Uncovering Three Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets continue to reach new heights, with U.S. small-cap indices like the Russell 2000 hitting record intraday highs, investor sentiment remains buoyant despite geopolitical tensions and domestic policy shifts. In this dynamic environment, identifying stocks that offer potential growth opportunities can be crucial for enhancing a diversified portfolio. A good stock in today's market often combines strong fundamentals with the ability to navigate economic uncertainties, making it an attractive option for investors seeking to capitalize on emerging trends and sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Star Lake BioscienceZhaoqing Guangdong (SHSE:600866)

Simply Wall St Value Rating: ★★★★★☆

Overview: Star Lake Bioscience Co., Inc. Zhaoqing Guangdong is involved in the production and distribution of pharmaceutical raw materials, as well as food and feed additives under the Star Lake and Yue Bao brands, with a market capitalization of CN¥11.26 billion.

Operations: Star Lake Bioscience generates revenue primarily from the sale of pharmaceutical raw materials and food and feed additives. The company's net profit margin is a key financial metric to consider, reflecting its profitability after all expenses are deducted from total revenue.

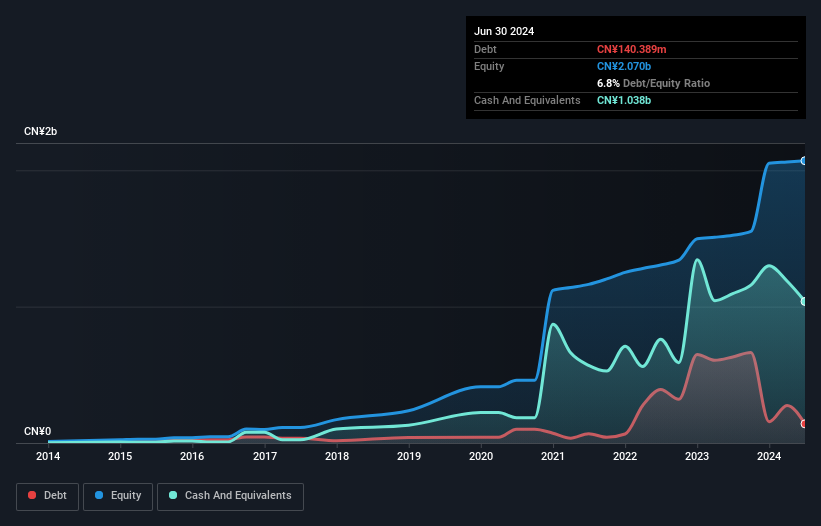

Star Lake Bioscience, a nimble player in the market, has shown robust earnings growth of 44.9% over the past year, outpacing its industry peers. Trading at 75.2% below its estimated fair value highlights its potential attractiveness to investors seeking undervalued opportunities. The company's net debt to equity ratio stands at a satisfactory 23.2%, indicating prudent financial management. Recent results for nine months ending September 30, 2024, reveal sales of CNY12.79 billion and net income of CNY677 million, with basic earnings per share rising from CNY0.29 to CNY0.41 compared to last year—showcasing improved profitability and operational efficiency.

Wenzhou Yuanfei pet toy products (SZSE:001222)

Simply Wall St Value Rating: ★★★★★★

Overview: Wenzhou Yuanfei Pet Toy Products Co., Ltd. operates in the pet toy industry and has a market capitalization of CN¥2.97 billion.

Operations: Financial data for Wenzhou Yuanfei Pet Toy Products Co., Ltd. is not available in the provided text, so a detailed analysis of revenue streams and cost breakdowns cannot be conducted.

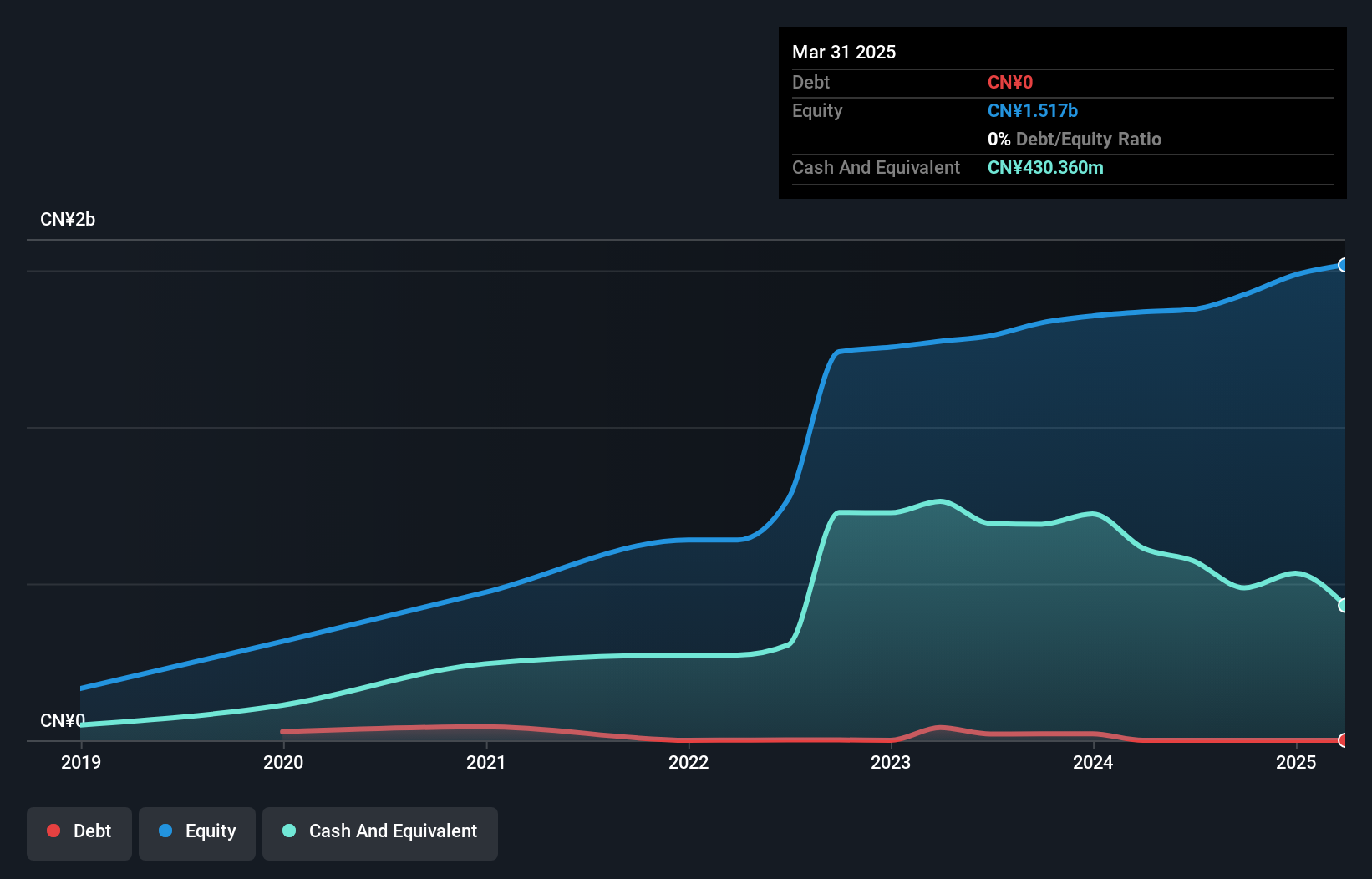

Wenzhou Yuanfei, a notable name in pet toy products, showcases promising financial health with no debt and a price-to-earnings ratio of 23.1x, which is favorable compared to the CN market's 36.9x. The company reported earnings growth of 13.6% over the past year, surpassing the leisure industry's -0.7%, indicating robust performance within its sector. For the nine months ending September 2024, sales reached CNY 930.79 million from CNY 731.25 million previously, while net income rose to CNY 119.74 million from CNY 104.34 million last year, suggesting solid revenue expansion and profitability improvements moving forward.

Shenzhen Farben Information TechnologyLtd (SZSE:300925)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Farben Information Technology Co., Ltd. operates in the technology sector, focusing on providing information technology services and solutions, with a market cap of CN¥10.36 billion.

Operations: Farben Information Technology generates revenue primarily from its information technology services and solutions. The company has a market capitalization of CN¥10.36 billion.

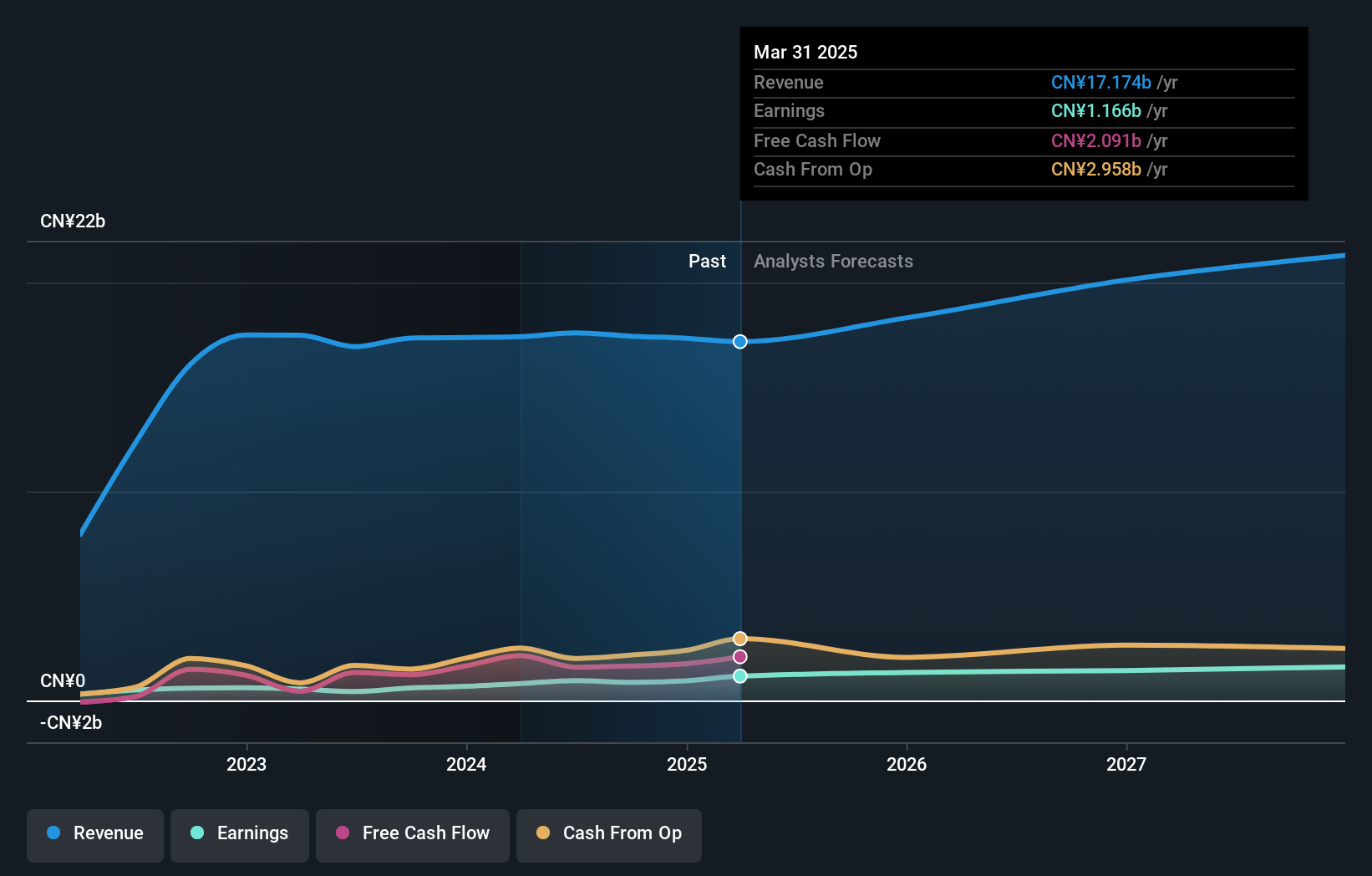

Shenzhen Farben's recent performance highlights its potential as a small cap contender in the IT space. The company reported earnings growth of 28.2% over the past year, outpacing the industry average of -8.1%. Its debt-to-equity ratio improved from 11.2% to 7.7% over five years, indicating better financial health. Despite shareholder dilution last year, Shenzhen Farben has high-quality earnings and sufficient cash to cover its total debt, ensuring no immediate liquidity concerns. Recent buybacks saw 4,353,300 shares repurchased for CNY 34.17 million, reflecting management's confidence in value creation for shareholders amidst volatile share prices recently observed.

Next Steps

- Gain an insight into the universe of 4643 Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600866

Star Lake BioscienceZhaoqing Guangdong

Engages in the manufacture and sale of pharmaceutical raw materials, and food and feed additives under the Star Lake and Yue Bao brand names in China and internationally.

Undervalued with solid track record and pays a dividend.