- China

- /

- Medical Equipment

- /

- SHSE:688576

Chongqing Xishan Science & Technology Co., Ltd.'s (SHSE:688576) Popularity With Investors Is Under Threat From Overpricing

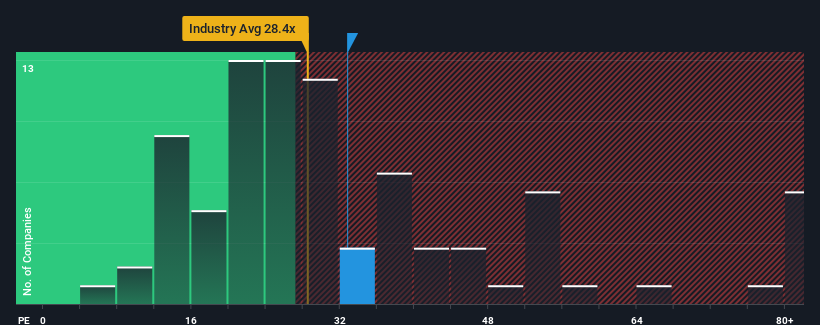

It's not a stretch to say that Chongqing Xishan Science & Technology Co., Ltd.'s (SHSE:688576) price-to-earnings (or "P/E") ratio of 32.8x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 31x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, Chongqing Xishan Science & Technology has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Chongqing Xishan Science & Technology

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Chongqing Xishan Science & Technology's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 33% last year. The strong recent performance means it was also able to grow EPS by 385% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 4.3% as estimated by the sole analyst watching the company. With the market predicted to deliver 39% growth , that's a disappointing outcome.

In light of this, it's somewhat alarming that Chongqing Xishan Science & Technology's P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Chongqing Xishan Science & Technology's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Chongqing Xishan Science & Technology with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Chongqing Xishan Science & Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688576

Chongqing Xishan Science & Technology

Chongqing Xishan Science & Technology Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives