- Taiwan

- /

- Tech Hardware

- /

- TWSE:8163

Top Dividend Stocks To Watch In February 2025

Reviewed by Simply Wall St

Amidst geopolitical tensions and consumer spending concerns, global markets have experienced a volatile week, with major U.S. indices declining despite early gains. As investors navigate these uncertain times, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those seeking to balance risk in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.60% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.91% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.64% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.23% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.64% | ★★★★★★ |

Click here to see the full list of 2010 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Cathay Pacific Airways (SEHK:293)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cathay Pacific Airways Limited, along with its subsidiaries, provides international passenger and air cargo transportation services and has a market cap of approximately HK$65.42 billion.

Operations: Cathay Pacific Airways Limited generates revenue through several segments, including Cathay Pacific at HK$90.85 billion, HK Express at HK$6.18 billion, Air Hong Kong at HK$3.48 billion, and Airline Services at HK$4.50 billion.

Dividend Yield: 3.9%

Cathay Pacific Airways has shown a mixed picture for dividend investors. While the company trades at a significant discount to its estimated fair value, it offers a modest dividend yield of 3.94%, lower than the top quartile in Hong Kong. Dividends are well-covered by earnings and cash flows, with payout ratios of 47.8% and 25%, respectively. However, the dividend history is volatile and unreliable over the past decade, despite recent growth in earnings by 319.6%.

- Click to explore a detailed breakdown of our findings in Cathay Pacific Airways' dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Cathay Pacific Airways shares in the market.

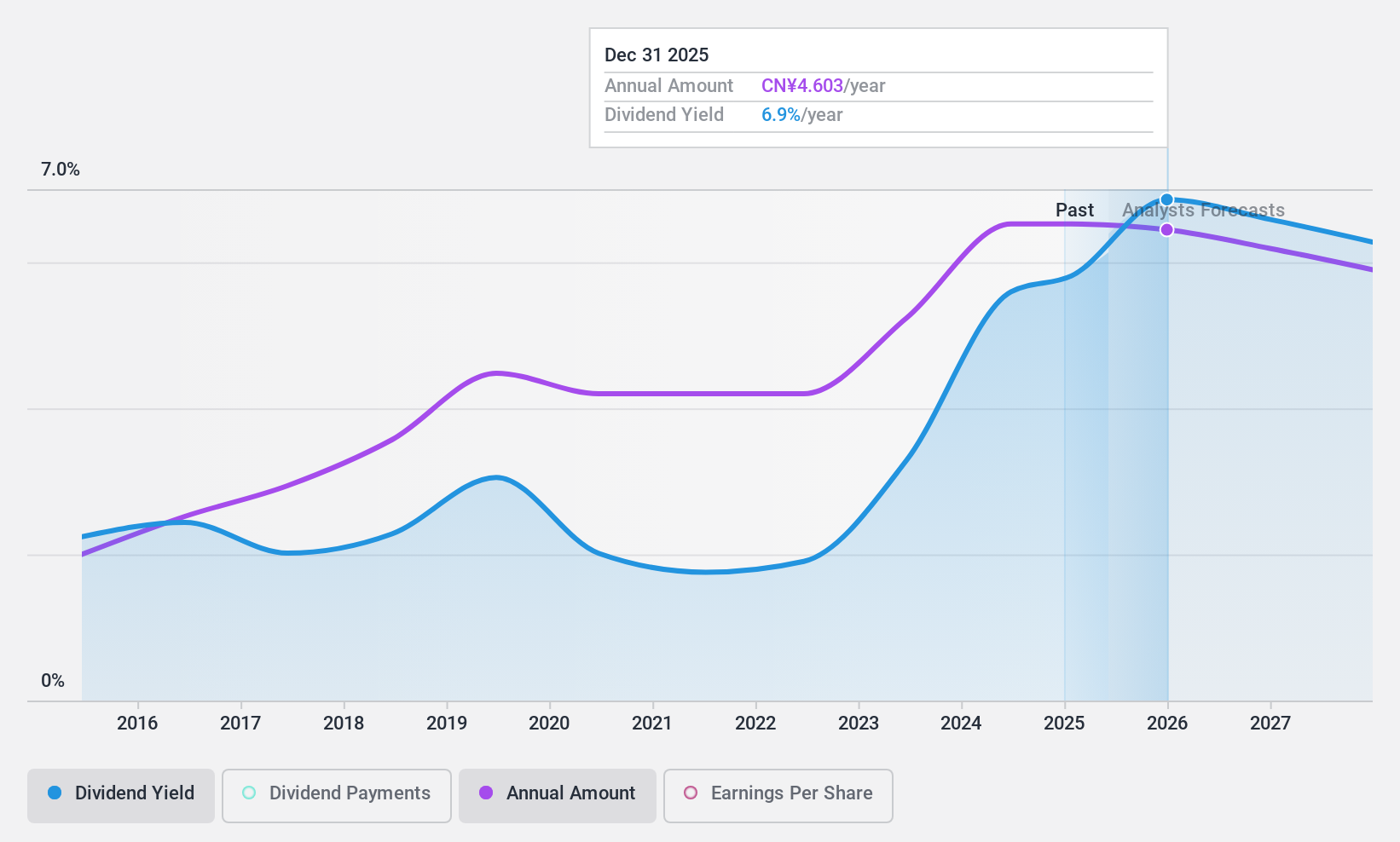

Jiangsu Yanghe Distillery (SZSE:002304)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Yanghe Distillery Co., Ltd. produces and sells liquors, wines, and spirits, with a market cap of CN¥119.52 billion.

Operations: Jiangsu Yanghe Distillery Co., Ltd.'s revenue primarily comes from the Alcohol Industry, generating CN¥29.72 billion.

Dividend Yield: 5.9%

Jiangsu Yanghe Distillery offers a dividend yield of 5.87%, placing it among the top 25% of dividend payers in China. However, its dividends are not well-covered by earnings or free cash flows, with high payout ratios indicating potential sustainability concerns. Despite this, dividends have been stable and reliable over the past decade, and recent approvals for interim cash dividends suggest a commitment to maintaining shareholder returns amidst trading at significant value below estimated fair value.

- Delve into the full analysis dividend report here for a deeper understanding of Jiangsu Yanghe Distillery.

- In light of our recent valuation report, it seems possible that Jiangsu Yanghe Distillery is trading behind its estimated value.

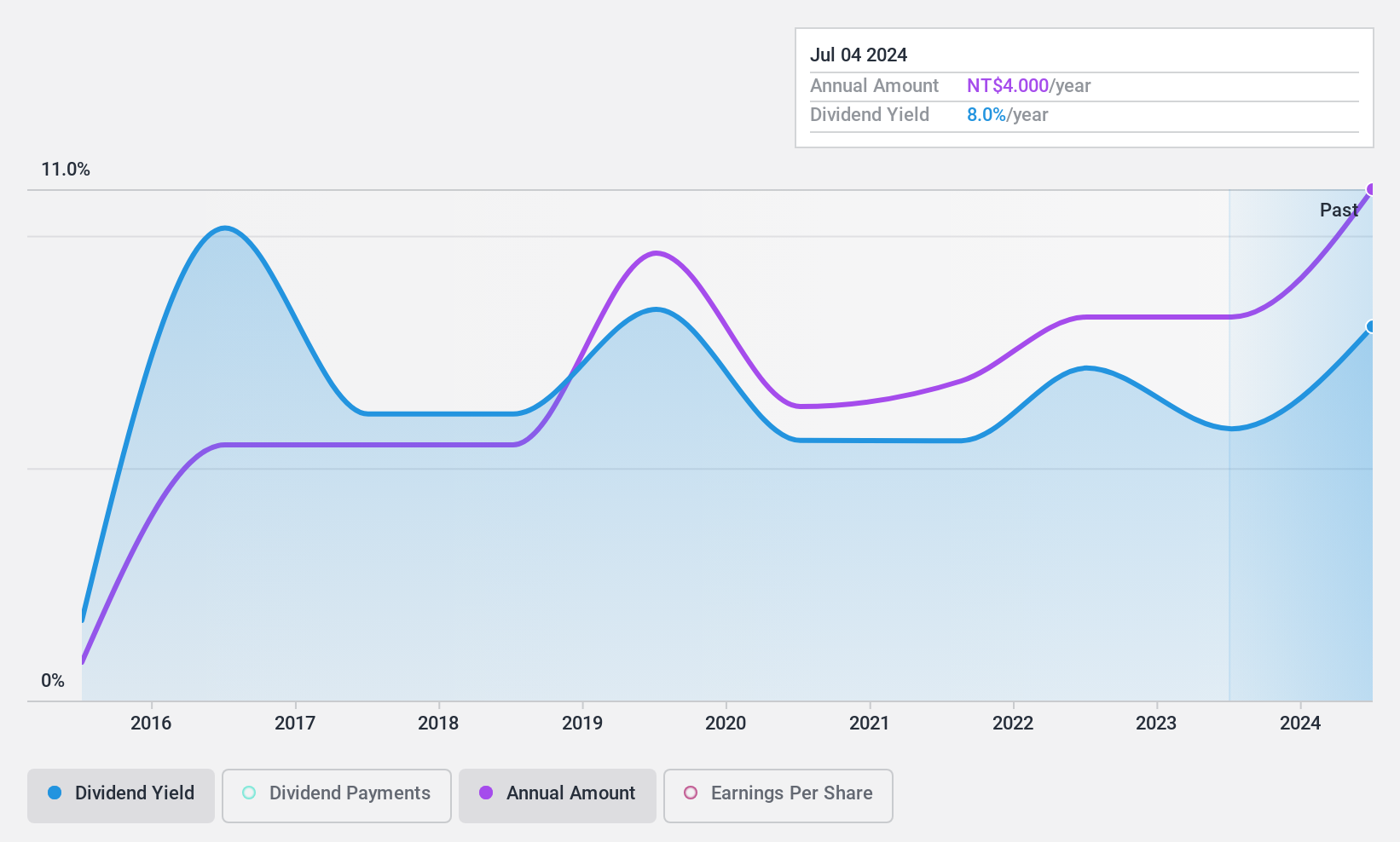

Darfon Electronics (TWSE:8163)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Darfon Electronics Corp. specializes in eco-friendly technologies for IT peripherals, passive components, and green energy solutions, with a market cap of NT$12.73 billion.

Operations: Darfon Electronics Corp.'s revenue is primarily derived from Intelligent Products, which contribute NT$12.40 billion, and Green Energy Products, accounting for NT$9.87 billion.

Dividend Yield: 8.7%

Darfon Electronics' dividend yield of 8.73% ranks it in the top 25% of Taiwan's market, yet its high payout ratio of 156.6% raises sustainability concerns as dividends aren't covered by earnings. Although dividends have grown over the past decade, they have been volatile with significant annual drops exceeding 20%. While trading at a substantial discount to fair value and revenue growth forecasted at 15.49%, dividend reliability remains questionable due to inconsistent payments.

- Click here and access our complete dividend analysis report to understand the dynamics of Darfon Electronics.

- Our expertly prepared valuation report Darfon Electronics implies its share price may be lower than expected.

Taking Advantage

- Unlock our comprehensive list of 2010 Top Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8163

Darfon Electronics

Manufactures and markets IT peripherals, passive components, and green energy solutions.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives