- China

- /

- Oil and Gas

- /

- SZSE:000096

Discovering January 2025's Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets continue to react positively to the Trump administration's initial policy moves, including a softer stance on tariffs and significant investments in artificial intelligence infrastructure, major indices like the S&P 500 have reached record highs. While large-cap stocks have generally outperformed their smaller-cap counterparts, small-cap companies remain an intriguing area for investors seeking growth potential amidst these evolving economic conditions. In this environment, identifying promising small-cap stocks involves looking for companies with strong fundamentals and unique market positions that can capitalize on current trends and opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Shenzhen Guangju Energy (SZSE:000096)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Guangju Energy Co., Ltd. operates in the storage, transportation, and distribution of liquefied petroleum gas both in China and internationally, with a market cap of CN¥6.18 billion.

Operations: Shenzhen Guangju Energy generates revenue primarily from the storage, transportation, and distribution of liquefied petroleum gas. The company's financial performance is highlighted by a notable net profit margin trend.

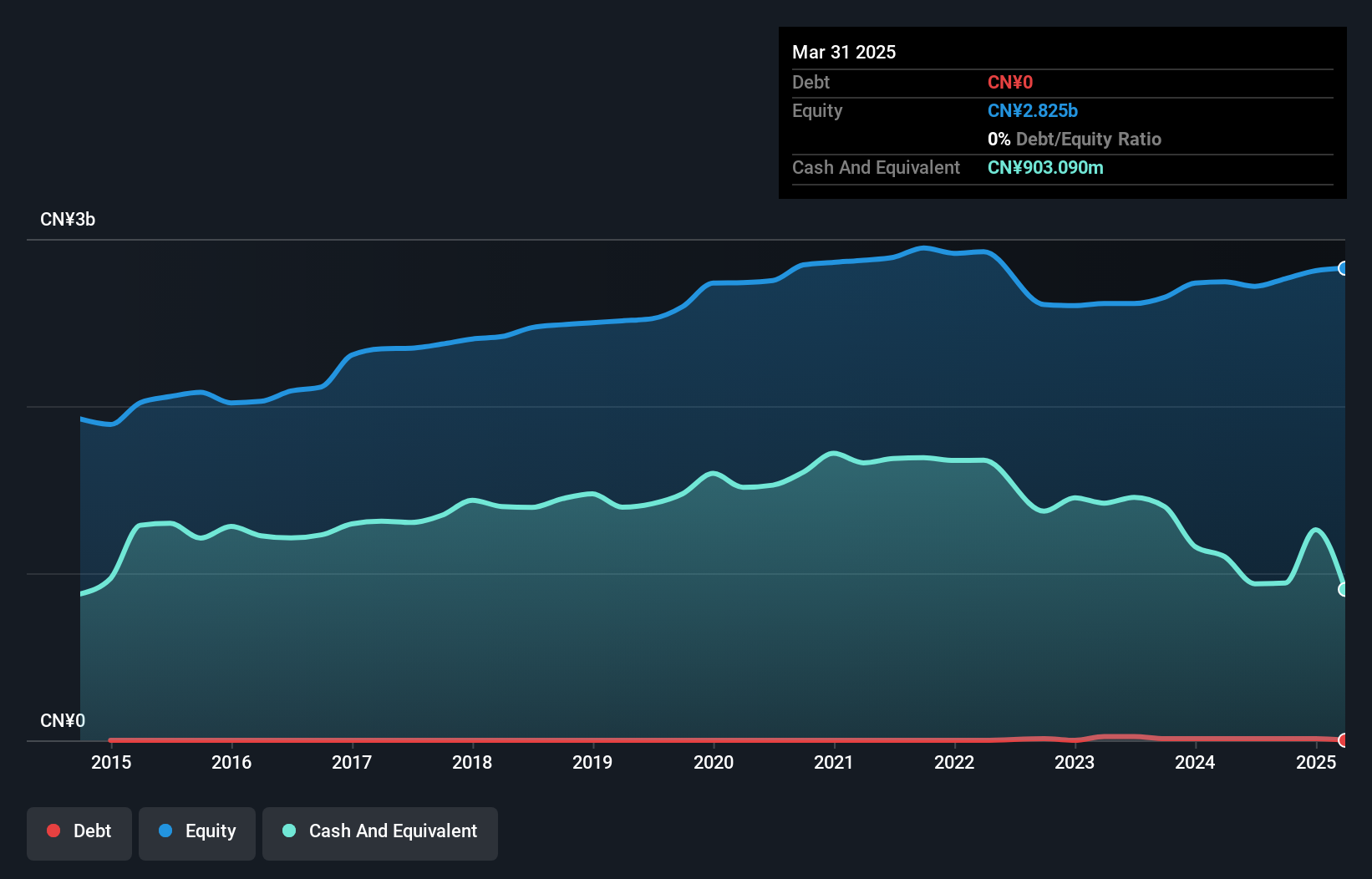

Guangju Energy is making waves with a remarkable 74.6% earnings growth over the past year, outpacing the Oil and Gas industry's -16.6%. Despite a challenging five-year period with an average annual earnings drop of 15.5%, this company has shown resilience and potential for recovery. It boasts high-quality earnings, which suggests operational efficiency and strong fundamentals. The firm seems financially sound, as it holds more cash than its total debt, ensuring interest payments are well-covered. With free cash flow remaining positive, Guangju Energy appears poised to capitalize on future opportunities within its sector.

- Unlock comprehensive insights into our analysis of Shenzhen Guangju Energy stock in this health report.

Assess Shenzhen Guangju Energy's past performance with our detailed historical performance reports.

Tomoe (TSE:1921)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tomoe Corporation is a Japanese company engaged in general construction, steel structures construction, and real estate businesses, with a market cap of approximately ¥43.45 billion.

Operations: Tomoe Corporation's revenue is primarily derived from its real estate business, contributing ¥31.56 billion, followed by the steel structure construction business at ¥1.99 billion.

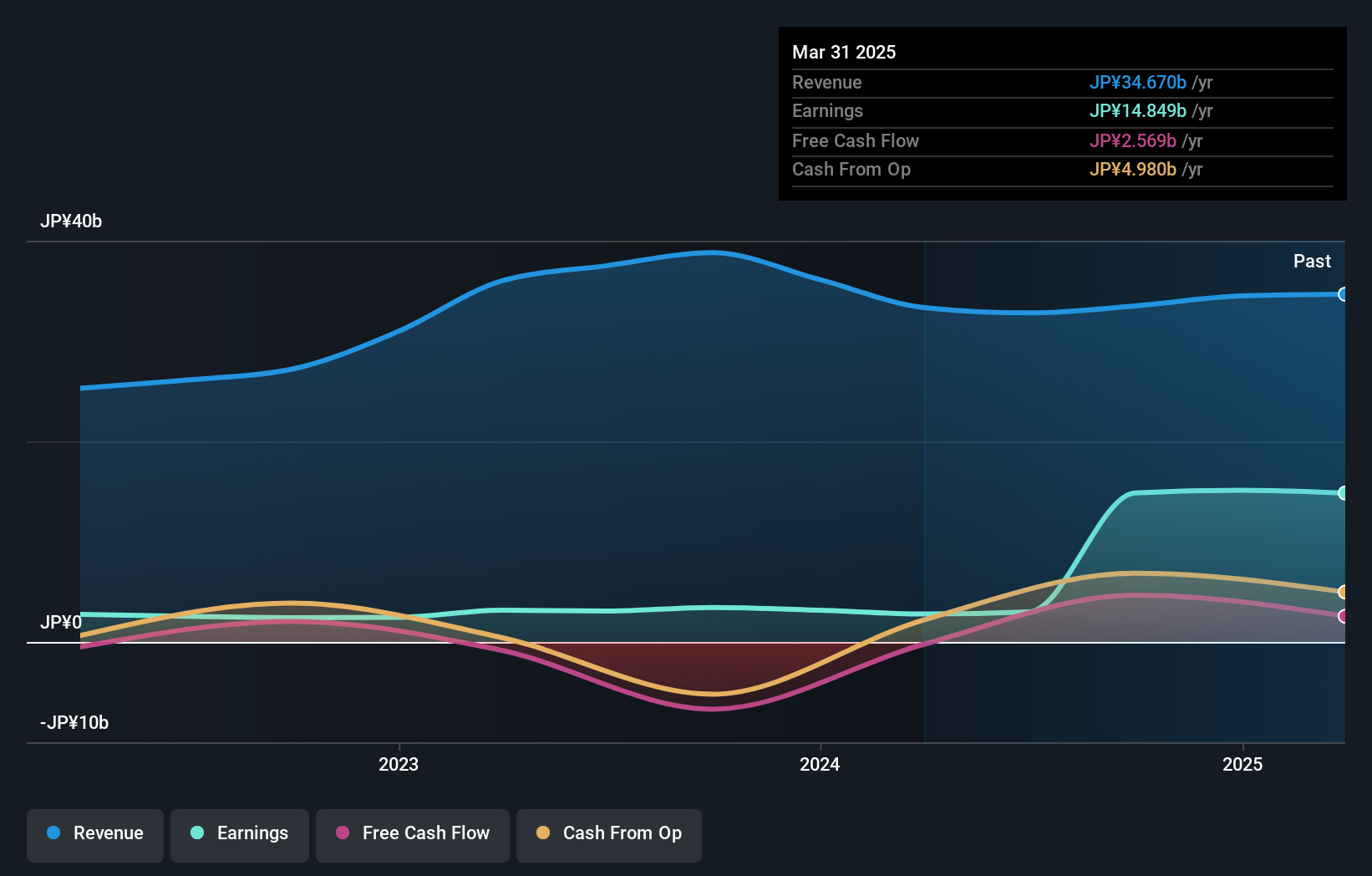

Tomoe, a smaller player in the construction industry, has shown impressive earnings growth of 331.5% over the past year, outpacing the industry's 20.7% increase. Despite its volatile share price recently, it trades at 66% below estimated fair value, suggesting potential upside for investors. The company's net debt to equity ratio stands at a satisfactory 2%, indicating prudent financial management. However, a significant one-off gain of ¥12 billion impacted recent results, which might not reflect ongoing operations' performance accurately. Looking ahead, Tomoe's ability to maintain profitability and manage debt effectively will be crucial for sustaining growth momentum.

- Take a closer look at Tomoe's potential here in our health report.

Explore historical data to track Tomoe's performance over time in our Past section.

Miyazaki Bank (TSE:8393)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Miyazaki Bank, Ltd., along with its subsidiaries, provides a range of banking products and services mainly in Japan, with a market cap of ¥54.78 billion.

Operations: Miyazaki Bank generates revenue primarily from its banking segment, amounting to ¥53.18 billion, and a smaller portion from its leasing business at ¥5.56 billion.

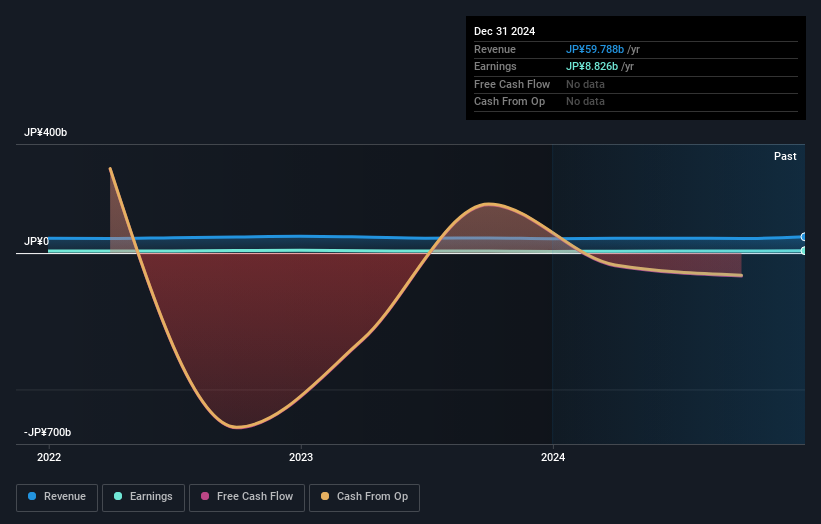

Miyazaki Bank, a smaller player in the banking sector, boasts total assets of ¥4,119.1 billion and equity of ¥188.5 billion. With deposits reaching ¥3,174.6 billion and loans at ¥2,340.9 billion, it operates with a net interest margin of 1.1%. Despite trading at 56% below its estimated fair value, Miyazaki faces challenges with a low allowance for bad loans at 47%, though its non-performing loan ratio stands appropriately low at 1.3%. The bank's earnings growth over the past year was modest at 1.7%, trailing behind the industry average of 23.5%.

Next Steps

- Discover the full array of 4687 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000096

Shenzhen Guangju Energy

Engages in the wholesale, retail and warehousing of refined oil in China and internationally.

Adequate balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)