In recent weeks, global markets have experienced notable shifts, with the S&P 500 Index advancing and the Nasdaq Composite rallying due to positive earnings surprises and renewed interest in AI-related stocks. Amidst these developments, growth companies with high insider ownership can be particularly compelling as they often align management interests with shareholders and demonstrate confidence in their long-term potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

Here we highlight a subset of our preferred stocks from the screener.

Hunan Oil Pump (SHSE:603319)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hunan Oil Pump Co., Ltd. manufactures and sells oil pumps both in China and internationally, with a market cap of CN¥3.84 billion.

Operations: Hunan Oil Pump Co., Ltd. generates revenue through the production and distribution of oil pumps across domestic and international markets.

Insider Ownership: 32.7%

Revenue Growth Forecast: 25.3% p.a.

Hunan Oil Pump shows potential as a growth company with high insider ownership. Its revenue is forecast to grow at 25.3% annually, outpacing the Chinese market average of 13.5%, although its earnings growth of 21.8% per year lags slightly behind the market's 23.8%. The company's Price-To-Earnings ratio of 18.7x suggests good value compared to the broader CN market at 33.6x, despite recent modest profit growth and an unsustainable dividend yield of 1.98%.

- Take a closer look at Hunan Oil Pump's potential here in our earnings growth report.

- Our valuation report here indicates Hunan Oil Pump may be overvalued.

Sino Medical Sciences Technology (SHSE:688108)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sino Medical Sciences Technology Inc. is a medical device company focused on the research, development, production, and distribution of interventional devices in China, with a market cap of CN¥4.38 billion.

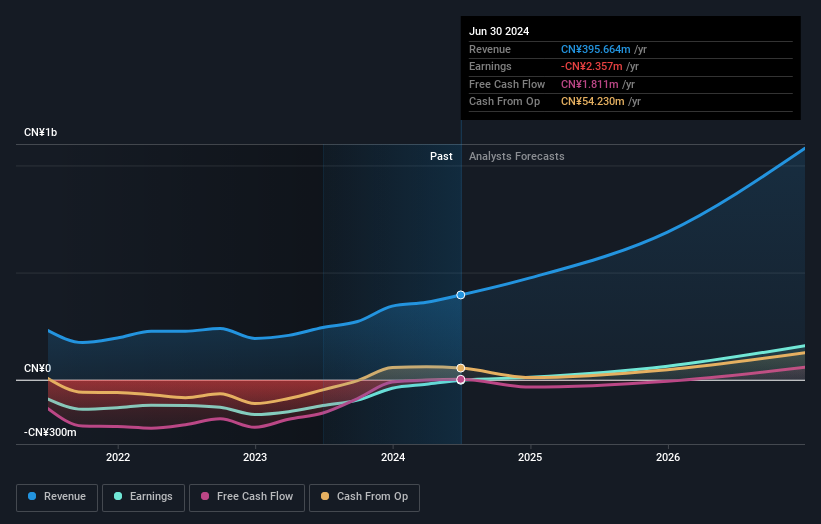

Operations: The company's revenue primarily comes from its medical products segment, amounting to CN¥395.66 million.

Insider Ownership: 25.8%

Revenue Growth Forecast: 41.1% p.a.

Sino Medical Sciences Technology demonstrates strong growth potential, with revenue forecasted to increase by 41.1% annually, significantly outpacing the Chinese market's 13.5%. Recent earnings results show a turnaround with CNY 7.66 million in net income compared to a prior loss, highlighting its improving financial health. Trading at over 60% below estimated fair value suggests it may offer good investment value despite low expected return on equity and no recent insider trading activity reported.

- Navigate through the intricacies of Sino Medical Sciences Technology with our comprehensive analyst estimates report here.

- The analysis detailed in our Sino Medical Sciences Technology valuation report hints at an inflated share price compared to its estimated value.

Guangdong Yussen Energy Technology (SZSE:002986)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Yussen Energy Technology Co., Ltd. (SZSE:002986) operates in the energy technology sector and has a market cap of CN¥4.60 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment details for Guangdong Yussen Energy Technology Co., Ltd.

Insider Ownership: 32.1%

Revenue Growth Forecast: 20.6% p.a.

Guangdong Yussen Energy Technology shows promising growth prospects, with revenue expected to rise 20.6% annually, surpassing the Chinese market's 13.5%. Despite a slight earnings decline recently, its Price-To-Earnings ratio of 10.6x indicates good value compared to the broader CN market at 33.6x. Insider ownership remains high without recent trading activity, and its addition to the S&P Global BMI Index underscores its growing industry significance despite past shareholder dilution concerns.

- Click to explore a detailed breakdown of our findings in Guangdong Yussen Energy Technology's earnings growth report.

- In light of our recent valuation report, it seems possible that Guangdong Yussen Energy Technology is trading behind its estimated value.

Next Steps

- Investigate our full lineup of 1487 Fast Growing Companies With High Insider Ownership right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Oil Pump might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603319

Hunan Oil Pump

Engages in the manufacture and sale of oil pumps in China and internationally.

Flawless balance sheet with high growth potential.