- China

- /

- Energy Services

- /

- SZSE:002629

Zhejiang Renzhi Co., Ltd. (SZSE:002629) Shares Slammed 25% But Getting In Cheap Might Be Difficult Regardless

Unfortunately for some shareholders, the Zhejiang Renzhi Co., Ltd. (SZSE:002629) share price has dived 25% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 50% share price drop.

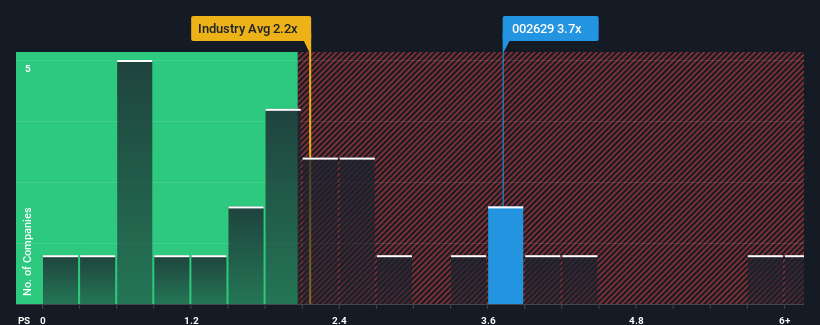

Even after such a large drop in price, when almost half of the companies in China's Energy Services industry have price-to-sales ratios (or "P/S") below 2.2x, you may still consider Zhejiang Renzhi as a stock probably not worth researching with its 3.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Zhejiang Renzhi

What Does Zhejiang Renzhi's Recent Performance Look Like?

The revenue growth achieved at Zhejiang Renzhi over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Zhejiang Renzhi, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Zhejiang Renzhi's Revenue Growth Trending?

Zhejiang Renzhi's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. Pleasingly, revenue has also lifted 73% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 17% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Zhejiang Renzhi's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On Zhejiang Renzhi's P/S

Despite the recent share price weakness, Zhejiang Renzhi's P/S remains higher than most other companies in the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Zhejiang Renzhi revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Zhejiang Renzhi that you should be aware of.

If these risks are making you reconsider your opinion on Zhejiang Renzhi, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Renzhi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002629

Zhejiang Renzhi

Provides professional services in the oil and gas drilling and engineering fields in China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives