As the Asian markets navigate a landscape of easing trade tensions and cautious optimism, investors are increasingly turning their attention to small-cap stocks, which have shown resilience despite broader economic uncertainties. In this environment, identifying promising stocks involves looking for companies with strong fundamentals and growth potential that can capitalize on regional economic developments.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 21.75% | 29.33% | ★★★★★★ |

| Macnica Galaxy | 40.95% | 6.55% | 17.46% | ★★★★★★ |

| Ohashi Technica | NA | 4.58% | -14.04% | ★★★★★★ |

| Synmosa Biopharma | 30.18% | 16.26% | 21.16% | ★★★★★★ |

| Saison Technology | NA | 0.96% | -11.65% | ★★★★★★ |

| Shanghai YongLi Belting | 15.01% | -12.16% | 25.96% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 13.81% | -0.34% | -27.47% | ★★★★★☆ |

| Tait Marketing & Distribution | 0.73% | 7.56% | 15.53% | ★★★★★☆ |

| Philippine Savings Bank | NA | 6.09% | 23.58% | ★★★★★☆ |

| Giant Heavy Machinery Service | 17.81% | 21.88% | 48.77% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Star Lake BioscienceZhaoqing Guangdong (SHSE:600866)

Simply Wall St Value Rating: ★★★★★☆

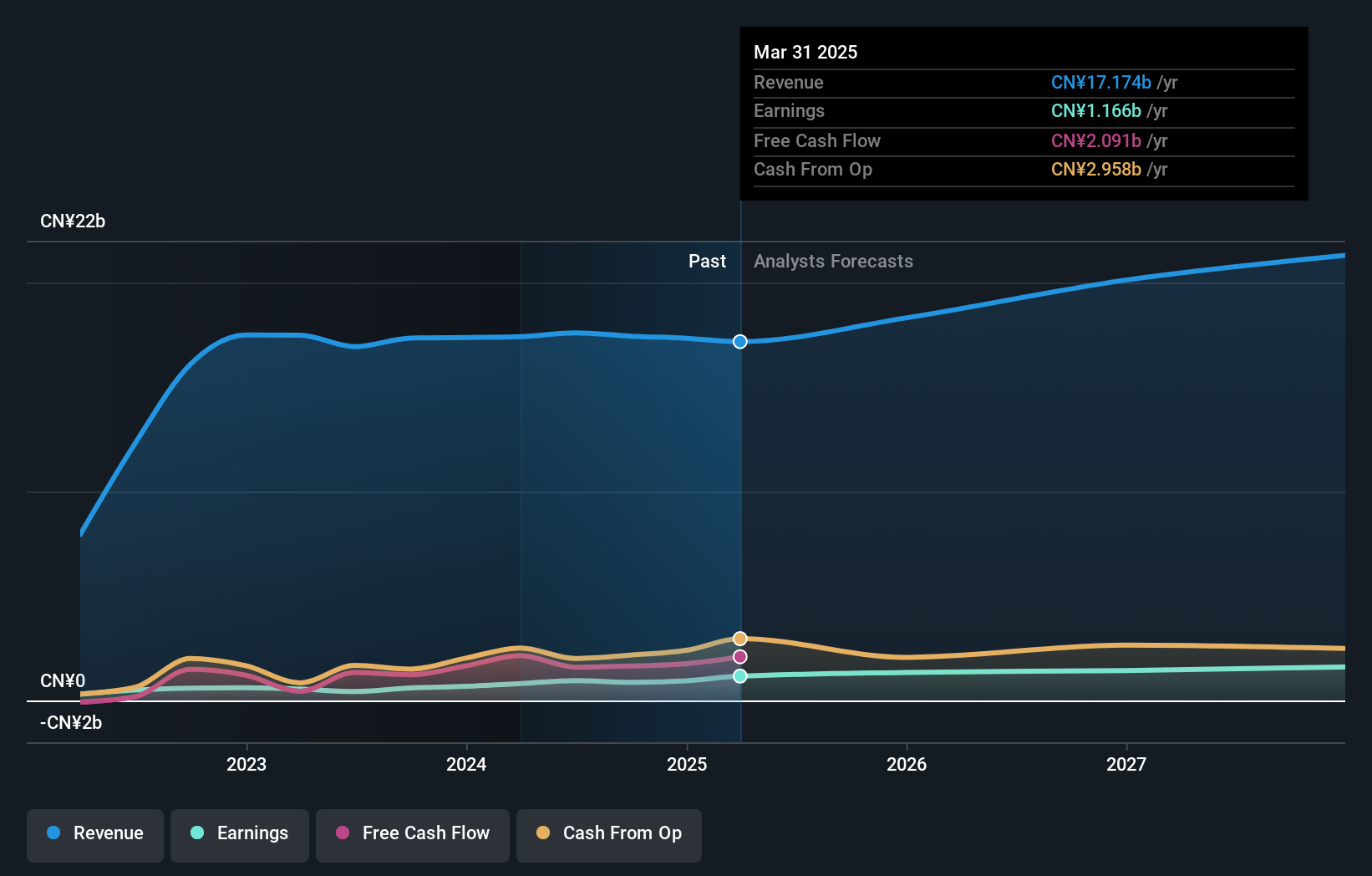

Overview: Star Lake Bioscience Co., Inc. Zhaoqing Guangdong is involved in the production and distribution of pharmaceutical raw materials, as well as food and feed additives under the Star Lake and Yue Bao brands, with a market capitalization of CN¥12.46 billion.

Operations: Star Lake Bioscience generates revenue primarily from the sale of pharmaceutical raw materials and food and feed additives. The company operates both domestically in China and internationally, leveraging its Star Lake and Yue Bao brands.

Star Lake Bioscience, a promising name in the Asian market, reported a net income of CNY 943.15 million for 2024, up from CNY 677.95 million the previous year, showcasing strong earnings growth despite slightly lower sales of CNY 17.33 billion compared to CNY 17.37 billion prior. The company’s basic earnings per share rose to CNY 0.57 from CNY 0.41, reflecting improved profitability and operational efficiency. With its net debt to equity ratio at a satisfactory level of just 2.6%, Star Lake appears well-positioned financially and continues to trade significantly below its estimated fair value by about 84%.

Chengdu Haoneng Technology (SHSE:603809)

Simply Wall St Value Rating: ★★★★☆☆

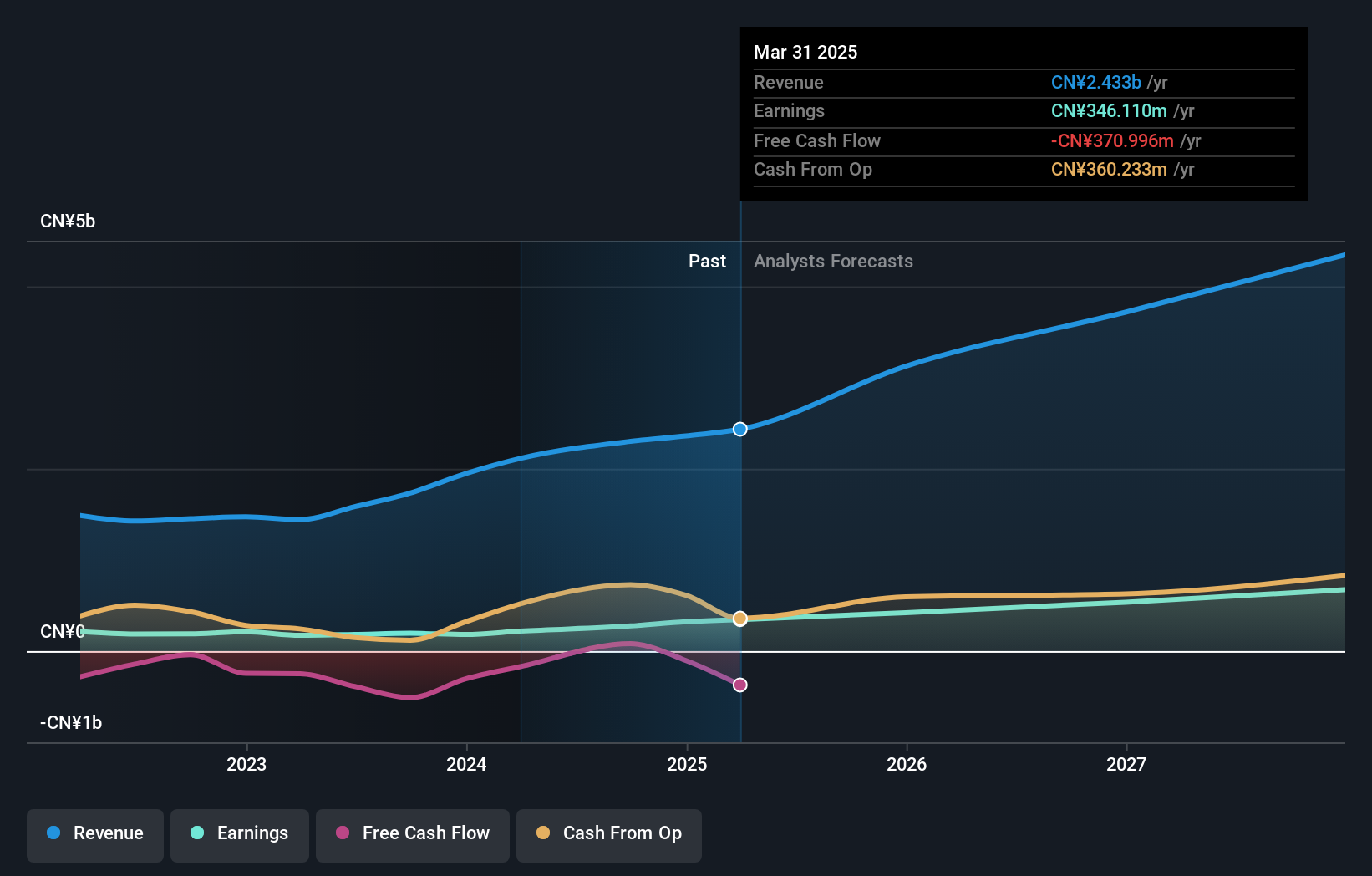

Overview: Chengdu Haoneng Technology Co., Ltd. focuses on the research, development, production, and sale of automotive transmission system components both in China and internationally, with a market cap of approximately CN¥10.98 billion.

Operations: Chengdu Haoneng Technology generates revenue primarily from automotive parts, contributing CN¥2.08 billion, and aviation parts at CN¥284.22 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Chengdu Haoneng Technology, a smaller player in the auto components sector, has shown impressive earnings growth of 76.9% over the past year, outpacing industry averages. Despite a high net debt to equity ratio at 47.3%, interest payments are comfortably covered by EBIT with a coverage of 5.6 times. The company's recent stock split and dividend announcement indicate active shareholder engagement, while its price-to-earnings ratio of 34.1x suggests it remains attractively valued compared to the broader Chinese market at 36.8x. However, free cash flow remains negative despite profitability being unaffected by cash runway concerns.

Zhongtong Bus HoldingLTD (SZSE:000957)

Simply Wall St Value Rating: ★★★★★★

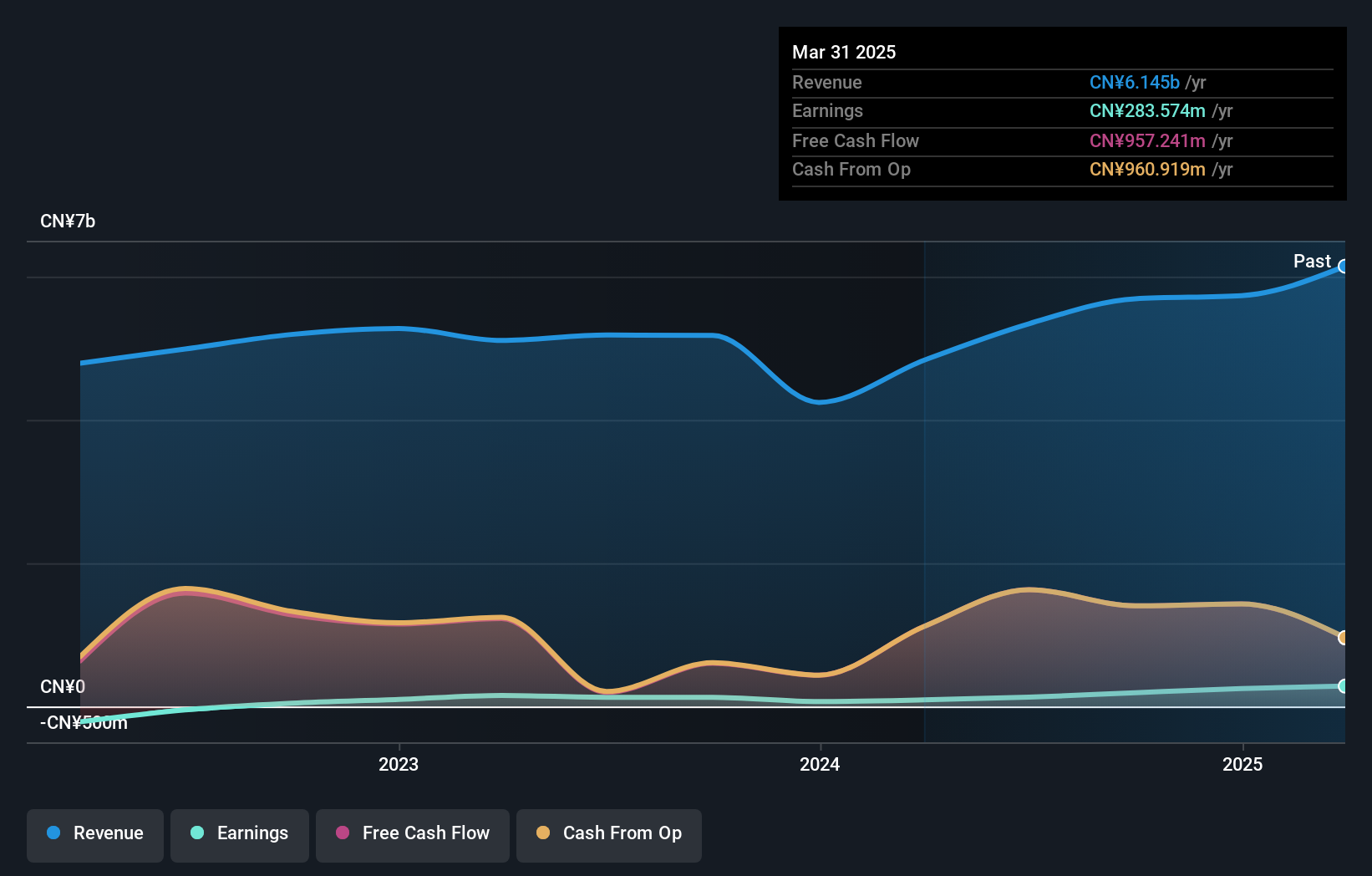

Overview: Zhongtong Bus Holding Co., LTD is involved in the manufacture and sale of buses in China, with a market capitalization of CN¥7.06 billion.

Operations: Zhongtong Bus generates revenue primarily from the manufacture and sale of buses. The company's financial performance is influenced by its ability to manage production costs effectively, impacting its net profit margin.

Zhongtong Bus Holding Co., LTD stands out with its robust performance, reporting a remarkable earnings growth of 210% over the past year. The company is trading at 48% below its estimated fair value, presenting a potential opportunity for investors. With no debt on its books, Zhongtong's financial health appears solid, allowing it to focus on expansion and operational efficiency. Recent earnings reports highlight a sales increase to CNY 1.69 billion from CNY 1.28 billion last year, while net income rose to CNY 76.51 million from CNY 42.38 million, reflecting effective cost management and strategic initiatives in the competitive machinery industry landscape.

Summing It All Up

- Reveal the 2649 hidden gems among our Asian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600866

Star Lake BioscienceZhaoqing Guangdong

Engages in the manufacture and sale of pharmaceutical raw materials, and food and feed additives under the Star Lake and Yue Bao brand names in China and internationally.

Very undervalued with solid track record.

Market Insights

Community Narratives