Investing in Leshan Giantstar Farming&Husbandry (SHSE:603477) five years ago would have delivered you a 371% gain

Long term investing can be life changing when you buy and hold the truly great businesses. And highest quality companies can see their share prices grow by huge amounts. For example, the Leshan Giantstar Farming&Husbandry Corporation Limited (SHSE:603477) share price is up a whopping 360% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. In the last week shares have slid back 2.3%.

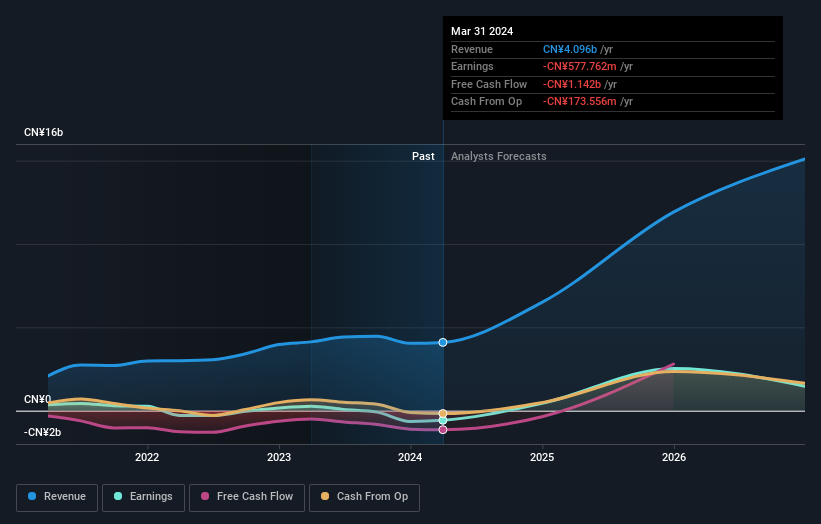

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

See our latest analysis for Leshan Giantstar Farming&Husbandry

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Leshan Giantstar Farming&Husbandry's earnings per share are down 39% per year, despite strong share price performance over five years.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

In contrast revenue growth of 39% per year is probably viewed as evidence that Leshan Giantstar Farming&Husbandry is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Leshan Giantstar Farming&Husbandry's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Leshan Giantstar Farming&Husbandry's TSR of 371% over the last 5 years is better than the share price return.

A Different Perspective

It's good to see that Leshan Giantstar Farming&Husbandry has rewarded shareholders with a total shareholder return of 27% in the last twelve months. However, the TSR over five years, coming in at 36% per year, is even more impressive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Leshan Giantstar Farming&Husbandry you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603477

Leshan Giantstar Farming&Husbandry

Engages in livestock and poultry breeding in China.

Exceptional growth potential and overvalued.