- China

- /

- Energy Services

- /

- SHSE:603619

Unveiling Three Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

In a week marked by market volatility and economic uncertainty, small-cap stocks have notably underperformed their larger counterparts, with the Russell 2000 Index dipping into correction territory. Amidst these challenging conditions, identifying promising stocks requires a keen eye for companies that demonstrate resilience and potential for growth despite broader market pressures.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| Standard Chartered Bank Kenya | 9.32% | 12.22% | 22.08% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Zhongman Petroleum and Natural Gas GroupLtd (SHSE:603619)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhongman Petroleum and Natural Gas Group Corp., Ltd. is an oil and gas company involved in drilling and completion engineering services as well as petroleum equipment manufacturing, with a market capitalization of CN¥8.85 billion.

Operations: Zhongman Petroleum and Natural Gas Group generates revenue primarily through its drilling and completion engineering services, alongside petroleum equipment manufacturing. The company's net profit margin has shown variability over recent periods.

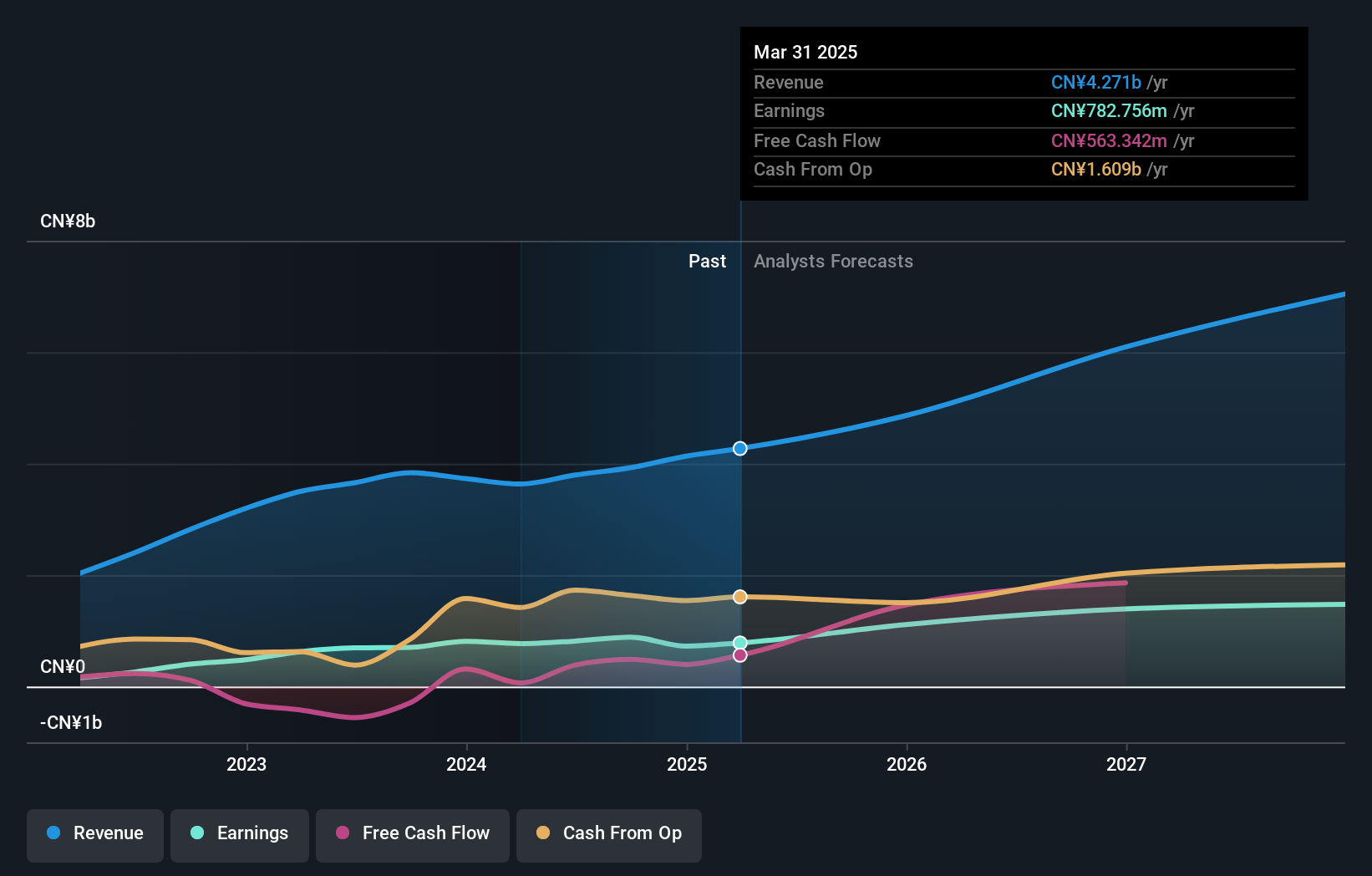

Zhongman Petroleum and Natural Gas Group Ltd. is making waves with its robust financial health and promising growth trajectory. The company's earnings grew by 25.7% last year, outpacing the Energy Services industry average of 7.6%, showcasing its competitive edge. With a net debt to equity ratio at a satisfactory 35.2%, Zhongman's financial leverage is well-managed, while interest payments are comfortably covered by EBIT at 7.8 times over, indicating strong operational efficiency. Recent reports highlight sales reaching CNY 3 billion for the first nine months of 2024, with net income rising to CNY 668 million from CNY 593 million the previous year, reflecting solid profitability improvements despite shareholder dilution concerns over the past year.

Guangxi Yuegui Guangye Holdings (SZSE:000833)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guangxi Yuegui Guangye Holdings Co., Ltd. operates in various sectors and has a market capitalization of CN¥8.46 billion.

Operations: The company generates revenue from diverse sectors, with a notable focus on its primary business activities. It experiences fluctuations in its financial performance, as evidenced by variations in net profit margin across reporting periods.

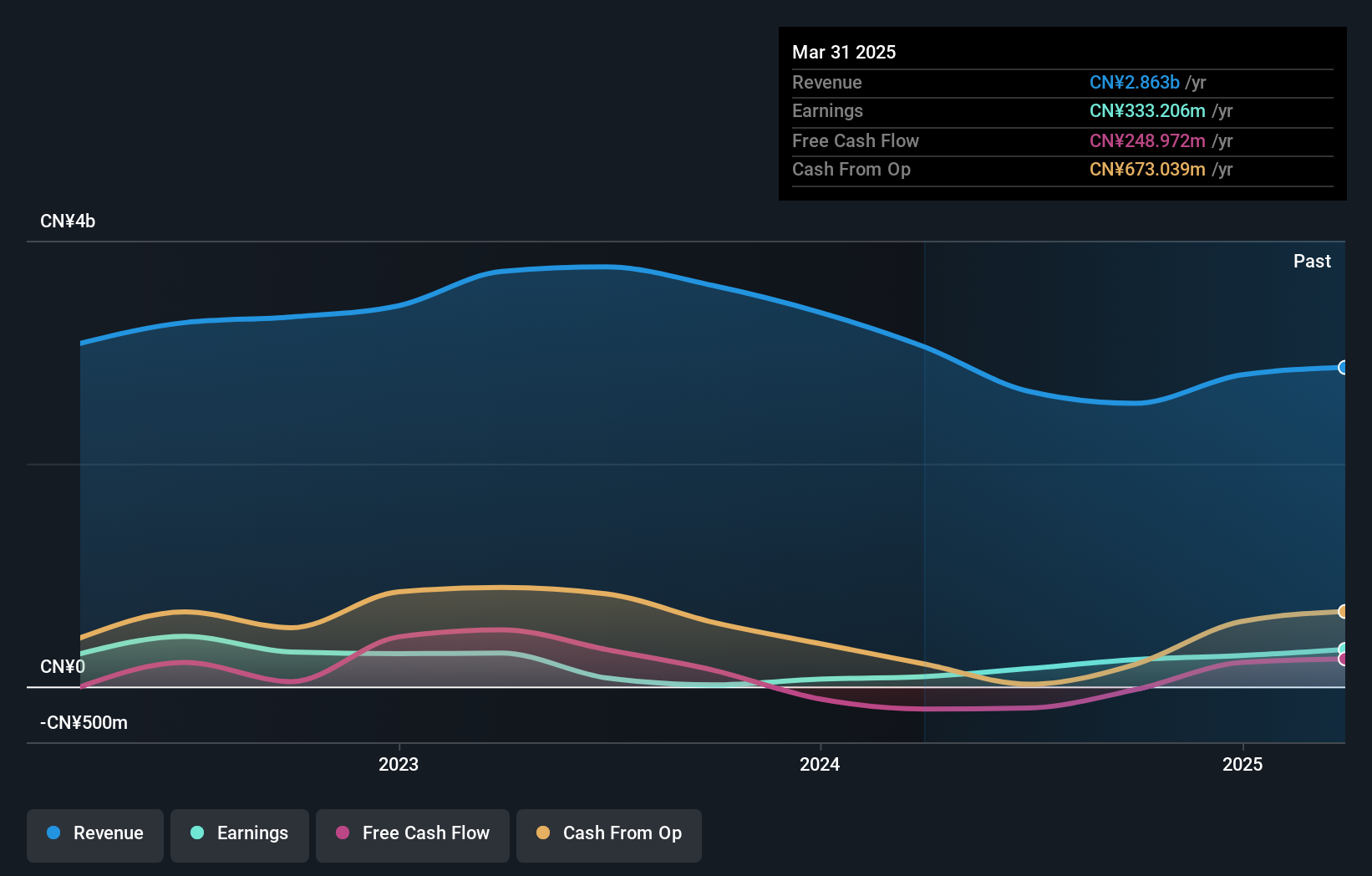

Guangxi Yuegui Guangye Holdings, a relatively small player in its sector, posted impressive net income growth to CNY 224.76 million from CNY 48.53 million over the past year, marking a remarkable earnings increase of 1472%. Despite sales slipping from CNY 2.84 billion to CNY 2.02 billion, the company has managed high-quality earnings and maintains satisfactory debt management with a net debt to equity ratio of 9.6%. Interest payments are well-covered by EBIT at a multiple of 13x, although free cash flow remains negative. The stock's recent volatility might concern some investors but highlights potential opportunities for others seeking value in dynamic markets.

GHTLtd (SZSE:300711)

Simply Wall St Value Rating: ★★★★★★

Overview: GHT Co., Ltd is involved in the research, development, production, sale, and servicing of information and communication technology-related products in China with a market capitalization of CN¥5.38 billion.

Operations: GHTLtd's revenue streams primarily derive from its activities in the information and communication technology sector. The company's net profit margin has shown variability, reflecting changes in operational efficiency and market conditions over time.

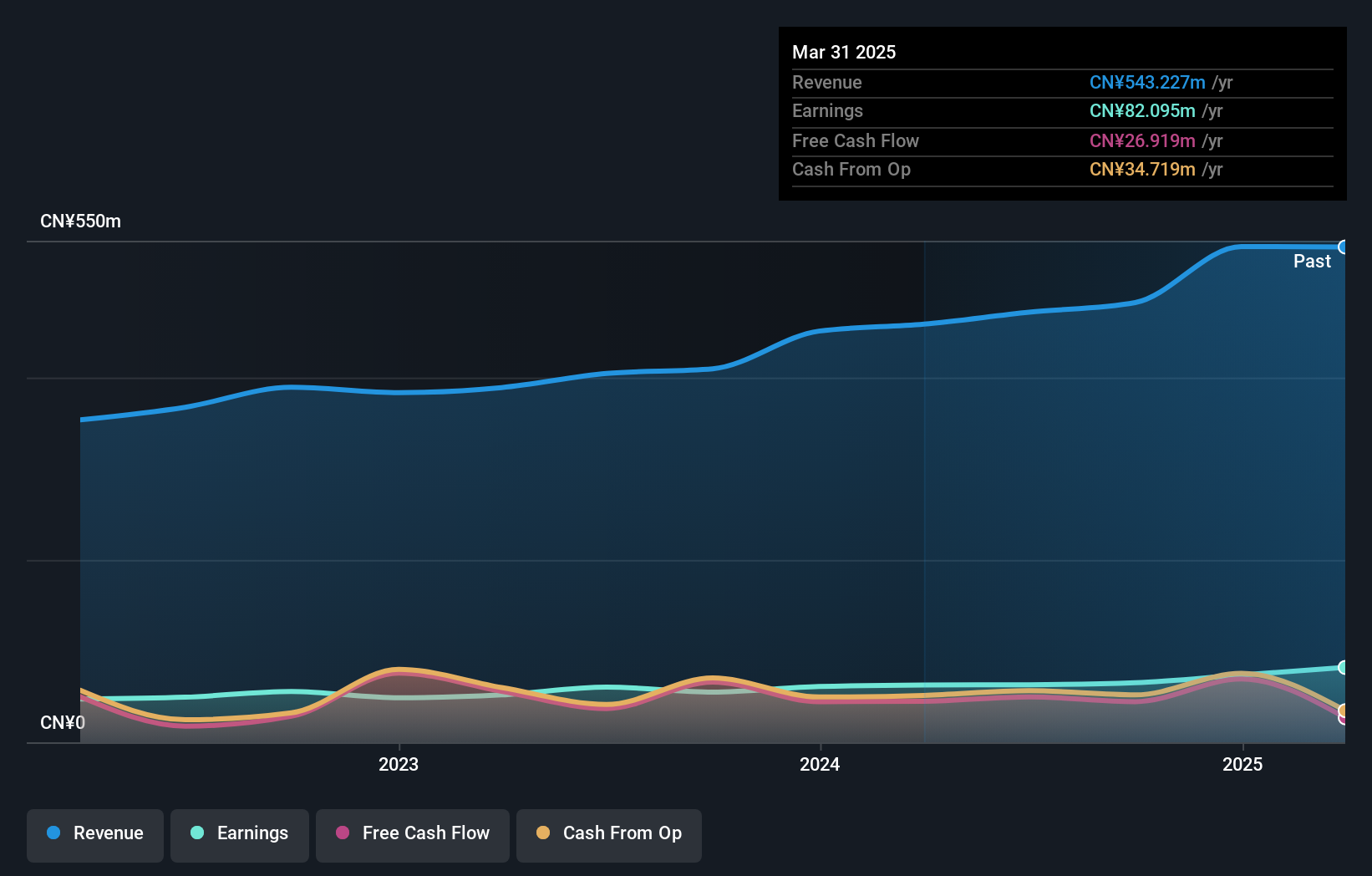

GHTLtd, a nimble player in the communications sector, has shown impressive financial resilience. With earnings growth of 18.6% over the past year, it outpaced an industry that saw a -0.3% change. Despite its small size, GHTLtd is debt-free and boasts positive free cash flow, demonstrating solid financial health. The company reported net income of CN¥20.96 million for the nine months ending September 2024, up from CN¥16.85 million in the previous year; however, this was influenced by a one-off gain of CN¥13.7 million impacting results significantly during this period.

- Delve into the full analysis health report here for a deeper understanding of GHTLtd.

Evaluate GHTLtd's historical performance by accessing our past performance report.

Next Steps

- Click here to access our complete index of 4551 Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhongman Petroleum and Natural Gas GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603619

Zhongman Petroleum and Natural Gas GroupLtd

An oil and gas company, engages in the drilling and completion engineering services, and petroleum equipment manufacturing businesses in China and internationally.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion