- China

- /

- Auto Components

- /

- SZSE:301173

Undiscovered Gems In Asia 3 Promising Stocks To Watch

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties, including persistent inflation and shifting trade policies, investors are increasingly turning their attention to Asia's burgeoning small-cap sector. In this dynamic environment, identifying promising stocks often hinges on uncovering companies with strong fundamentals and the potential to thrive amid broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 46.58% | 6.59% | 23.75% | ★★★★★★ |

| Miwon Chemicals | 0.22% | 11.24% | 14.59% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 7.52% | 53.96% | ★★★★★★ |

| Woori Technology Investment | NA | 25.42% | -1.59% | ★★★★★★ |

| Anapass | 7.88% | 5.06% | 41.70% | ★★★★★★ |

| INCAR FINANCIAL SERVICE | 39.64% | 34.41% | 38.54% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 45.47% | 3.47% | -1.67% | ★★★★★☆ |

| iMarketKorea | 29.86% | 5.28% | 1.62% | ★★★★★☆ |

| ONEJOON | 9.85% | 24.95% | 4.85% | ★★★★★☆ |

| Hansae Yes24 Holdings | 80.77% | 1.28% | 9.02% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Zhejiang Huangma TechnologyLtd (SHSE:603181)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Huangma Technology Co., Ltd engages in the research, development, production, and sale of surfactants and related products both domestically and internationally, with a market capitalization of CN¥6.99 billion.

Operations: Huangma Technology generates revenue primarily from its specialty chemicals segment, with reported sales of CN¥2.21 billion. The company's market capitalization stands at approximately CN¥6.99 billion.

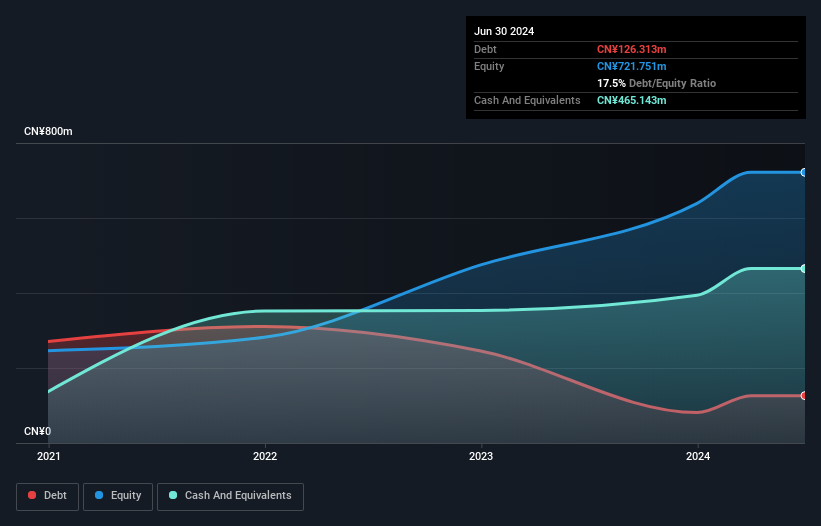

Zhejiang Huangma Technology, a nimble player in the chemicals sector, has shown impressive financial health with earnings growth of 12.7% last year, outpacing the industry's -5.4%. The price-to-earnings ratio at 18.6x suggests it's trading below the CN market average of 37.2x, indicating potential value for investors. With more cash than total debt and a debt-to-equity ratio rising to 13.2% over five years, its financial structure seems robust enough to support future endeavors. Earnings are forecasted to grow by 21.13% annually, positioning it as an intriguing prospect in Asia's dynamic market landscape.

Shandong Weigao Orthopaedic Device (SHSE:688161)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Weigao Orthopaedic Device Co., Ltd. operates in the medical device industry with a focus on orthopaedic products and has a market cap of CN¥11.06 billion.

Operations: The company generates revenue primarily from the sale of orthopaedic products. Its cost structure includes manufacturing and distribution expenses, impacting its financial performance. The net profit margin reflects the company's profitability after accounting for all costs and expenses.

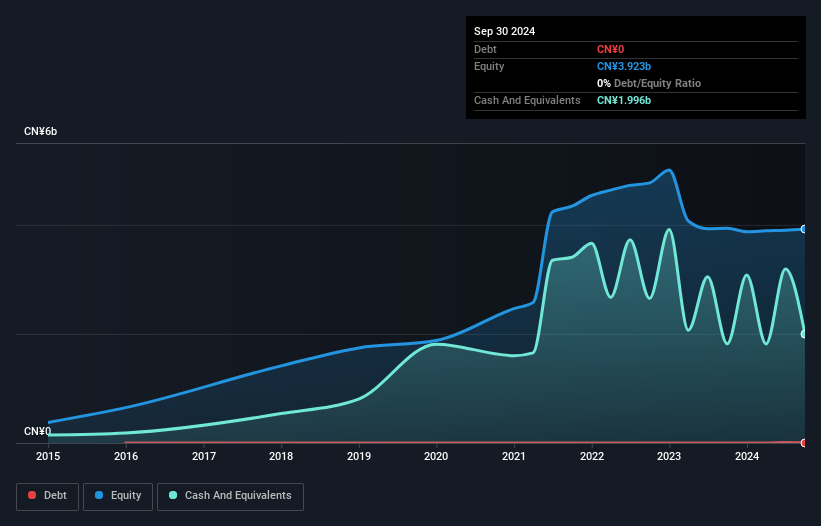

Shandong Weigao Orthopaedic Device, a nimble player in the medical equipment sector, showcases promising financial health. With earnings surging 97.5% over the past year, it outpaced industry averages and reported net income of CNY 221.81 million for 2024, up from CNY 112.32 million previously. The company trades at a value estimated to be 37.7% below its fair worth and remains debt-free with high-quality earnings, offering a solid foundation for growth prospects forecasted at an annual rate of 21%. Despite being dropped from a key index recently, its fundamentals appear robust and attractive for potential investors.

Shanghai Mobitech TechnologyLtd (SZSE:301173)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Mobitech Technology Co., Ltd. specializes in the manufacturing and sale of automotive sports parts both in China and internationally, with a market cap of CN¥6.20 billion.

Operations: Shanghai Mobitech Technology Co., Ltd. generates revenue through the manufacturing and sale of automotive sports parts across domestic and international markets. The company has a market cap of CN¥6.20 billion, indicating its significant presence in the industry.

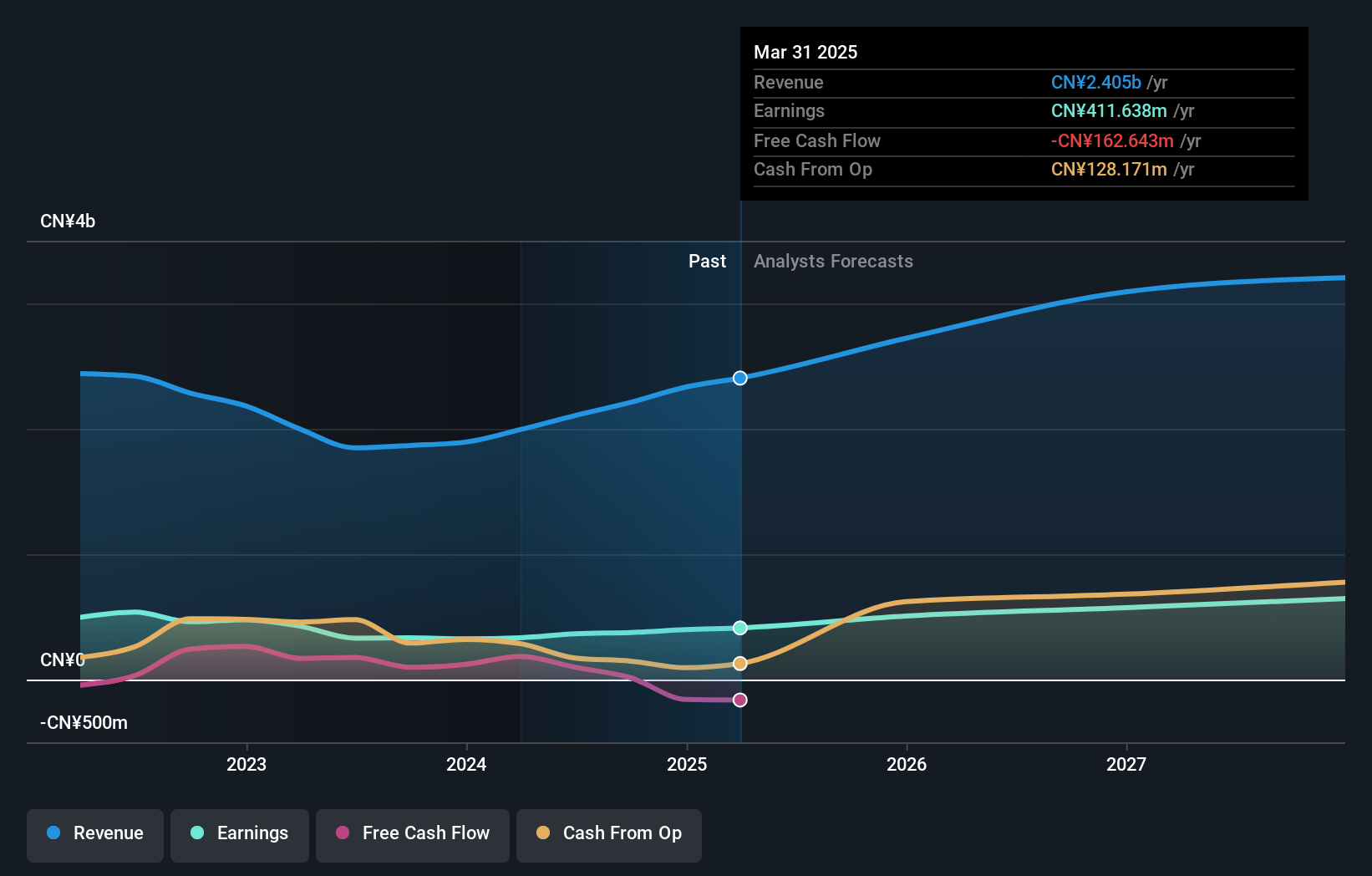

Shanghai Mobitech Technology, a small but promising player in the tech sector, recently completed an IPO raising CNY 622.09 million, marking a significant milestone with its inclusion in key indices like the Shenzhen Stock Exchange Composite Index. The company boasts an impressive earnings growth of 70.7% over the past year, outpacing industry norms significantly. Despite shares being highly illiquid and trading at 47.3% below estimated fair value, Mobitech remains free cash flow positive and holds more cash than total debt, indicating robust financial health and potential for future expansion within its market niche.

Make It Happen

- Access the full spectrum of 2576 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301173

Shanghai Mobitech TechnologyLtd

Shanghai Mobitech Technology Co., Ltd. engages in the manufacture and sale of manufactures and sells automotive sports parts in China and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives