- China

- /

- Auto Components

- /

- SHSE:603158

Shanghai Milkground Food Tech And Two Other Growth Stocks Insiders Are Betting On

Reviewed by Simply Wall St

In the midst of geopolitical tensions and consumer spending concerns, global markets have experienced notable fluctuations, with major indexes like the S&P 500 seeing early gains erased by week's end. Amidst this volatility, investors often look toward growth companies with high insider ownership as potential opportunities, given that significant insider investment can indicate confidence in a company's future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 43.2% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

Underneath we present a selection of stocks filtered out by our screen.

Shanghai Milkground Food Tech (SHSE:600882)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Milkground Food Tech Co., Ltd specializes in manufacturing and selling cheese and liquid milk products to both consumers and industrial clients in China, with a market cap of CN¥8.94 billion.

Operations: Shanghai Milkground Food Tech Co., Ltd generates revenue primarily through the production and distribution of cheese and liquid milk products within the Chinese market, targeting both consumer and industrial sectors.

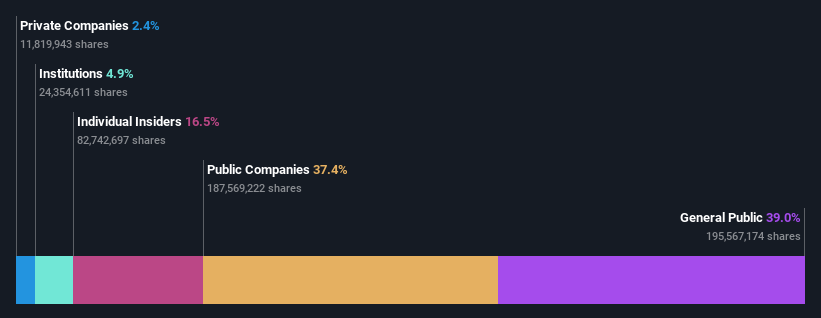

Insider Ownership: 16.5%

Revenue Growth Forecast: 15.3% p.a.

Shanghai Milkground Food Tech is trading at 84.9% below its estimated fair value, indicating potential undervaluation. Earnings grew by a very large amount over the past year and are expected to continue growing significantly, outpacing the Chinese market's average growth rate. Revenue growth is forecasted at 15.3% per year, surpassing the market's 13.4%. However, future Return on Equity is projected to be low at 4.5%. A shareholders meeting is scheduled for December 30, 2024.

- Dive into the specifics of Shanghai Milkground Food Tech here with our thorough growth forecast report.

- Our valuation report unveils the possibility Shanghai Milkground Food Tech's shares may be trading at a premium.

Changzhou Tenglong AutoPartsCo.Ltd (SHSE:603158)

Simply Wall St Growth Rating: ★★★★☆☆

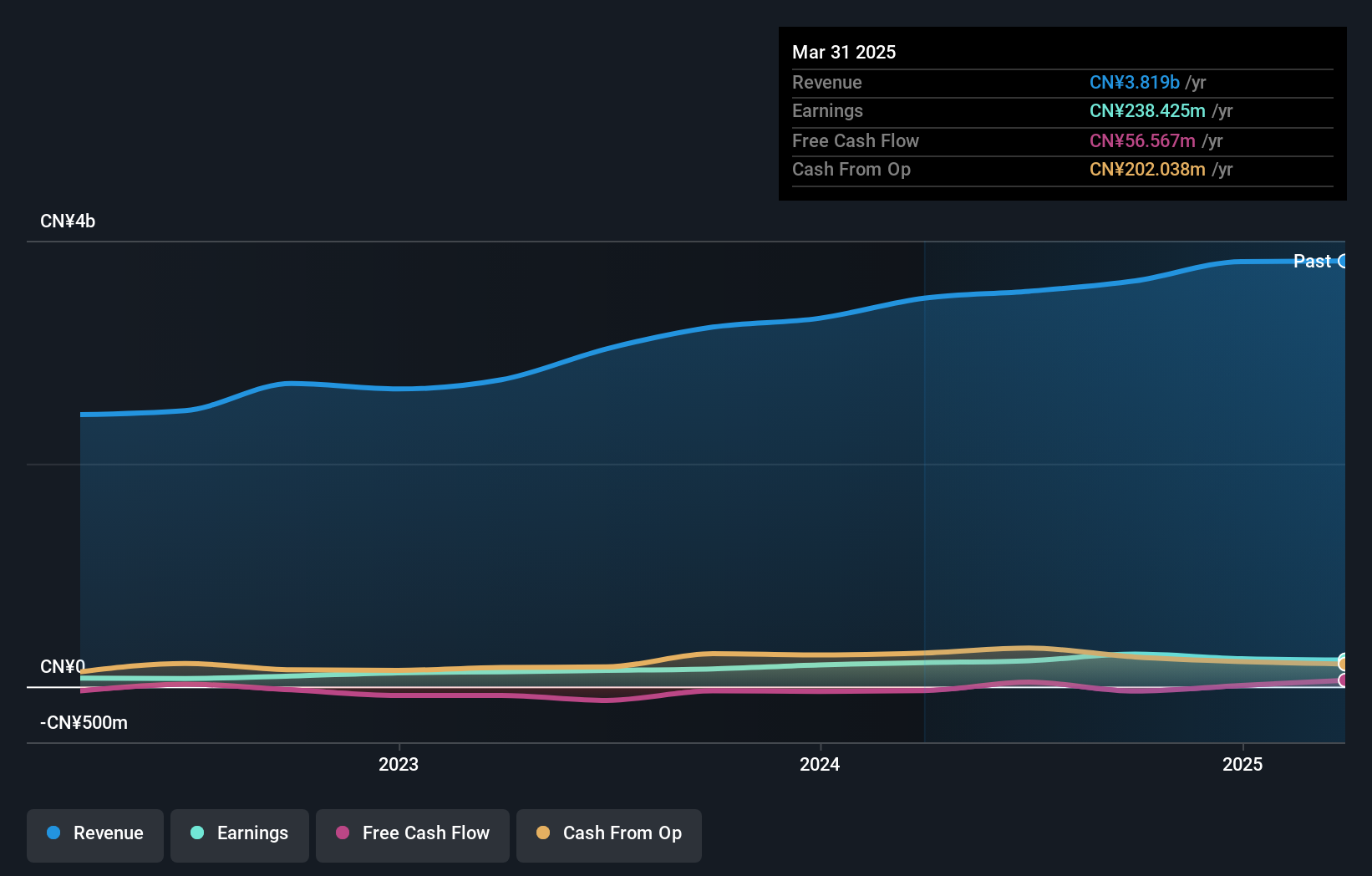

Overview: Changzhou Tenglong AutoPartsCo., Ltd. researches, develops, manufactures, and sells auto parts both in China and internationally, with a market cap of CN¥4.50 billion.

Operations: Revenue segments for Changzhou Tenglong AutoPartsCo., Ltd. include the research, development, manufacturing, and sales of auto parts in both domestic and international markets.

Insider Ownership: 14.7%

Revenue Growth Forecast: 27.7% p.a.

Changzhou Tenglong AutoPartsCo.Ltd. is trading at a favorable value with a price-to-earnings ratio of 16x, well below the Chinese market average of 38.1x. Although its earnings growth forecast of 21.15% annually lags behind the market's, revenue is expected to grow significantly faster at 27.7% per year. Despite recent substantial profit growth, future returns on equity are projected to be modest at 15.2%. An extraordinary shareholders meeting is set for January 7, 2025.

- Navigate through the intricacies of Changzhou Tenglong AutoPartsCo.Ltd with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Changzhou Tenglong AutoPartsCo.Ltd shares in the market.

Ningbo Deye Technology Group (SHSE:605117)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ningbo Deye Technology Group Co., Ltd. specializes in producing and selling heat exchangers, inverters, and dehumidifiers across China, the United Kingdom, the United States, Germany, India, and other international markets with a market cap of CN¥59.26 billion.

Operations: The company's revenue is primarily derived from the production and sales of heat exchangers, inverters, and dehumidifiers across various international markets including China, the United Kingdom, the United States, Germany, and India.

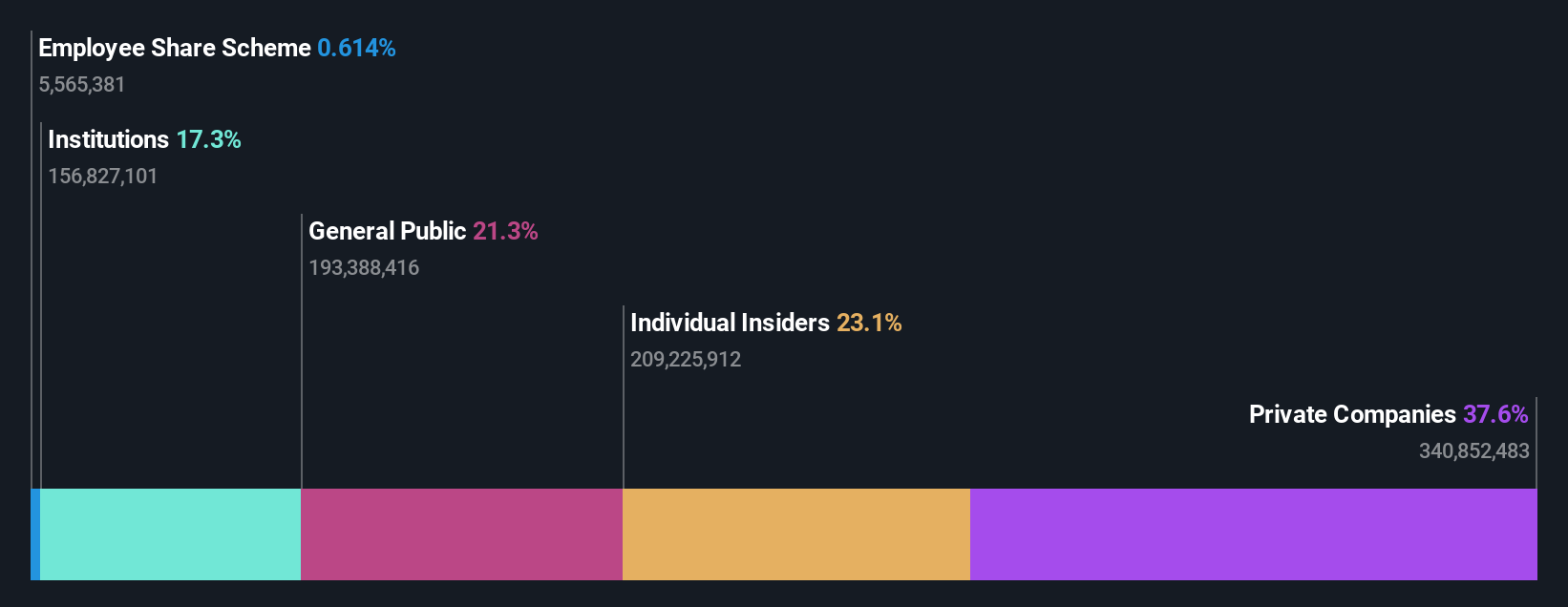

Insider Ownership: 23.2%

Revenue Growth Forecast: 30.4% p.a.

Ningbo Deye Technology Group is poised for robust growth, with revenue projected to increase by 30.4% annually, outpacing the Chinese market's 13.4%. Its earnings are also expected to grow significantly at 27.6% per year, surpassing market averages. The stock trades at a 24.5% discount to its estimated fair value and offers good relative value compared to peers. Despite no recent insider trading activity, the company's high forecasted return on equity of 33.5% underscores its potential appeal.

- Click to explore a detailed breakdown of our findings in Ningbo Deye Technology Group's earnings growth report.

- Our comprehensive valuation report raises the possibility that Ningbo Deye Technology Group is priced lower than what may be justified by its financials.

Where To Now?

- Reveal the 1451 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603158

Changzhou Tenglong AutoPartsCo.Ltd

Researches, develops, manufactures, and sells auto parts in China and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success