- China

- /

- Healthcare Services

- /

- SHSE:603368

3 Global Dividend Stocks With Yields Up To 6.3%

Reviewed by Simply Wall St

Amidst a backdrop of tariff fears, inflation concerns, and trade policy uncertainties weighing heavily on global markets, investors are increasingly seeking stability through dividend stocks. In times of economic volatility, these stocks can provide a reliable income stream and potential for capital appreciation, making them an appealing choice for those looking to navigate the current market landscape.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.51% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.01% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.11% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.84% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.25% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.56% | ★★★★★★ |

Click here to see the full list of 1440 stocks from our Top Global Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Jinneng Holding Shanxi Coal Industryltd (SHSE:601001)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jinneng Holding Shanxi Coal Industry Co., Ltd., along with its subsidiaries, is involved in the production and sale of coal and related chemical products in China, with a market capitalization of CN¥19.48 billion.

Operations: Jinneng Holding Shanxi Coal Industry Co., Ltd. generates revenue primarily through its coal production and sales, as well as the sale of related chemical products in China.

Dividend Yield: 6.3%

Jinneng Holding Shanxi Coal Industry offers a compelling dividend profile with its dividends well-covered by earnings and cash flows, boasting payout ratios of 40.1% and 30.4%, respectively. Despite only three years of dividend history, payments have been stable and growing. The stock trades significantly below estimated fair value, enhancing its appeal for value-focused investors. However, the limited dividend history may be a consideration for those seeking long-term reliability.

- Get an in-depth perspective on Jinneng Holding Shanxi Coal Industryltd's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Jinneng Holding Shanxi Coal Industryltd is trading behind its estimated value.

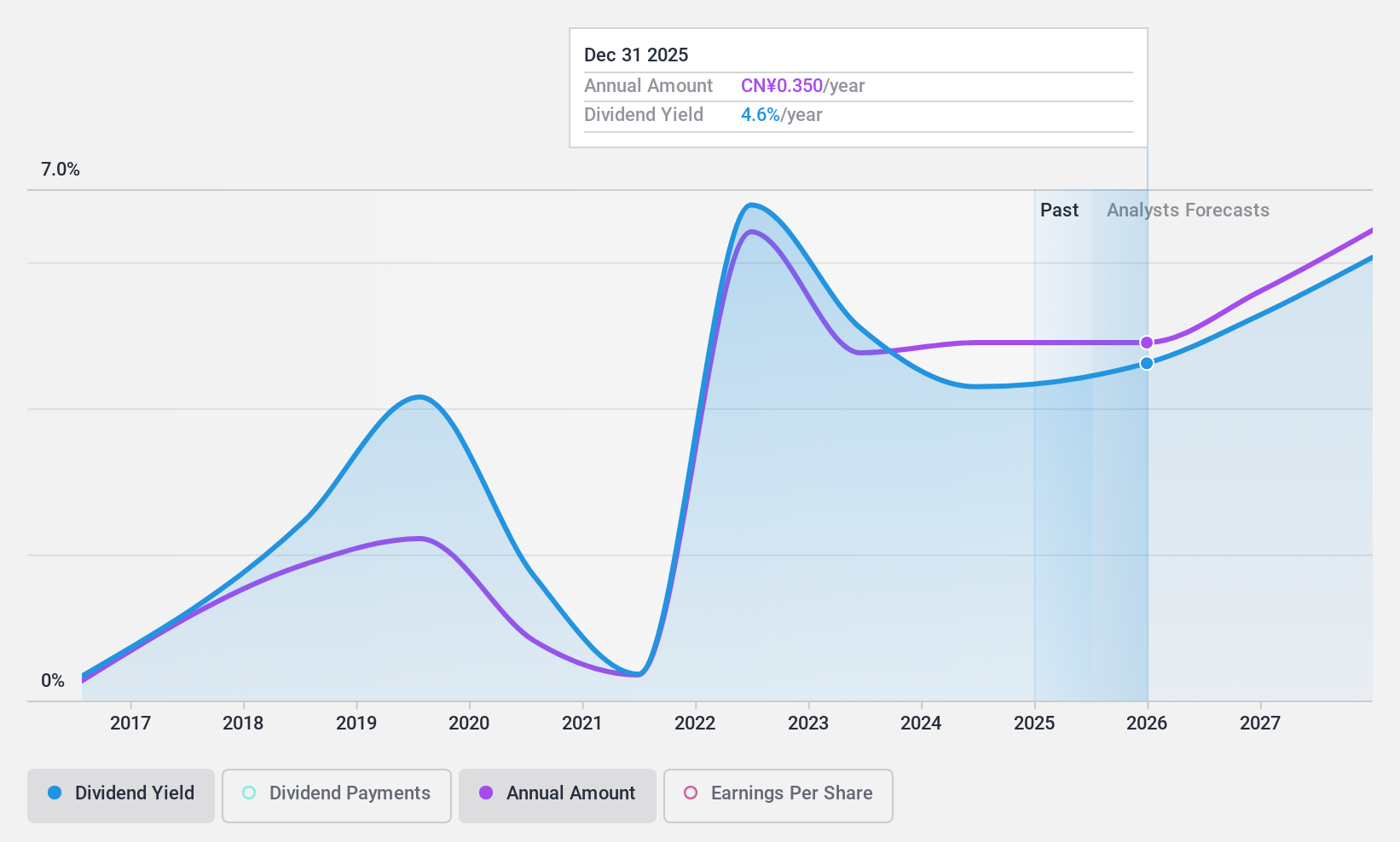

Beijing Haohua Energy Resource (SHSE:601101)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing Haohua Energy Resource Co., Ltd. operates in China, focusing on the mining, washing, manufacturing, processing, export, and sale of coal with a market cap of CN¥10.47 billion.

Operations: Beijing Haohua Energy Resource Co., Ltd. generates revenue primarily through its coal-related activities, including mining, washing, manufacturing, processing, exportation, and sales within China.

Dividend Yield: 4.6%

Beijing Haohua Energy Resource's dividend profile shows potential with a 4.55% yield, placing it among the top 25% in China's market. Its dividends are well-covered by earnings and cash flows, with payout ratios of 43.9% and 26.6%, respectively, ensuring sustainability. However, the company has an unstable dividend track record over the past decade due to volatility despite recent growth in payments. The stock trades at a significant discount to its estimated fair value, appealing to value investors.

- Unlock comprehensive insights into our analysis of Beijing Haohua Energy Resource stock in this dividend report.

- Our expertly prepared valuation report Beijing Haohua Energy Resource implies its share price may be lower than expected.

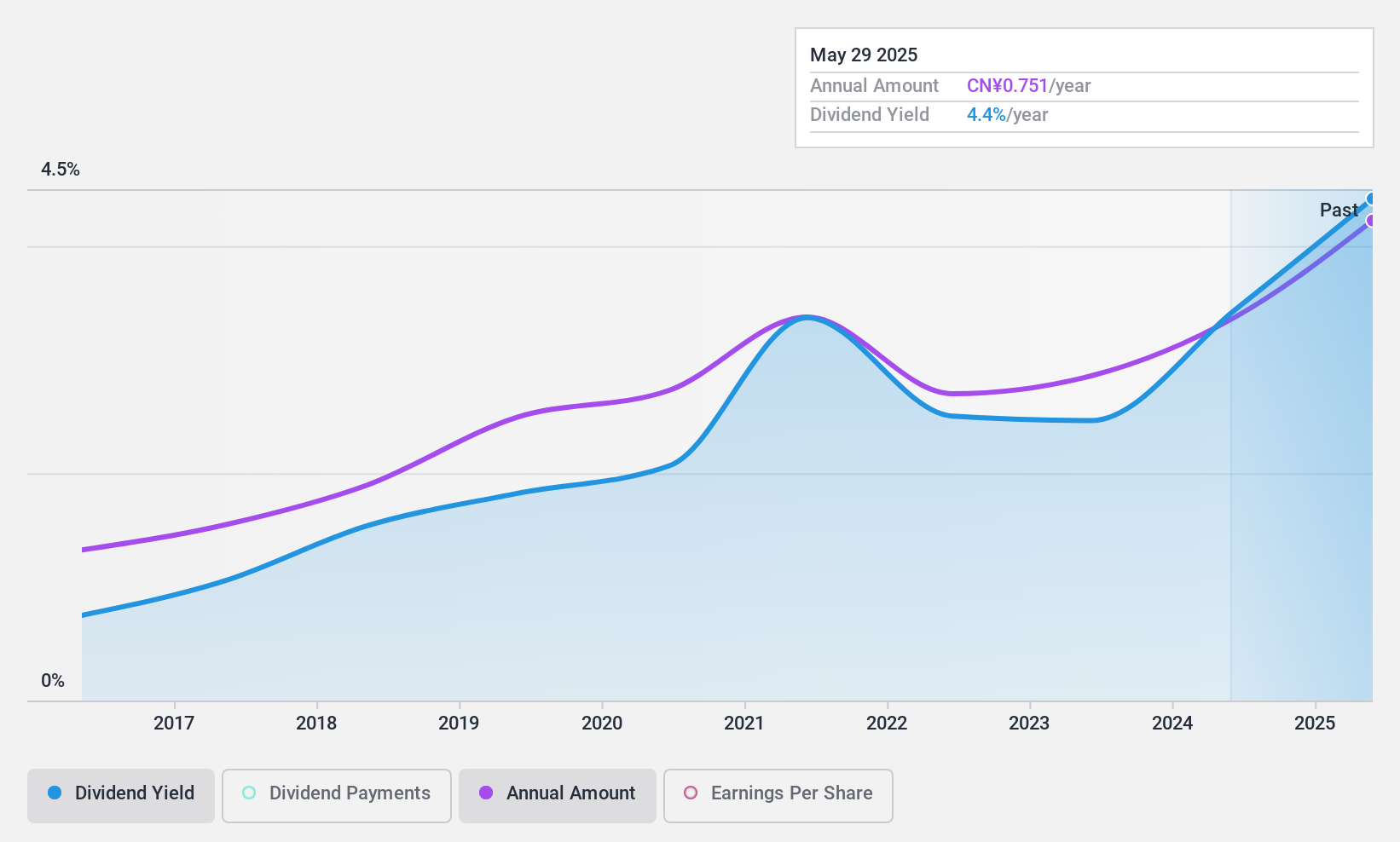

Guangxi LiuYao Group (SHSE:603368)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Guangxi LiuYao Group Co., Ltd is involved in the wholesale and retail of pharmaceutical products in China, with a market cap of CN¥7.01 billion.

Operations: Guangxi LiuYao Group Co., Ltd generates its revenue through the wholesale and retail distribution of pharmaceutical products in China.

Dividend Yield: 3.2%

Guangxi LiuYao Group offers a reliable dividend yield of 3.23%, ranking in the top 25% of CN market payers. Its dividends are well-supported by earnings and cash flows, with payout ratios of 25.4% and 44%, respectively, indicating sustainability. Over the past decade, dividends have grown steadily without volatility. The stock is attractively valued with a price-to-earnings ratio of 8.3x compared to the broader CN market at 38.9x, enhancing its appeal for value-conscious investors.

- Click here to discover the nuances of Guangxi LiuYao Group with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Guangxi LiuYao Group shares in the market.

Make It Happen

- Take a closer look at our Top Global Dividend Stocks list of 1440 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603368

Guangxi LiuYao Group

Engages in the wholesale and retail of pharmaceutical products in China.

6 star dividend payer and undervalued.

Market Insights

Community Narratives