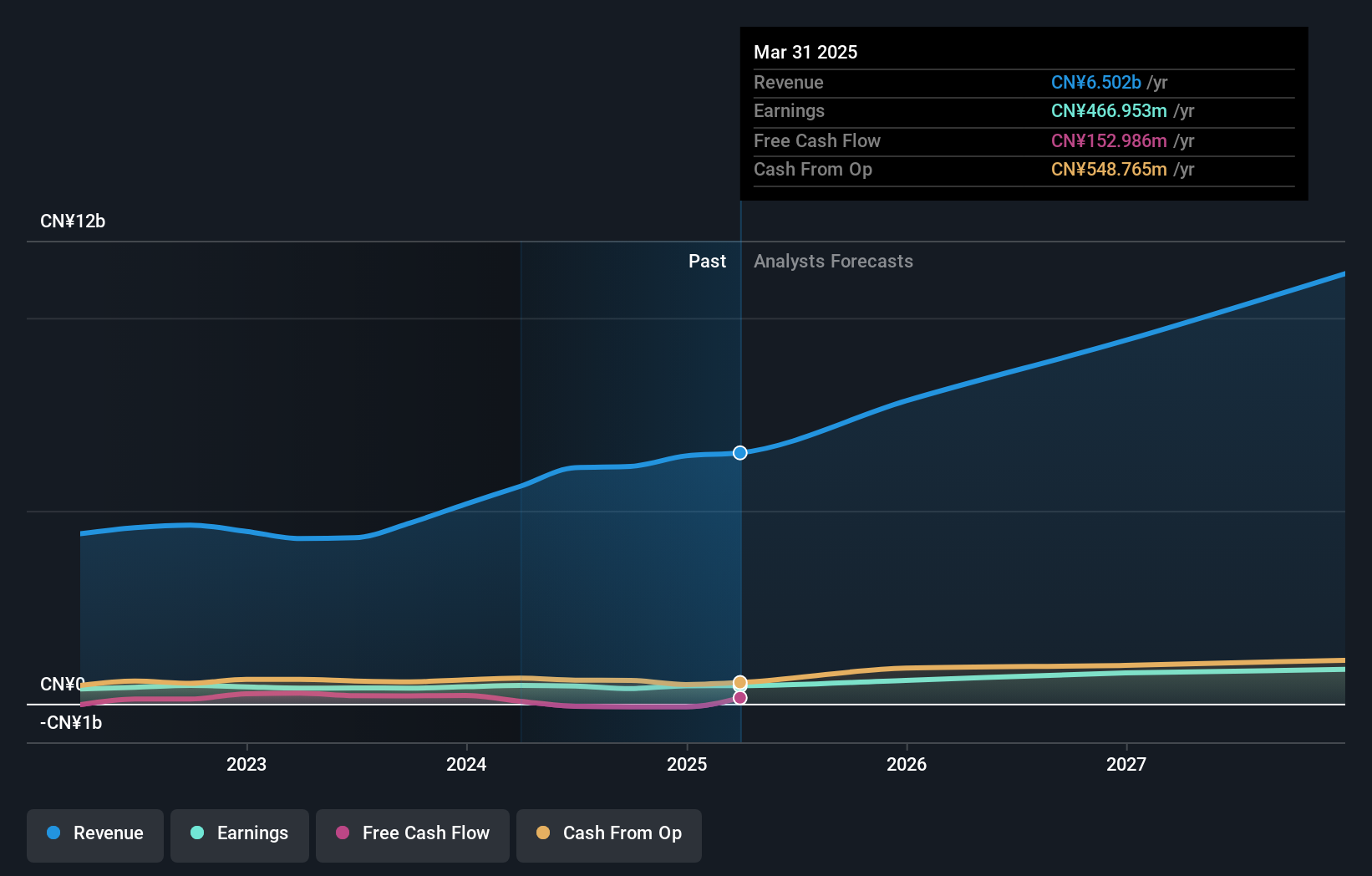

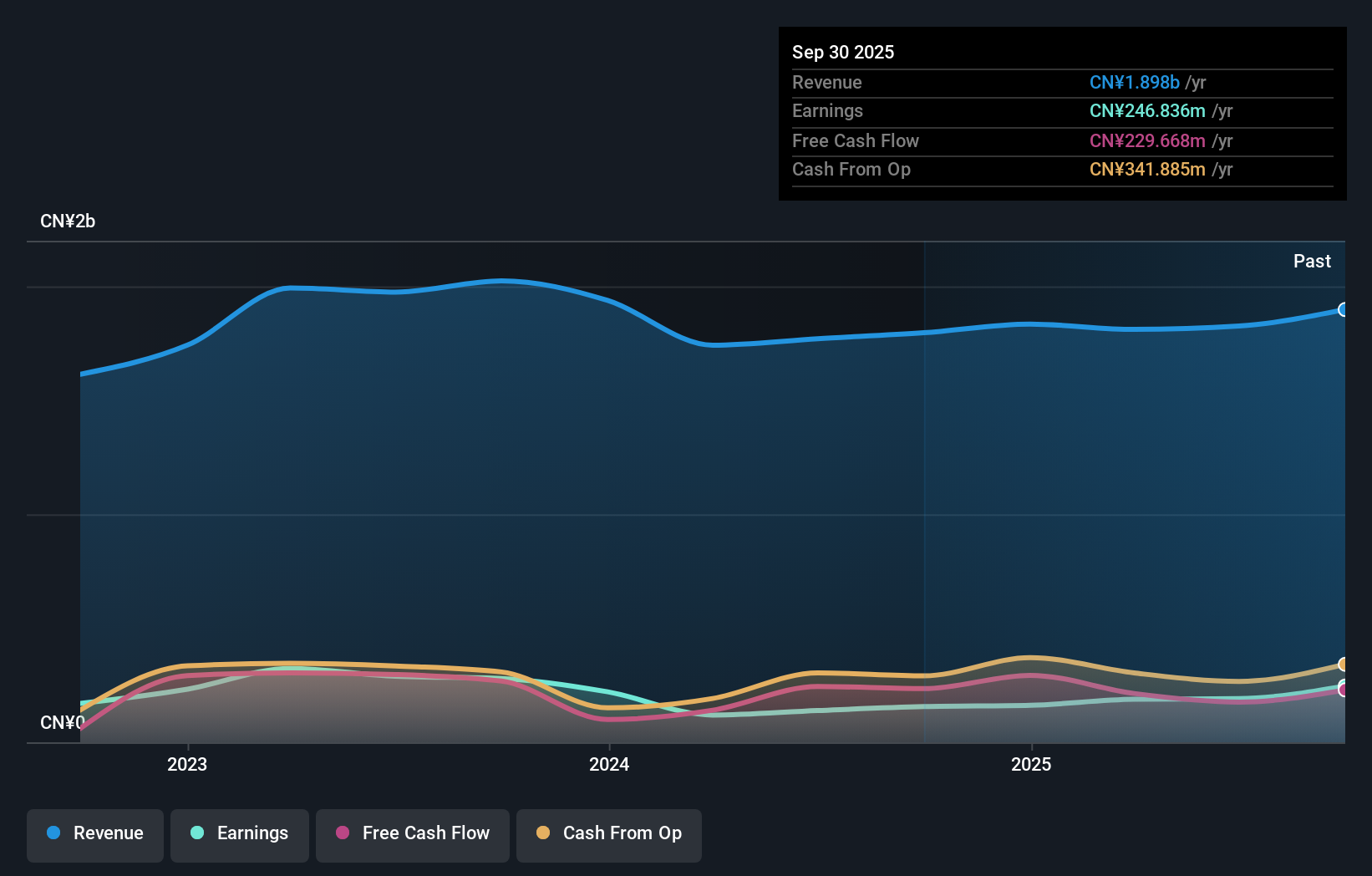

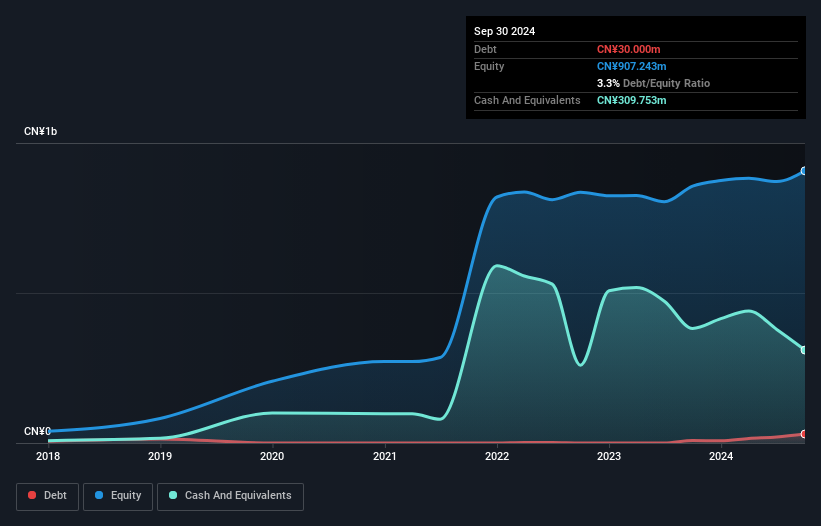

Edan Instruments has been making waves with its robust performance, highlighted by a net income of CNY 256.63 million for the nine months ending September 2025, up from CNY 171.9 million the previous year. The company’s recent expansion into a new U.S. manufacturing hub in San Diego strengthens its foothold in North America and enhances supply chain resilience. With a debt-to-equity ratio dropping significantly from 5.5 to 0.3 over five years and earnings growth of 57.8% outpacing industry norms, Edan is well-positioned for continued success in the medical equipment sector.

- Dive into the specifics of Edan Instruments here with our thorough health report.

Review our historical performance report to gain insights into Edan Instruments''s past performance.

ShenZhen QiangRui Precision Technology (SZSE:301128)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ShenZhen QiangRui Precision Technology Co., Ltd. operates in the precision manufacturing industry and has a market capitalization of approximately CN¥9.97 billion.

Operations: QiangRui Precision Technology generates its revenue primarily from its manufacturing segment, which accounts for CN¥1.49 billion. The company's financial performance is characterized by a focus on this core revenue stream within the precision manufacturing sector.

ShenZhen QiangRui Precision Technology, a smaller player in the machinery industry, has shown impressive growth with earnings rising 18.8% over the past year, outpacing the industry's 3.5%. Despite volatile share prices recently, its net debt to equity ratio stands at a satisfactory 4.7%, indicating prudent financial management. The company reported sales of CNY 835 million for the first half of 2025, up from CNY 478 million last year, and net income increased to CNY 54.91 million from CNY 47.51 million, showcasing strong operational performance amidst market challenges and potential for continued growth in revenue streams.

Key Takeaways

- Gain an insight into the universe of 2389 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edan Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300206

Edan Instruments

Engages in the research, development, manufacture, and service of medical electronic equipment and in vitro diagnostic products in China and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives