- China

- /

- Oil and Gas

- /

- SHSE:601918

China Coal Xinji Energy Co.,Ltd's (SHSE:601918) Business And Shares Still Trailing The Market

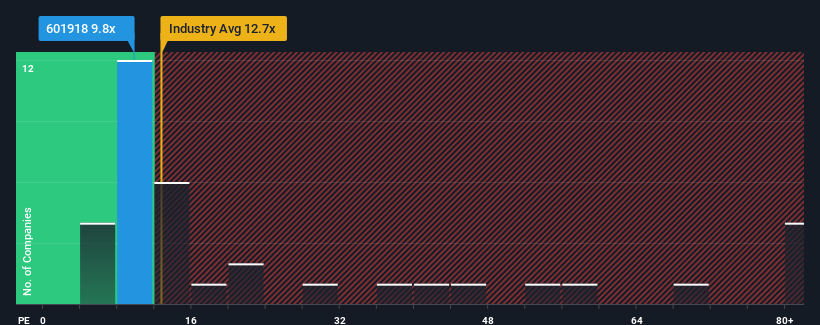

China Coal Xinji Energy Co.,Ltd's (SHSE:601918) price-to-earnings (or "P/E") ratio of 9.8x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 37x and even P/E's above 71x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for China Coal Xinji EnergyLtd as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for China Coal Xinji EnergyLtd

Is There Any Growth For China Coal Xinji EnergyLtd?

There's an inherent assumption that a company should far underperform the market for P/E ratios like China Coal Xinji EnergyLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 6.9%. The last three years don't look nice either as the company has shrunk EPS by 14% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 22% during the coming year according to the seven analysts following the company. With the market predicted to deliver 39% growth , the company is positioned for a weaker earnings result.

With this information, we can see why China Coal Xinji EnergyLtd is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that China Coal Xinji EnergyLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with China Coal Xinji EnergyLtd (at least 2 which are significant), and understanding these should be part of your investment process.

You might be able to find a better investment than China Coal Xinji EnergyLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601918

China Coal Xinji EnergyLtd

Engages in mining, washing, and sales of bituminous and anthracite coal in China and internationally.

Undervalued with acceptable track record.

Market Insights

Community Narratives