- China

- /

- Healthcare Services

- /

- SZSE:002788

Three Compelling Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

In the wake of a significant U.S. election outcome, global markets have experienced notable shifts, with U.S. stocks rallying to record highs amid expectations of growth-friendly policies and tax reforms. As investors navigate these dynamic conditions, dividend stocks emerge as a compelling option for those seeking stability and income potential in their portfolios amidst market volatility and evolving economic landscapes.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Globeride (TSE:7990) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.35% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.46% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.32% | ★★★★★☆ |

| Premier Financial (NasdaqGS:PFC) | 4.32% | ★★★★★☆ |

Click here to see the full list of 1936 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

FinecoBank Banca Fineco (BIT:FBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FinecoBank Banca Fineco S.p.A. offers a range of banking and investment products and services, with a market cap of approximately €9.07 billion.

Operations: FinecoBank Banca Fineco S.p.A. generates its revenue primarily from its banking segment, which amounts to €1.30 billion.

Dividend Yield: 4.5%

FinecoBank Banca Fineco reported a net income increase to €169.68 million for Q3 2024, up from €145.32 million the previous year, indicating solid earnings growth despite forecasts of a 1.2% annual decline over the next three years. The dividend yield is relatively low at 4.5%, and payments have been volatile over the past decade, though currently covered by earnings with a payout ratio of 67.9%.

- Delve into the full analysis dividend report here for a deeper understanding of FinecoBank Banca Fineco.

- Upon reviewing our latest valuation report, FinecoBank Banca Fineco's share price might be too optimistic.

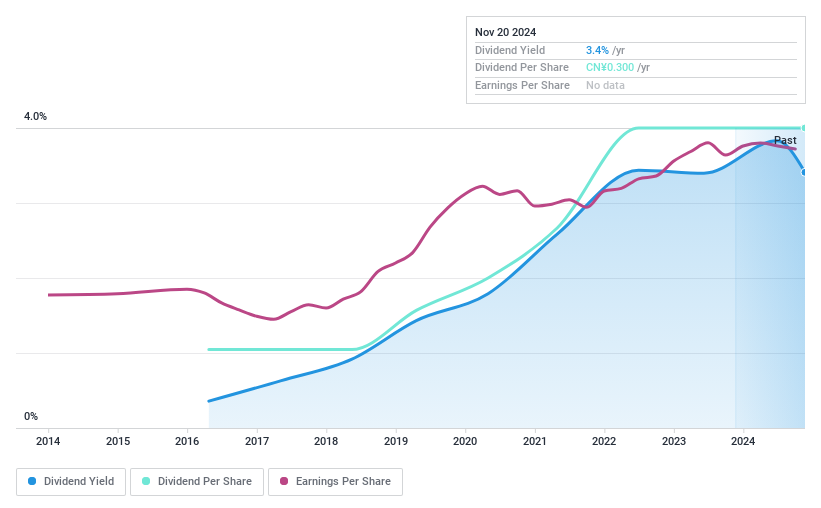

Luyan PharmaLtd (SZSE:002788)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Luyan Pharma Co., Ltd. is involved in the research, development, production, and sale of human health products in China with a market cap of CN¥3.48 billion.

Operations: Luyan Pharma Co., Ltd.'s revenue segments include the research, development, production, and sale of human health products in China.

Dividend Yield: 3.3%

Luyan Pharma Ltd. reported stable earnings for the nine months ending September 2024, with net income slightly decreasing to CNY 257.35 million from CNY 261.98 million a year prior. The company offers a dividend yield of 3.34%, placing it in the top quartile of CN market dividend payers, supported by a low cash payout ratio of 23.3%. Despite its short dividend history under ten years, payments have been reliable and well-covered by earnings and cash flow.

- Get an in-depth perspective on Luyan PharmaLtd's performance by reading our dividend report here.

- Our valuation report unveils the possibility Luyan PharmaLtd's shares may be trading at a discount.

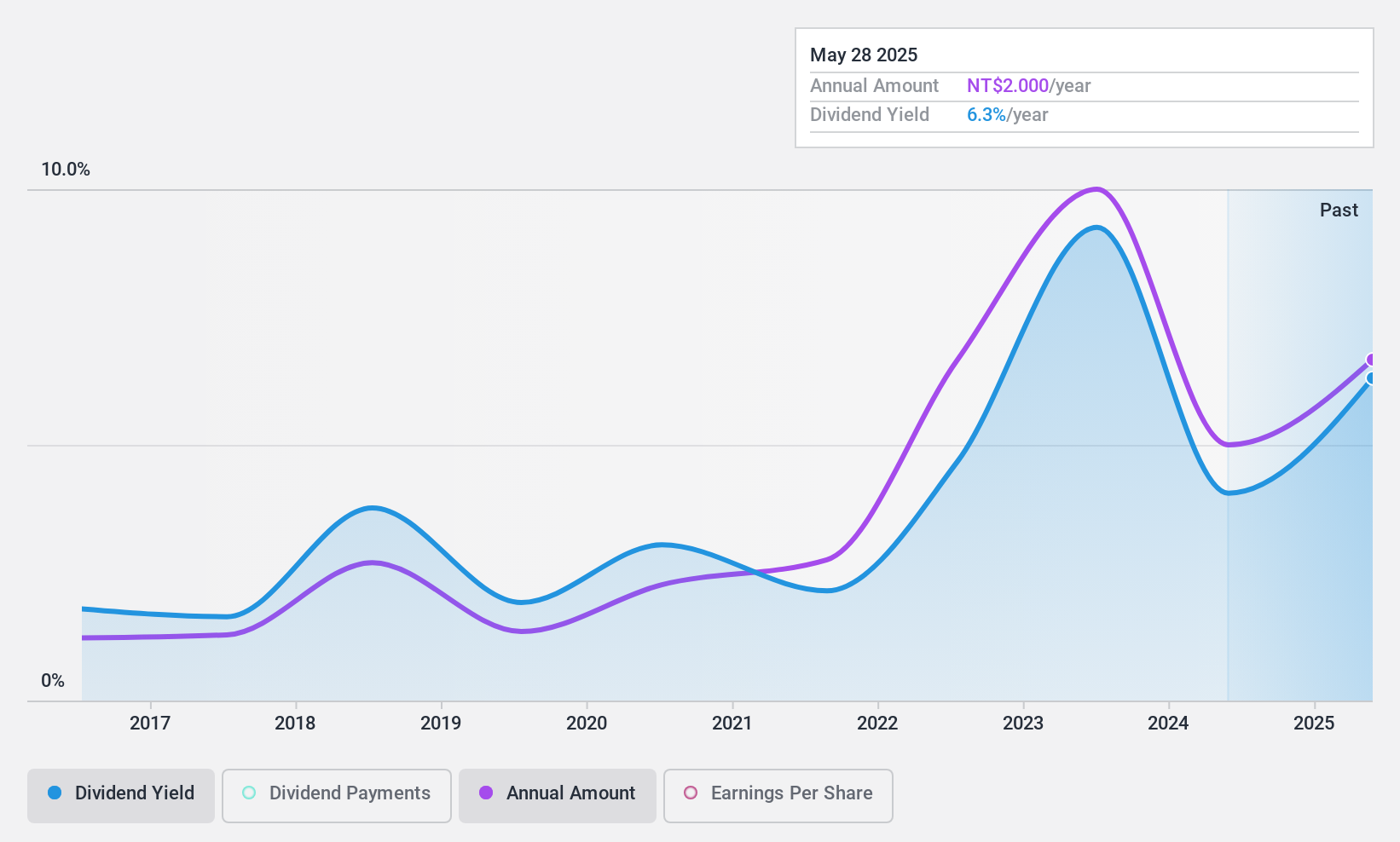

Sesoda (TWSE:1708)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sesoda Corporation manufactures and markets sulfate of potash (SOP) in Taiwan with a market capitalization of NT$10.48 billion.

Operations: Sesoda Corporation's revenue is primarily derived from the production and sale of sulfate of potash (SOP).

Dividend Yield: 3.6%

Sesoda Corporation's dividend payments have been volatile over the past decade, though they are well-covered by earnings and cash flows, with a payout ratio of 42.8% and a cash payout ratio of 27.9%. Despite trading significantly below its estimated fair value, Sesoda has recently turned profitable, reporting substantial growth in net income for Q3 2024 at TWD 291.24 million compared to TWD 105.71 million last year, indicating potential stability in future dividends.

- Click here to discover the nuances of Sesoda with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Sesoda's current price could be quite moderate.

Seize The Opportunity

- Dive into all 1936 of the Top Dividend Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002788

Luyan PharmaLtd

Engages in the research and development, production, and sale of human health products in China.

Good value with adequate balance sheet and pays a dividend.