- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600415

3 Undervalued Chinese Stocks That Could Be Worth A Closer Look

Reviewed by Simply Wall St

Despite recent declines in Chinese stocks driven by weak inflation data, there are still opportunities for discerning investors. In this environment, identifying undervalued stocks with strong fundamentals and growth potential can be particularly rewarding.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningxia Baofeng Energy Group (SHSE:600989) | CN¥14.75 | CN¥28.79 | 48.8% |

| Beijing InHand Networks Technology (SHSE:688080) | CN¥23.30 | CN¥45.11 | 48.4% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥22.93 | CN¥45.73 | 49.9% |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥138.70 | CN¥272.22 | 49% |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.98 | CN¥33.11 | 48.7% |

| Aerospace CH UAVLtd (SZSE:002389) | CN¥13.18 | CN¥26.06 | 49.4% |

| Songcheng Performance DevelopmentLtd (SZSE:300144) | CN¥7.15 | CN¥14.03 | 49% |

| Jiugui Liquor (SZSE:000799) | CN¥37.76 | CN¥73.92 | 48.9% |

| Hiconics Eco-energy Technology (SZSE:300048) | CN¥4.37 | CN¥8.69 | 49.7% |

| Chengdu Olymvax Biopharmaceuticals (SHSE:688319) | CN¥8.41 | CN¥16.70 | 49.6% |

Here's a peek at a few of the choices from the screener.

China Jushi (SHSE:600176)

Overview: China Jushi Co., Ltd. manufactures and sells fiberglass both in China and internationally, with a market cap of CN¥37.35 billion.

Operations: The company's revenue primarily comes from the production and sales of glass fiber and its products, amounting to CN¥14.79 billion.

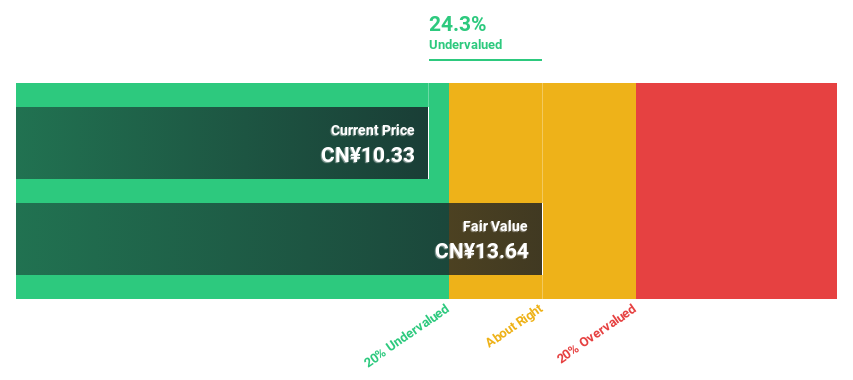

Estimated Discount To Fair Value: 30.6%

China Jushi is trading at CN¥9.33, significantly below its estimated fair value of CN¥13.44, indicating potential undervaluation based on cash flows. Despite a decline in profit margins from 27.7% to 13.1% over the past year and net income dropping to CN¥961.24 million from CN¥2,063.03 million, earnings are forecasted to grow at 25.8% annually, outpacing the market's 23%. However, debt coverage by operating cash flow remains a concern and dividends are not well covered by free cash flows.

- Our comprehensive growth report raises the possibility that China Jushi is poised for substantial financial growth.

- Take a closer look at China Jushi's balance sheet health here in our report.

Zhejiang China Commodities City Group (SHSE:600415)

Overview: Zhejiang China Commodities City Group Co., Ltd., with a market cap of CN¥47.11 billion, develops, manages, operates, and services an online trading platform in China through its subsidiaries.

Operations: The company's revenue segments include the development, management, operation, and service of an online trading platform in China.

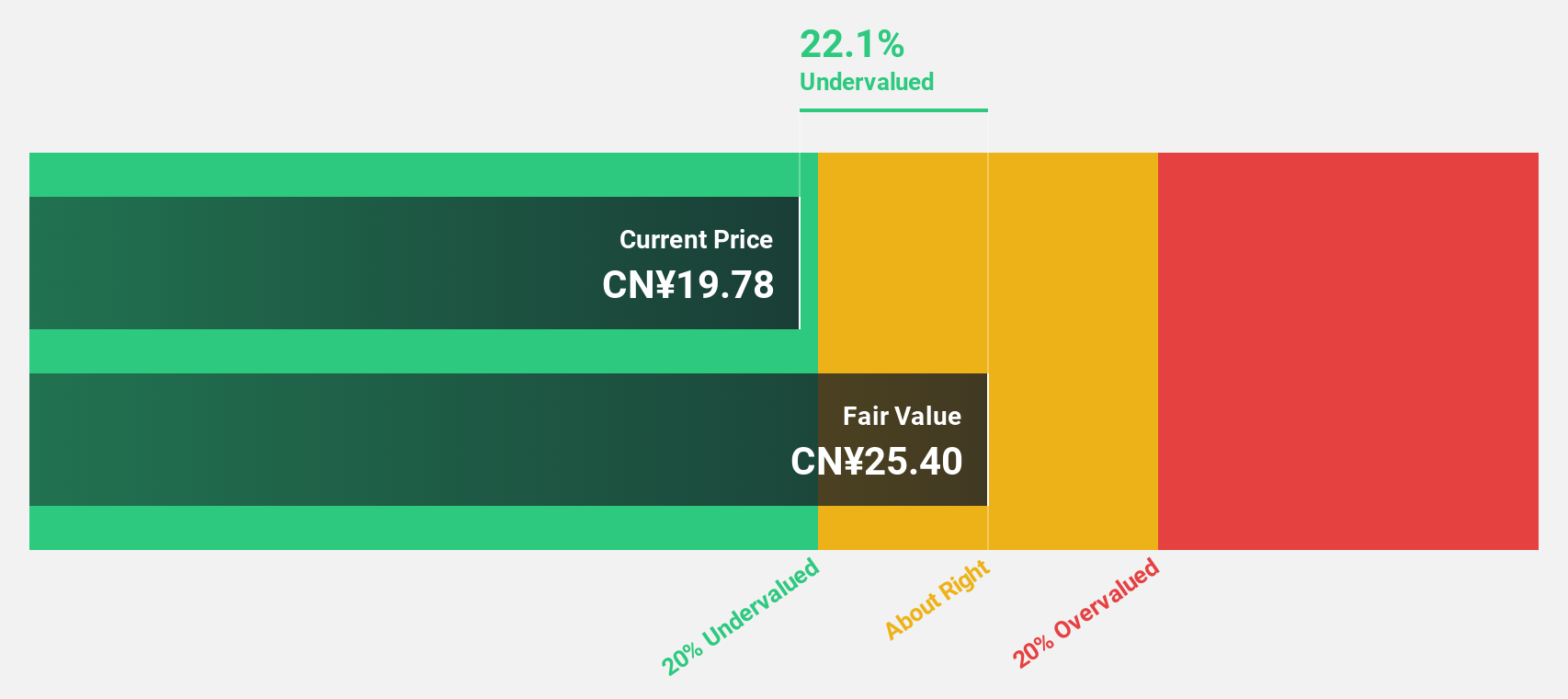

Estimated Discount To Fair Value: 19.2%

Zhejiang China Commodities City Group is trading at CN¥8.59, below the estimated fair value of CN¥10.63, indicating potential undervaluation based on cash flows. Revenue grew to CN¥6.77 billion in H1 2024 from CN¥5.16 billion a year ago, though net income fell to CN¥1.45 billion from CN¥2 billion. Earnings are expected to grow significantly over the next three years at 23.45% per year, despite high debt levels and low return on equity forecasts of 15.8%.

- In light of our recent growth report, it seems possible that Zhejiang China Commodities City Group's financial performance will exceed current levels.

- Click here to discover the nuances of Zhejiang China Commodities City Group with our detailed financial health report.

Jiugui Liquor (SZSE:000799)

Overview: Jiugui Liquor Co., Ltd. produces and sells liquor series products in China and internationally, with a market cap of CN¥12.27 billion.

Operations: Revenue Segments (in millions of CN¥): Alcohol Sales: 2272.99

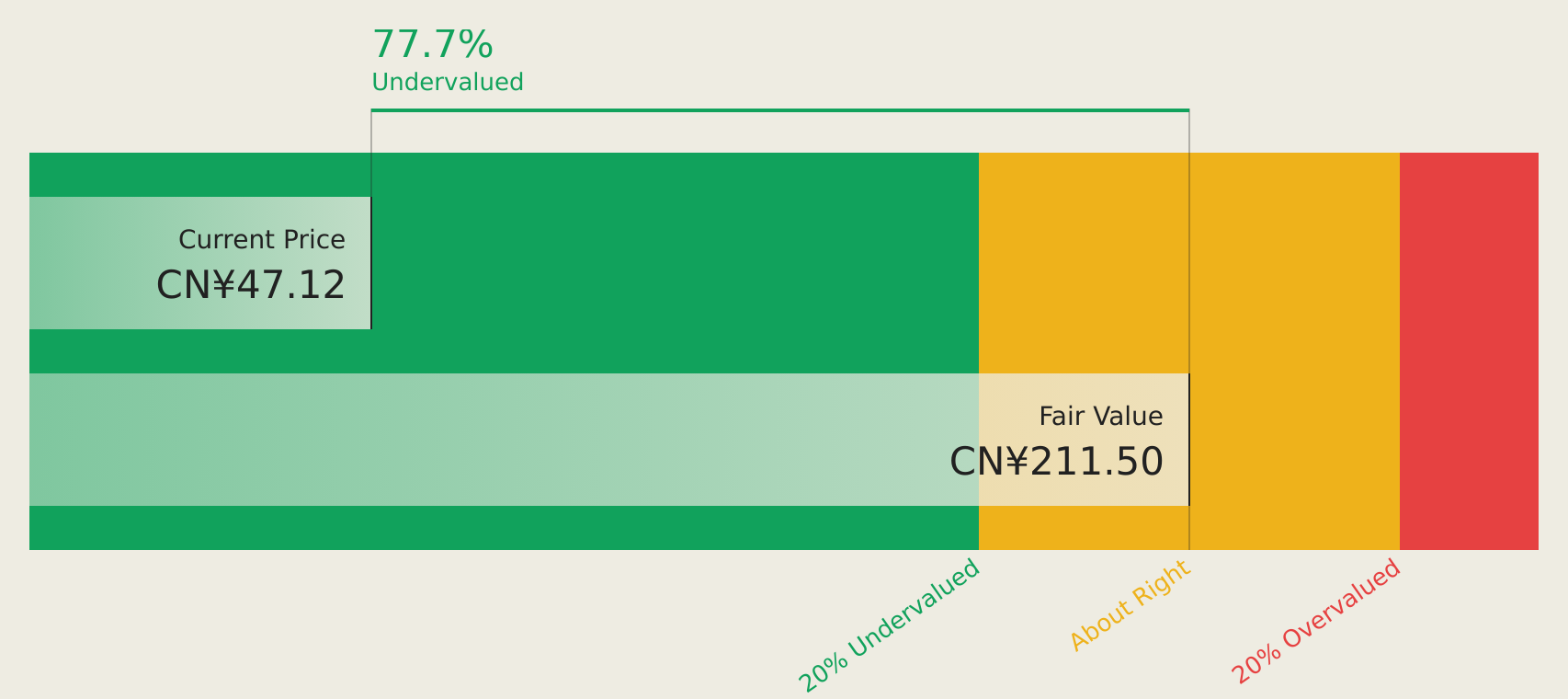

Estimated Discount To Fair Value: 48.9%

Jiugui Liquor's stock is trading at CN¥37.76, significantly below its estimated fair value of CN¥73.92, highlighting potential undervaluation based on cash flows. Despite a sharp decline in H1 2024 revenue to CN¥994.15 million from CN¥1.54 billion and net income dropping to CN¥121.02 million from CN¥421.95 million, earnings are forecasted to grow 26.74% per year over the next three years, outpacing the market average of 23%.

- According our earnings growth report, there's an indication that Jiugui Liquor might be ready to expand.

- Get an in-depth perspective on Jiugui Liquor's balance sheet by reading our health report here.

Taking Advantage

- Navigate through the entire inventory of 121 Undervalued Chinese Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang China Commodities City Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600415

Zhejiang China Commodities City Group

Through its subsidiaries, engages in the development, management, operation, and service of an online trading platform in China.

Reasonable growth potential with adequate balance sheet.