- Brazil

- /

- Consumer Durables

- /

- BOVESPA:CURY3

Top Growth Companies With High Insider Ownership In August 2024

Reviewed by Simply Wall St

In August 2024, global markets have experienced notable volatility, with major U.S. indices pulling back sharply due to downside economic surprises and a cooling labor market. Despite these challenges, growth companies with high insider ownership present unique opportunities for investors seeking resilience and potential upside in uncertain times. When evaluating stocks in such a turbulent environment, it's crucial to consider companies where insiders hold significant stakes. This often indicates strong confidence from those who know the business best and aligns their interests closely with shareholders'.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 36.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Adveritas (ASX:AV1) | 21.1% | 103.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| HANA Micron (KOSDAQ:A067310) | 17.4% | 97.4% |

We're going to check out a few of the best picks from our screener tool.

Cury Construtora e Incorporadora (BOVESPA:CURY3)

Simply Wall St Growth Rating: ★★★★☆☆

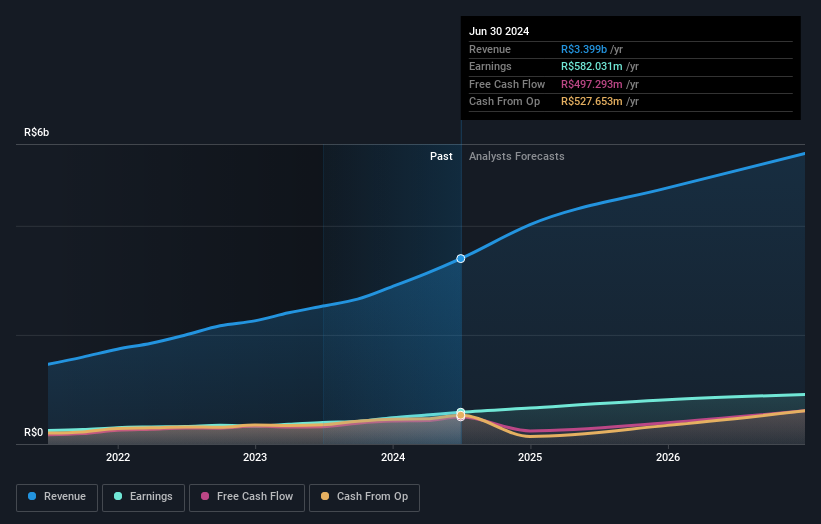

Overview: Cury Construtora e Incorporadora S.A. operates in the real estate business and has a market cap of R$6.58 billion.

Operations: Cury Construtora e Incorporadora S.A. generates its revenue primarily from the real estate sector.

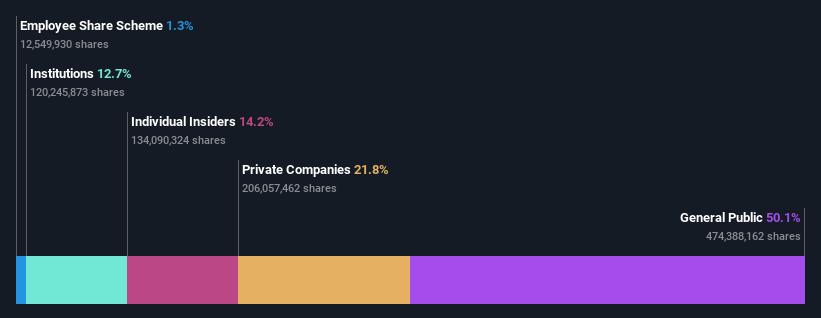

Insider Ownership: 22%

Earnings Growth Forecast: 17.6% p.a.

Cury Construtora e Incorporadora has demonstrated robust growth, with recent earnings for the second quarter reaching BRL 172.25 million, up from BRL 121.37 million a year ago. The company's earnings are forecast to grow at 17.6% annually, outpacing the broader Brazilian market's 13.9%. Despite an unstable dividend track record, Cury's return on equity is expected to be very high at 60.1% in three years, indicating strong profitability potential driven by substantial insider ownership and consistent revenue growth projections of 17.3% per year.

- Click here to discover the nuances of Cury Construtora e Incorporadora with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Cury Construtora e Incorporadora's current price could be inflated.

Huayi Brothers Media (SZSE:300027)

