As global markets reach new highs following the Federal Reserve's recent rate cut, investors are keenly exploring opportunities to optimize their portfolios. In this buoyant market environment, dividend stocks yielding up to 5.9% can offer a compelling blend of income and growth potential. A good dividend stock typically combines a strong yield with robust fundamentals, making it an attractive option in today's economic landscape where interest rates are on the decline and consumer confidence remains high.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.96% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| Globeride (TSE:7990) | 4.29% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.37% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.95% | ★★★★★★ |

| Innotech (TSE:9880) | 4.81% | ★★★★★★ |

| CVB Financial (NasdaqGS:CVBF) | 4.53% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.21% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.73% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.87% | ★★★★★★ |

Click here to see the full list of 2031 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

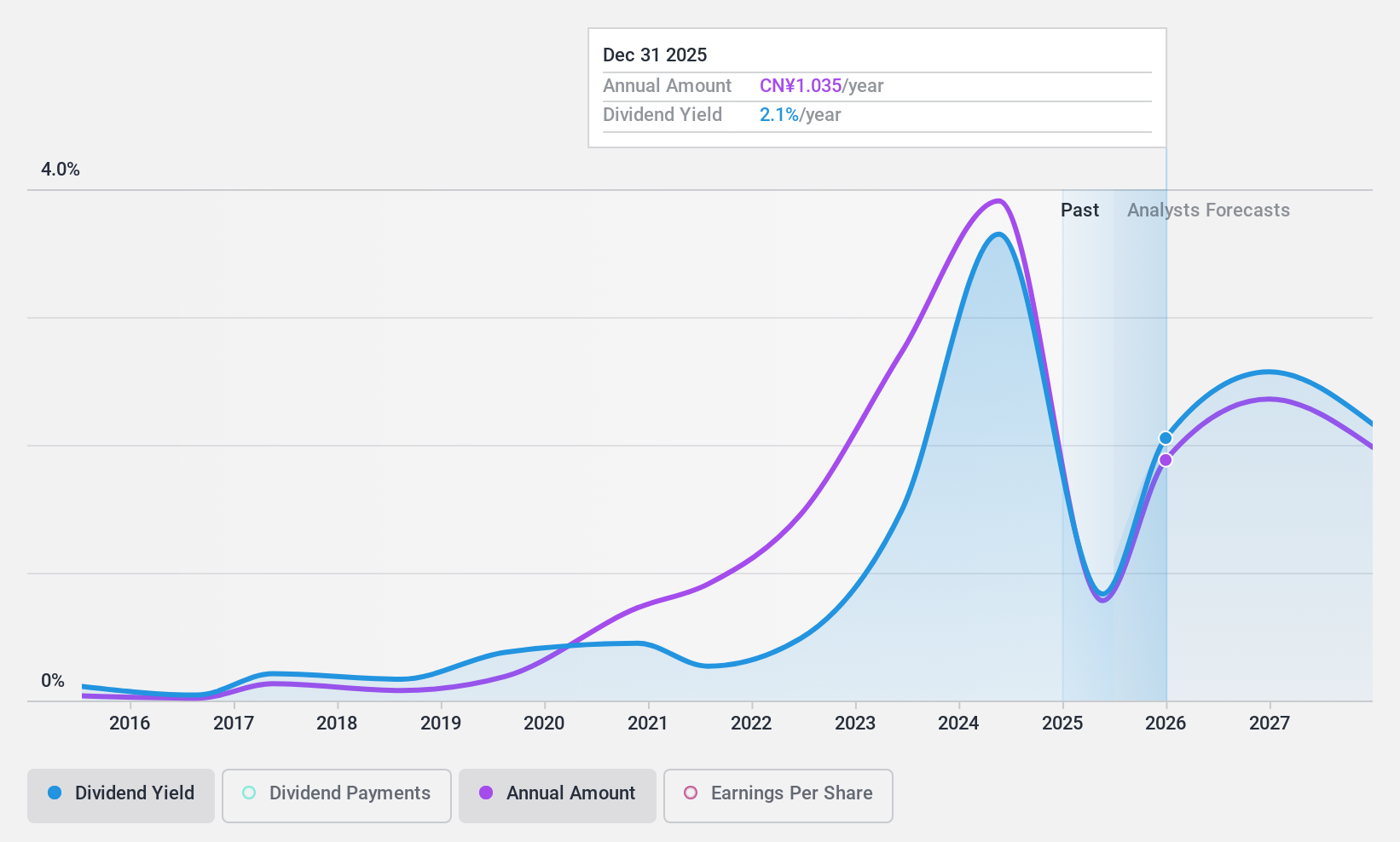

Shede Spirits (SHSE:600702)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shede Spirits Co., Ltd., with a market cap of CN¥16.38 billion, designs, produces, and sells liquor products in China through its subsidiaries.

Operations: Shede Spirits Co., Ltd. generates revenue from the design, production, and sale of liquor products in China.

Dividend Yield: 4%

Shede Spirits' dividend yield of 3.95% places it in the top 25% of CN market payers, yet its payments have been volatile and not well covered by free cash flows. Despite a low payout ratio (49.5%), recent earnings dropped significantly with H1 2024 net income at CNY 590.86 million, down from CNY 919.3 million a year ago, raising concerns about dividend sustainability amidst declining revenues and profits.

- Click here to discover the nuances of Shede Spirits with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Shede Spirits is trading behind its estimated value.

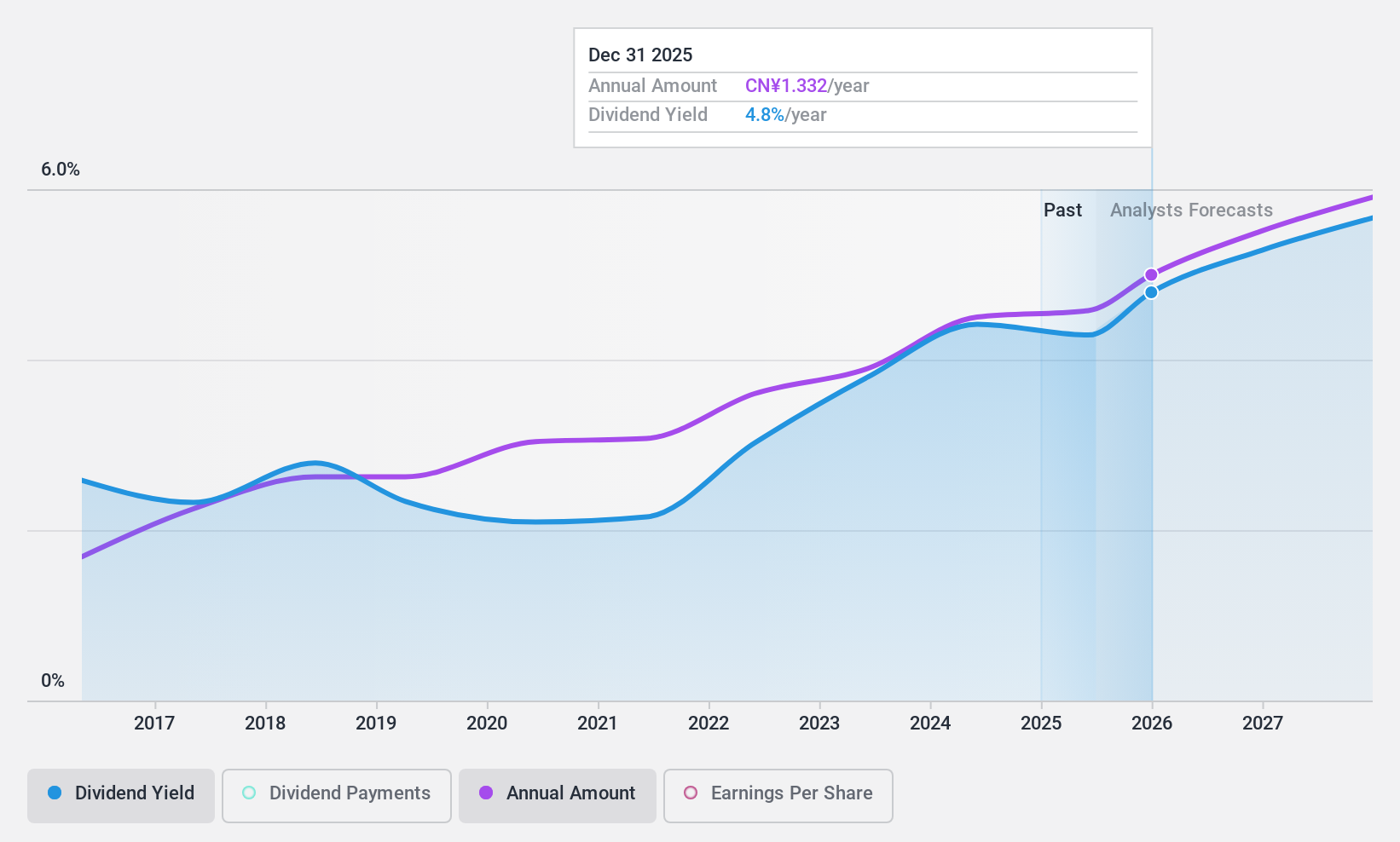

Inner Mongolia Yili Industrial Group (SHSE:600887)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Inner Mongolia Yili Industrial Group Co., Ltd. operates as a leading dairy producer in China, with a market cap of CN¥161.88 billion.

Operations: Inner Mongolia Yili Industrial Group Co., Ltd. generates revenue through its core dairy products segment, which includes liquid milk, milk powder, yogurt, and ice cream.

Dividend Yield: 4.3%

Inner Mongolia Yili Industrial Group's dividend yield of 4.35% ranks in the top 25% of CN market payers, supported by stable and growing payments over the past decade. The company's recent H1 2024 earnings report showed a net income increase to CNY 7.53 billion despite a drop in sales, indicating strong profitability. Dividends are well-covered by both earnings (65.5% payout ratio) and cash flows (64.3% cash payout ratio), enhancing their sustainability for investors seeking reliable income streams.

- Delve into the full analysis dividend report here for a deeper understanding of Inner Mongolia Yili Industrial Group.

- Our expertly prepared valuation report Inner Mongolia Yili Industrial Group implies its share price may be lower than expected.

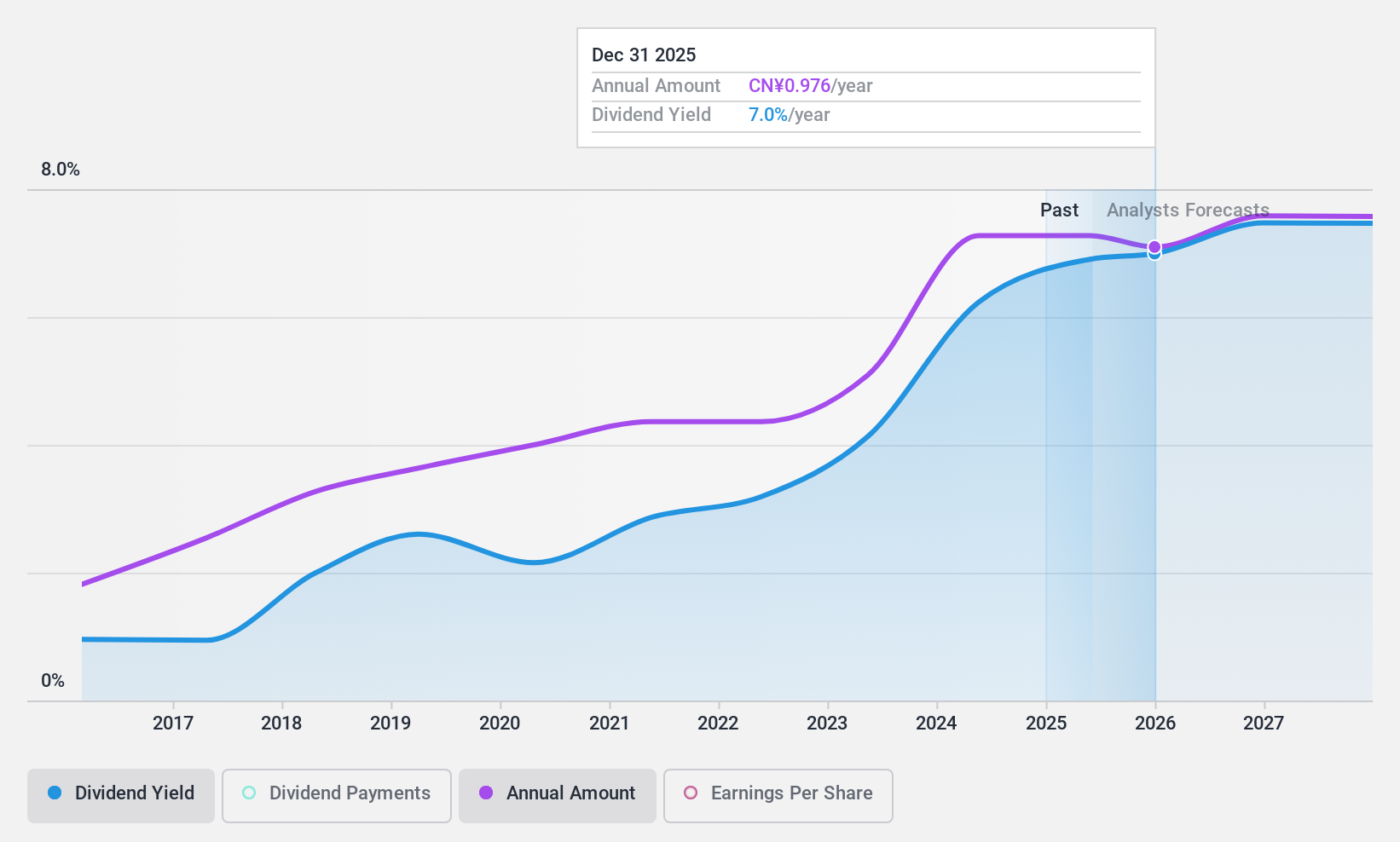

Suofeiya Home Collection (SZSE:002572)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Suofeiya Home Collection Co., Ltd. engages in the research, development, manufacturing, and sale of furniture products in the People’s Republic of China and has a market cap of CN¥14.74 billion.

Operations: Suofeiya Home Collection Co., Ltd. generates its revenue primarily from Furniture Manufacturing, which accounts for CN¥11.84 billion.

Dividend Yield: 5.9%

Suofeiya Home Collection's dividend yield of 5.94% is among the top 25% in the CN market, but its sustainability is questionable due to a high cash payout ratio of 416.9%. Despite stable and growing dividends over the past decade, recent earnings growth (15.1%) and a reasonable payout ratio (70.6%) suggest coverage by earnings but not free cash flows. Recent H1 2024 results show revenue at CNY 4.93 billion and net income at CNY 564.6 million, reflecting profitability improvements.

- Unlock comprehensive insights into our analysis of Suofeiya Home Collection stock in this dividend report.

- Our valuation report here indicates Suofeiya Home Collection may be undervalued.

Next Steps

- Access the full spectrum of 2031 Top Dividend Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600702

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives