- China

- /

- Medical Equipment

- /

- SHSE:605369

Undiscovered Gems Three Small Caps with Promising Potential

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, small-cap stocks continue to capture the attention of investors seeking growth opportunities amid broader market volatility. With indices like the S&P MidCap 400 and Russell 2000 showing resilience, identifying promising small-cap companies with strong fundamentals and innovative potential becomes increasingly crucial for those looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Zhejiang Gongdong Medical Technology (SHSE:605369)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Gongdong Medical Technology Co., Ltd. operates in the medical technology sector, with a market cap of CN¥4.46 billion.

Operations: Zhejiang Gongdong generates revenue primarily from its medical technology products, with a reported market cap of CN¥4.46 billion.

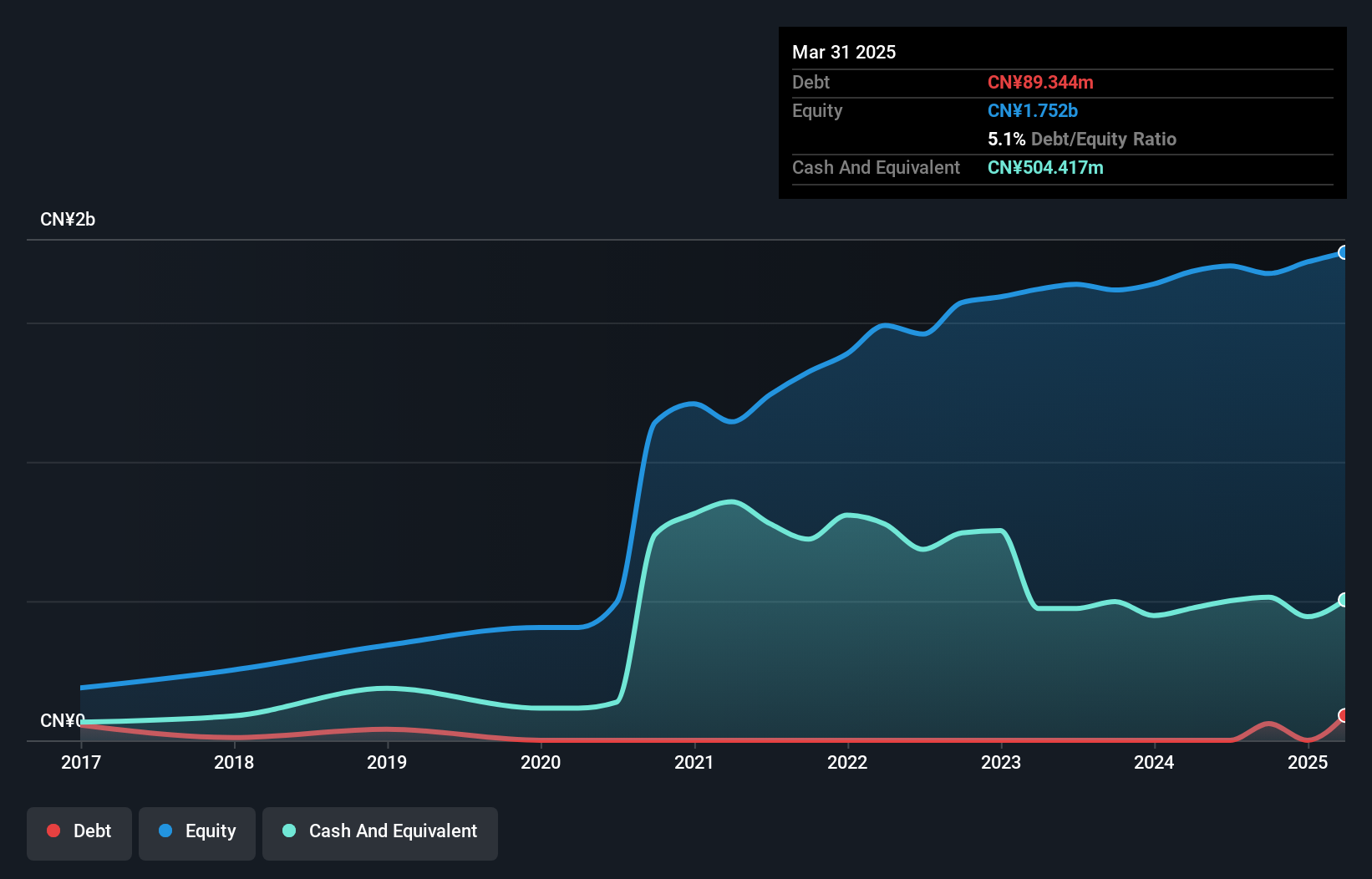

Zhejiang Gongdong Medical Technology, a notable player in the medical equipment sector, has demonstrated robust growth with earnings surging by 53% over the past year, outpacing the industry average of -8.8%. The company trades at 71% below its estimated fair value, suggesting potential undervaluation. Financially sound with more cash than total debt and positive free cash flow, it seems poised for continued stability. Recent reports show sales climbing to CNY 836 million from CNY 713 million last year and net income rising to CNY 141 million from CNY 88 million. Earnings per share increased to CNY 0.9 from CNY 0.56 a year ago, indicating solid profitability improvements.

Argosy Research (TPEX:3217)

Simply Wall St Value Rating: ★★★★★★

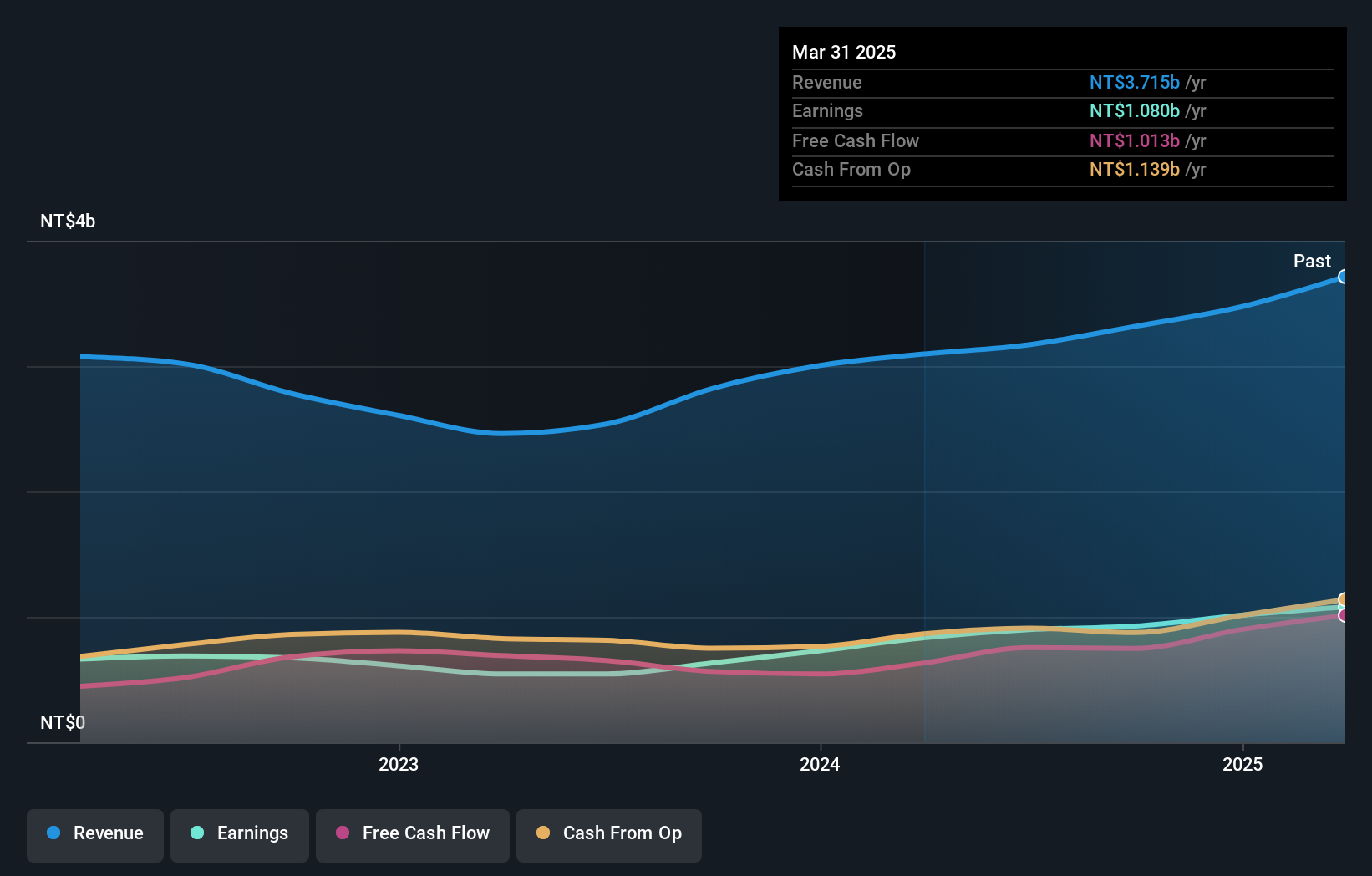

Overview: Argosy Research Inc. is engaged in the manufacturing and sale of electronic components and connectors across Asia, the United States, and internationally, with a market capitalization of NT$14.37 billion.

Operations: The primary revenue stream for Argosy Research comes from the manufacturing and sales of electronic component products, contributing NT$3.32 billion.

Argosy Research, a promising player in its field, has showcased robust financial performance recently. Over the past year, earnings grew by 46%, far outpacing the Electronic industry's 7% growth. The company is trading at a significant discount of 41% below its estimated fair value and remains debt-free with no interest payment concerns. Recent quarterly results revealed sales of TWD 1.04 billion, up from TWD 893 million last year, while net income reached TWD 315 million compared to TWD 287 million previously. This growth trajectory is complemented by strategic board changes aimed at sustainable development and governance improvements.

- Delve into the full analysis health report here for a deeper understanding of Argosy Research.

Understand Argosy Research's track record by examining our Past report.

Sunplus Innovation Technology (TPEX:5236)

Simply Wall St Value Rating: ★★★★★★

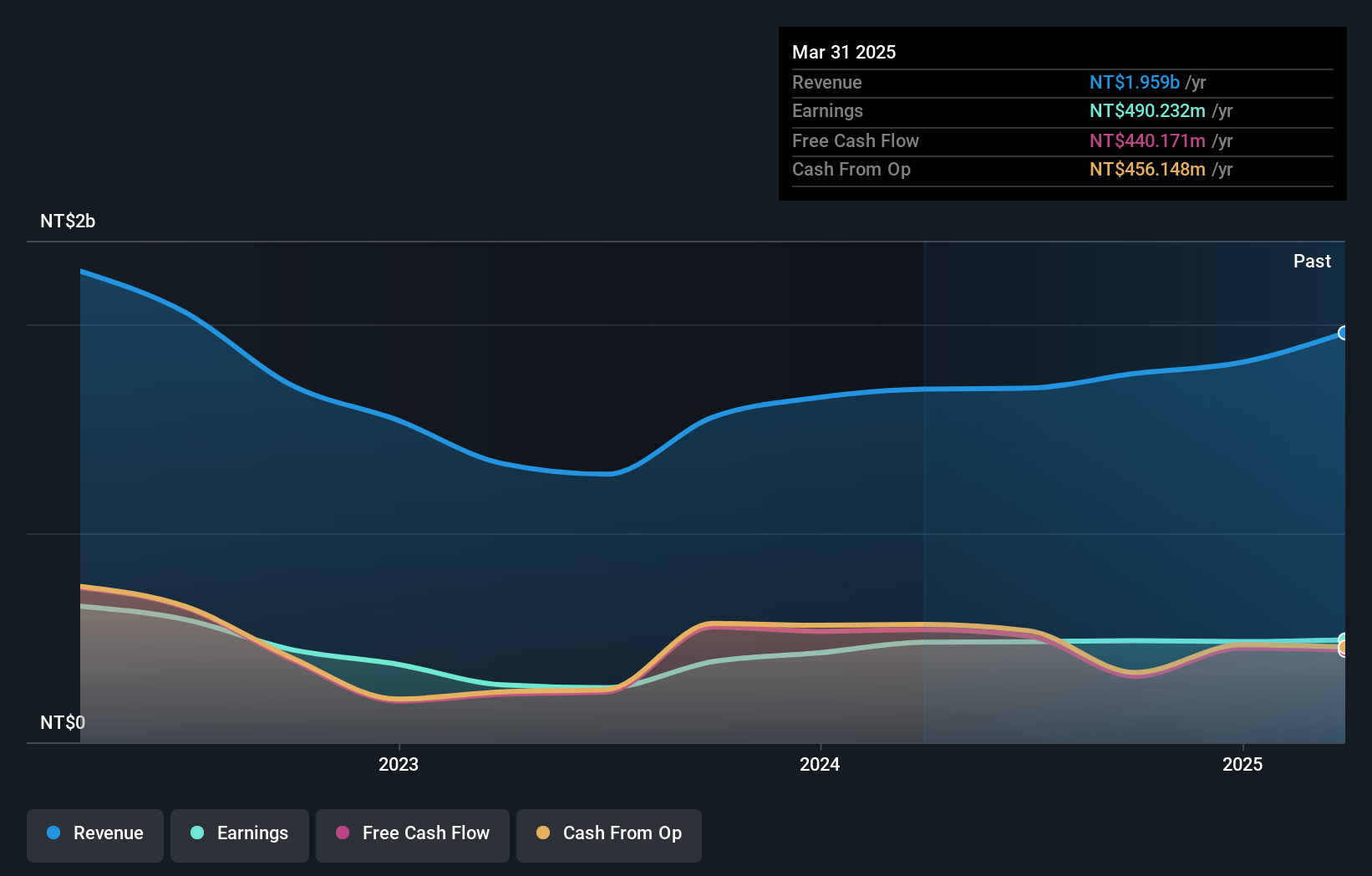

Overview: Sunplus Innovation Technology Inc. is a Taiwanese company that specializes in the research, development, manufacturing, and marketing of microcontrollers and system-on-chips with embedded software solutions, with a market cap of NT$8.97 billion.

Operations: Sunplus Innovation Technology generates revenue primarily from the semiconductor segment, amounting to NT$1.76 billion. The company has a market cap of NT$8.97 billion.

Sunplus Innovation Technology, a nimble player in the semiconductor space, has shown promising financial health. Its price-to-earnings ratio of 18.4x is attractive compared to the TW market's 21x, signaling potential value for investors. The company is debt-free and boasts a robust earnings growth rate of 26% over the past year, outpacing the industry average of 5.9%. Recent results highlight a solid performance with third-quarter sales reaching TWD 550 million from TWD 480 million last year and net income rising to TWD 141 million from TWD 136 million, reflecting steady profitability improvements.

Next Steps

- Unlock our comprehensive list of 4667 Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Gongdong Medical Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605369

Zhejiang Gongdong Medical Technology

Zhejiang Gongdong Medical Technology Co., Ltd.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives