As global markets respond to the recent U.S.-China tariff suspension, Asian stocks have shown resilience, with indexes like the Shanghai Composite and Hang Seng advancing amid improved trade relations. In this environment of cautious optimism, identifying promising small-cap opportunities can be particularly rewarding as these companies often benefit from easing trade tensions and shifting economic dynamics. A good stock in such a setting is one that demonstrates robust fundamentals and potential for growth despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | NA | 22.16% | 22.91% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Imuraya Group | 4.07% | 4.41% | 30.80% | ★★★★★★ |

| Pan Asian Microvent Tech (Jiangsu) | 23.44% | 15.19% | 13.48% | ★★★★★★ |

| Zhubo Design | NA | -12.60% | -19.76% | ★★★★★★ |

| Wooyang HC | 13.57% | -8.40% | 25.80% | ★★★★★★ |

| Jiangsu Lianfa TextileLtd | 26.67% | 2.17% | -26.08% | ★★★★★☆ |

| AJIS | 0.68% | 3.20% | -12.98% | ★★★★★☆ |

| TOMONY Holdings | 58.26% | 8.09% | 14.24% | ★★★★★☆ |

| Nippon Sharyo | 53.44% | -0.74% | -11.37% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Vobile Group (SEHK:3738)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Mainland China, and other international markets, with a market cap of approximately HK$8.80 billion.

Operations: Vobile Group generates revenue primarily from its SaaS offerings, amounting to approximately HK$2.40 billion. The company's net profit margin reflects its financial efficiency in managing costs relative to revenue.

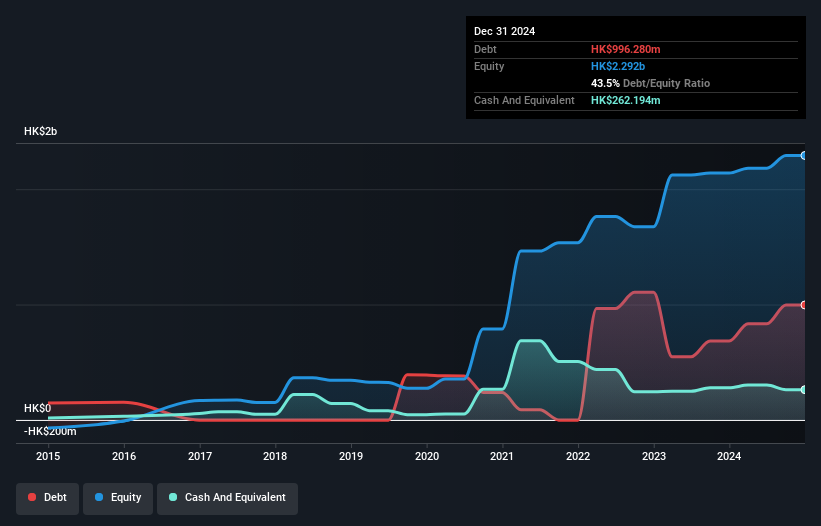

Vobile Group, a dynamic player in the tech space, has seen its debt to equity ratio improve significantly from 142.5% to 43.5% over five years, reflecting a stronger financial footing. The company recently reported a net income of HKD 142.73 million for 2024, bouncing back from a previous loss of HKD 7.82 million. With earnings expected to grow by nearly 28% annually and the launch of DreamMaker leveraging NVIDIA's tech for AI-driven video production, Vobile is positioning itself as an innovative force in content creation and protection while maintaining satisfactory debt levels with a net debt to equity ratio at 32%.

- Click to explore a detailed breakdown of our findings in Vobile Group's health report.

Gain insights into Vobile Group's past trends and performance with our Past report.

Wenzhou Yuanfei pet toy products (SZSE:001222)

Simply Wall St Value Rating: ★★★★★★

Overview: Wenzhou Yuanfei Pet Toy Products Co., Ltd. is a company specializing in the production and sale of pet toys, with a market cap of CN¥3.90 billion.

Operations: The company generates revenue primarily from the sale of pet toys, with a market capitalization of CN¥3.90 billion.

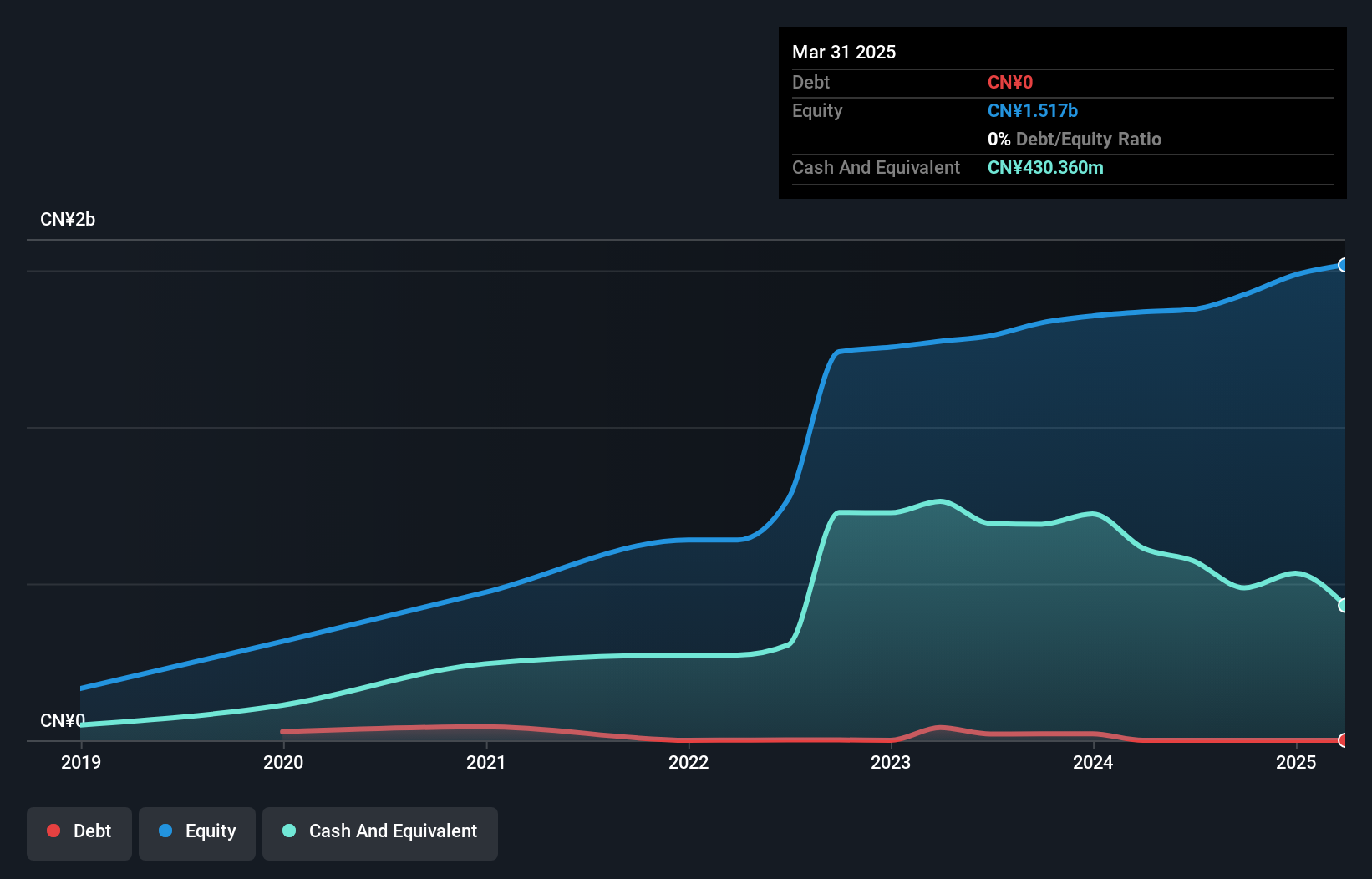

Yuanfei, a small player in the pet toy market, shows a mixed financial landscape. Despite reporting CNY 334.83 million in sales for Q1 2025, an increase from CNY 245.66 million last year, net income dropped to CNY 25.37 million from CNY 36.54 million. The company remains debt-free with high-quality earnings and a price-to-earnings ratio of 25.5x below the CN market average of 38.2x, suggesting good value potential. Earnings grew by 8% over the past year, outpacing industry trends; however, recent dividend reductions may reflect caution amid fluctuating profits and cash flow challenges.

Baolingbao BiologyLtd (SZSE:002286)

Simply Wall St Value Rating: ★★★★★★

Overview: Baolingbao Biology Co., Ltd. is engaged in the research, development, manufacturing, and sale of functional sugars in China, with a market capitalization of CN¥4.22 billion.

Operations: The company generates revenue primarily from the sale of functional sugars. The net profit margin has shown variability, reflecting fluctuations in production costs and market conditions.

Baolingbao Biology Ltd., a noteworthy player in the food industry, has demonstrated robust growth with earnings surging by 130% over the past year, outpacing the industry's -5.5%. The company's net debt to equity ratio stands at a satisfactory 3.8%, indicating sound financial health. Its price-to-earnings ratio of 30.5x is appealing compared to the broader CN market's 38.2x, suggesting potential value for investors. Recent results show significant improvement with Q1 sales reaching CNY 684.8 million from CNY 551 million last year and net income climbing to CNY 50 million from CNY 23 million, reflecting strong operational performance despite share price volatility recently observed in the market.

Turning Ideas Into Actions

- Reveal the 2618 hidden gems among our Asian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baolingbao BiologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002286

Baolingbao BiologyLtd

Researches and develops, manufactures, and sells a range of functional sugars in China.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives