Exploring Undervalued Opportunities: Three Chinese Stocks With Intrinsic Discounts Ranging From 29.6% to 41.1%

Reviewed by Simply Wall St

Amid a backdrop of fluctuating global markets, Chinese stocks have shown resilience, with strong export data helping to counterbalance domestic economic pressures. This context sets the stage for investors to consider the potential of undervalued stocks within China's complex market landscape. Identifying stocks that trade below their intrinsic value can offer attractive opportunities, especially in a market where strategic policy decisions are anticipated to drive future growth trajectories.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥166.62 | CN¥321.74 | 48.2% |

| Ningbo Dechang Electrical Machinery Made (SHSE:605555) | CN¥18.05 | CN¥33.37 | 45.9% |

| Thunder Software TechnologyLtd (SZSE:300496) | CN¥46.59 | CN¥84.25 | 44.7% |

| Shenzhen Ridge Engineering Consulting (SZSE:300977) | CN¥15.84 | CN¥29.84 | 46.9% |

| Eyebright Medical Technology (Beijing) (SHSE:688050) | CN¥66.16 | CN¥121.86 | 45.7% |

| INKON Life Technology (SZSE:300143) | CN¥7.56 | CN¥14.64 | 48.4% |

| China Film (SHSE:600977) | CN¥10.50 | CN¥20.25 | 48.2% |

| Seres GroupLtd (SHSE:601127) | CN¥77.37 | CN¥149.74 | 48.3% |

| Quectel Wireless Solutions (SHSE:603236) | CN¥51.10 | CN¥96.65 | 47.1% |

| Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥9.77 | CN¥18.84 | 48.1% |

Underneath we present a selection of stocks filtered out by our screen.

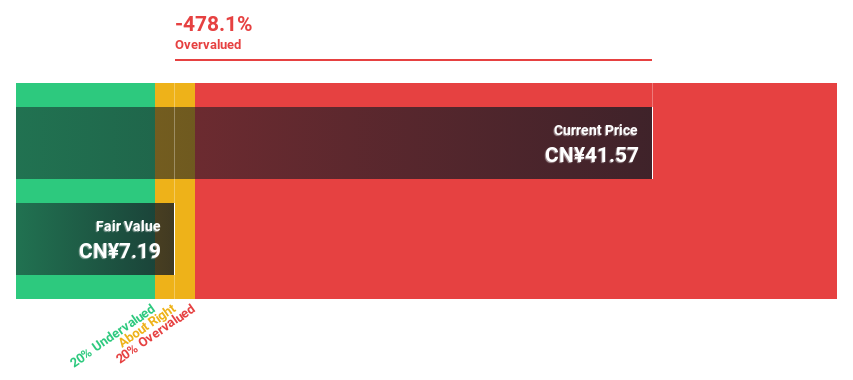

Jiugui Liquor (SZSE:000799)

Overview: Jiugui Liquor Co., Ltd. is a company based in China that produces and sells a range of liquor products both domestically and internationally, with a market capitalization of approximately CN¥13.49 billion.

Operations: The company generates revenue primarily through alcohol sales, totaling CN¥2.35 billion.

Estimated Discount To Fair Value: 41.1%

Jiugui Liquor, despite recent dividend cuts and a significant drop in quarterly earnings from CNY 300.19 million to CNY 73.38 million, remains undervalued based on cash flow analysis. Trading at CN¥41.51, significantly below the estimated fair value of CN¥70.45, it presents a potential opportunity for value investors. While profit margins have decreased to 13.6% from last year's 24.9%, earnings are expected to grow by a robust 26.1% annually over the next three years, outpacing the broader Chinese market forecast of 22.2%. However, its current dividend yield of 2.41% is poorly supported by both earnings and free cash flows, suggesting potential sustainability issues.

- Upon reviewing our latest growth report, Jiugui Liquor's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Jiugui Liquor stock in this financial health report.

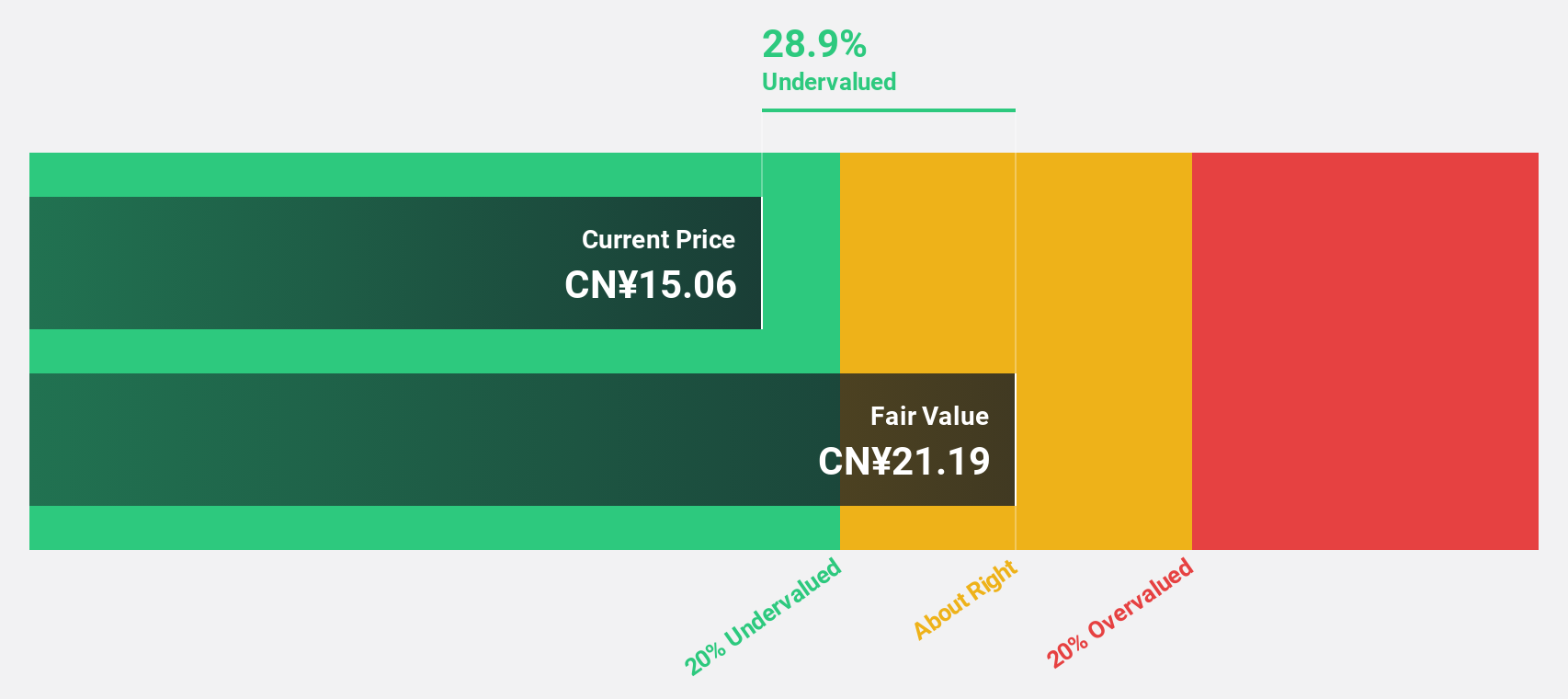

Anhui Anli Material Technology (SZSE:300218)

Overview: Anhui Anli Material Technology Co., Ltd. specializes in the R&D, production, and sales of ecological functional polyurethane synthetic leather products and other polymer composites in China, with a market capitalization of approximately CN¥3.77 billion.

Operations: The company generates CN¥2.11 billion in revenue from its artificial and synthetic leather industry segment.

Estimated Discount To Fair Value: 33.9%

Anhui Anli Material Technology Co., Ltd., currently priced at CN¥17.64, is markedly below its calculated fair value of CN¥26.69, indicating a significant undervaluation based on cash flows. Recent financials show a turnaround with a net income of CN¥41.27 million this quarter, up from last year's loss, alongside robust sales growth to CN¥540.86 million from CN¥434.03 million. Despite these positives, the company has an unstable dividend history and low forecasted Return on Equity at 16.5%. However, earnings and revenue are expected to grow impressively at rates of 30.5% and 20.2% per year respectively, outstripping broader market expectations.

- According our earnings growth report, there's an indication that Anhui Anli Material Technology might be ready to expand.

- Dive into the specifics of Anhui Anli Material Technology here with our thorough financial health report.

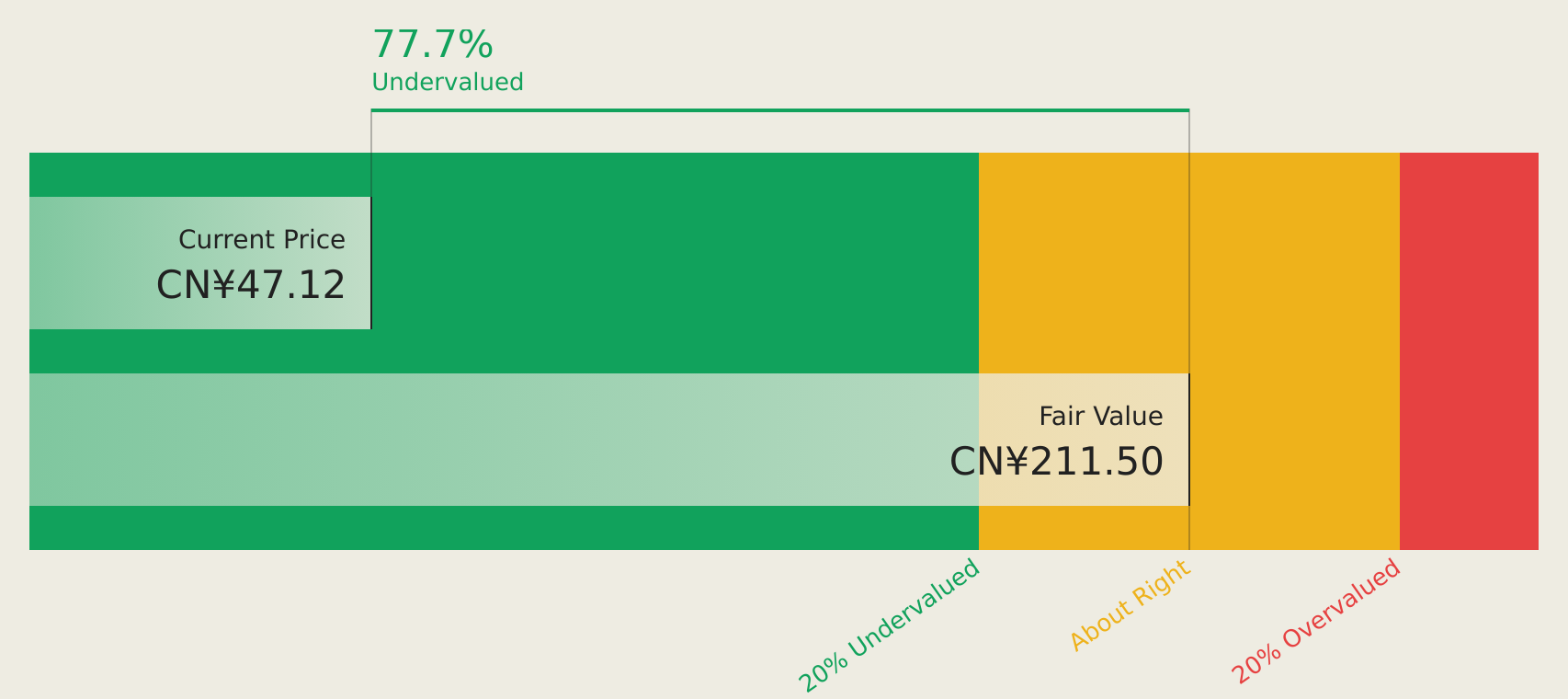

Wuhan DR Laser TechnologyLtd (SZSE:300776)

Overview: Wuhan DR Laser Technology Ltd (SZSE: 300776) specializes in manufacturing and selling laser equipment for solar cell applications, operating both in China and internationally, with a market capitalization of CN¥13.03 billion.

Operations: The company generates CN¥1.71 billion in revenue from its photovoltaic segment.

Estimated Discount To Fair Value: 29.6%

Wuhan DR Laser TechnologyLtd, trading at CN¥47.91, significantly under its fair value of CN¥68.03, exhibits strong growth prospects with earnings and revenue forecasted to increase by 23.63% and 23.4% annually. Despite its volatile share price and unstable dividends, the company's strategic buybacks and recent corporate governance changes underscore proactive management efforts to enhance shareholder value. However, a low forecasted Return on Equity at 19.8% tempers its overall investment appeal based on cash flows.

- In light of our recent growth report, it seems possible that Wuhan DR Laser TechnologyLtd's financial performance will exceed current levels.

- Take a closer look at Wuhan DR Laser TechnologyLtd's balance sheet health here in our report.

Make It Happen

- Navigate through the entire inventory of 99 Undervalued Chinese Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300218

Anhui Anli Material Technology

Engages in the research and development, production, sale, and servicing of ecological functional polyurethane synthetic leather products, polyurethane resin series products, and other polymer composite materials in China.

Flawless balance sheet with high growth potential and pays a dividend.