- China

- /

- Energy Services

- /

- SHSE:603800

Should You Be Adding Suzhou Douson Drilling & Production EquipmentLtd (SHSE:603800) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Suzhou Douson Drilling & Production EquipmentLtd (SHSE:603800). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Suzhou Douson Drilling & Production EquipmentLtd

Suzhou Douson Drilling & Production EquipmentLtd's Improving Profits

Suzhou Douson Drilling & Production EquipmentLtd has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. To the delight of shareholders, Suzhou Douson Drilling & Production EquipmentLtd's EPS soared from CN¥0.70 to CN¥1.06, over the last year. That's a impressive gain of 52%.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Suzhou Douson Drilling & Production EquipmentLtd's revenue last year was revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Unfortunately, Suzhou Douson Drilling & Production EquipmentLtd's revenue dropped 4.5% last year, but the silver lining is that EBIT margins improved from 10% to 15%. While not disastrous, these figures could be better.

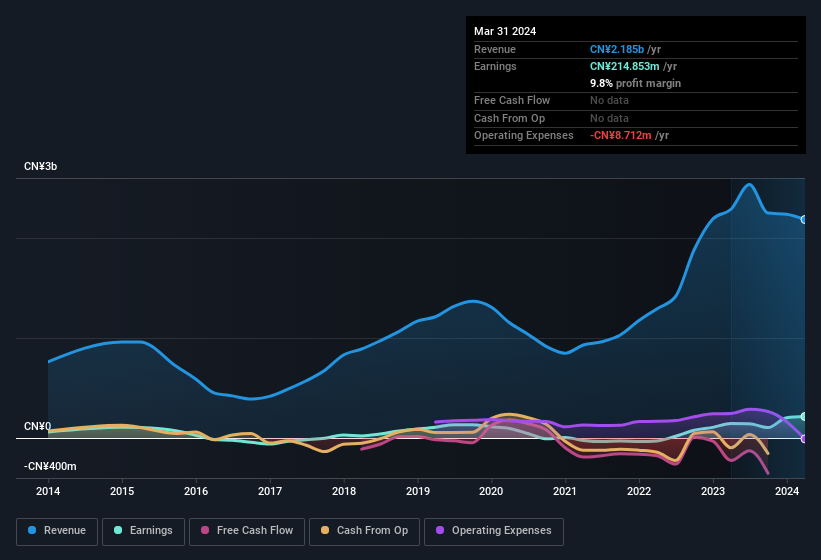

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Suzhou Douson Drilling & Production EquipmentLtd's forecast profits?

Are Suzhou Douson Drilling & Production EquipmentLtd Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Suzhou Douson Drilling & Production EquipmentLtd insiders have a significant amount of capital invested in the stock. To be specific, they have CN¥232m worth of shares. That's a lot of money, and no small incentive to work hard. As a percentage, this totals to 5.1% of the shares on issue for the business, an appreciable amount considering the market cap.

Should You Add Suzhou Douson Drilling & Production EquipmentLtd To Your Watchlist?

You can't deny that Suzhou Douson Drilling & Production EquipmentLtd has grown its earnings per share at a very impressive rate. That's attractive. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. What about risks? Every company has them, and we've spotted 1 warning sign for Suzhou Douson Drilling & Production EquipmentLtd you should know about.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603800

Jiangsu Hongtian TechnologyLtd

Research, develops, produces, and sale of oil, natural gas, and shale gas drilling and production equipment in China.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success