Simply Wall St Growth Rating: ★★★★★★

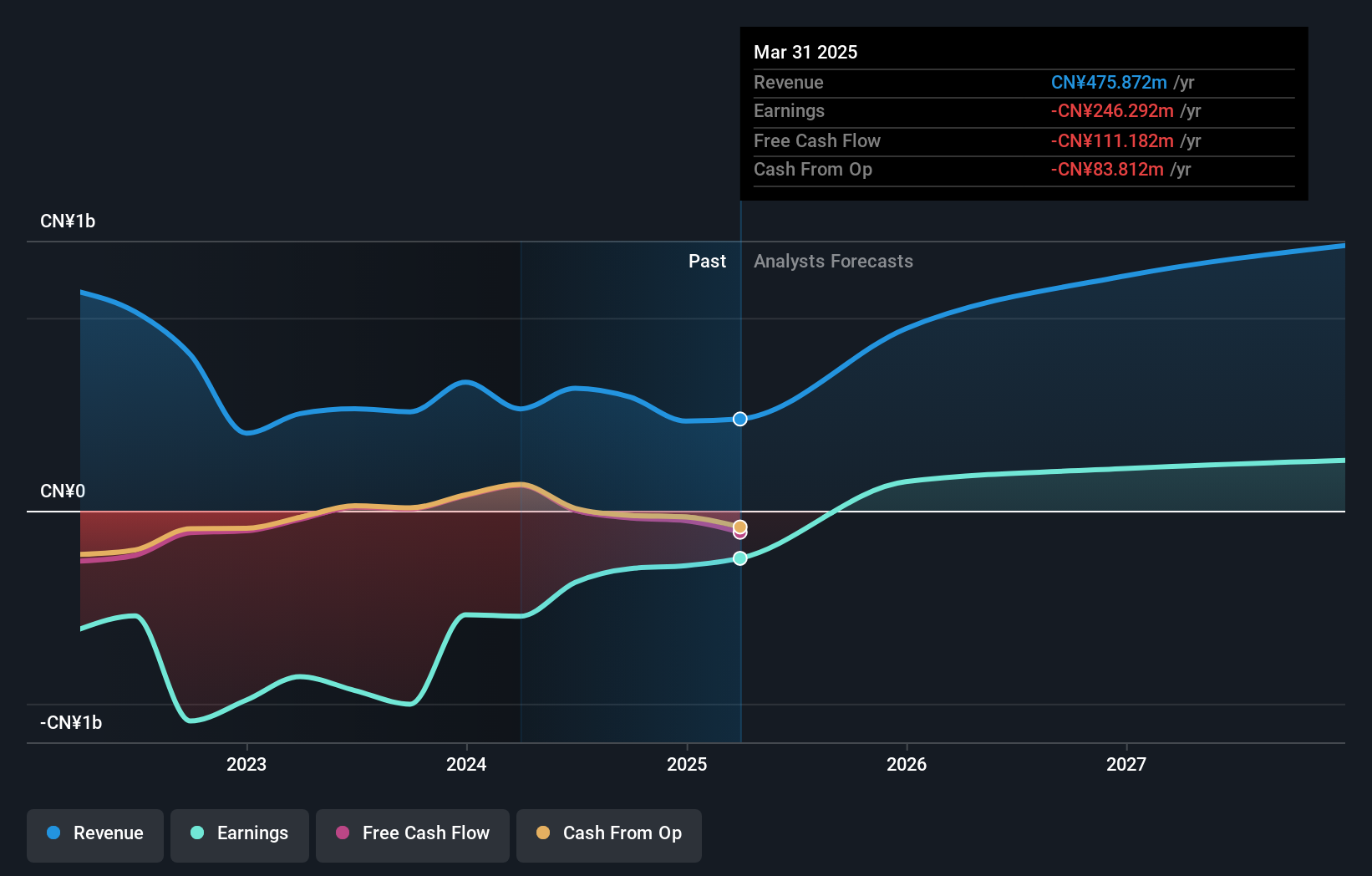

Overview: Huayi Brothers Media Corporation operates as an entertainment media company in China and internationally, with a market cap of CN¥4.91 billion.

Operations: The company's revenue segments include film and television production, artist management, and cinema operations.

Insider Ownership: 17.5%

Earnings Growth Forecast: 99.9% p.a.

Huayi Brothers Media is trading at 73.1% below its estimated fair value and has demonstrated substantial growth, with earnings increasing 33.7% annually over the past five years. Earnings are forecast to grow 99.87% per year, and revenue is expected to rise by 38.5% per year, outpacing the Chinese market's growth rate of 13.5%. The company is projected to become profitable within three years and achieve a high return on equity of 37%. Recent shareholder meetings have focused on connected transactions and audit firm changes.

- Take a closer look at Huayi Brothers Media's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Huayi Brothers Media's current price could be quite moderate.

Winall Hi-tech Seed (SZSE:300087)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Winall Hi-tech Seed Co., Ltd. engages in the research, development, breeding, promotion, and service of various crop seeds in China and internationally with a market cap of CN¥6.42 billion.

Operations: The company's revenue segments (in millions of CN¥) include the research and development, breeding, promotion, and service of various crop seeds in China and internationally.

Insider Ownership: 14.2%

Earnings Growth Forecast: 23.7% p.a.

Winall Hi-tech Seed demonstrates strong growth potential with earnings forecasted to grow 23.71% annually, outpacing the CN market's 22.1%. Revenue is also expected to rise by 22.6% per year, significantly higher than the market's 13.5%. Despite a low forecasted return on equity of 15.1%, its price-to-earnings ratio of 24.7x indicates good value compared to the market average of 27.8x. Recent dividend announcements highlight ongoing profit distribution plans for shareholders.

- Delve into the full analysis future growth report here for a deeper understanding of Winall Hi-tech Seed.

- The analysis detailed in our Winall Hi-tech Seed valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Unlock our comprehensive list of 1471 Fast Growing Companies With High Insider Ownership by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:CURY3

Solid track record with excellent balance sheet.