As global markets continue to reach new heights, with the S&P 500 and Russell 2000 indices hitting record intraday highs, investors are increasingly focused on small-cap stocks that are finally catching up with their larger peers. Amidst this backdrop of economic stability and geopolitical developments, identifying promising small-cap stocks involves looking for companies with solid fundamentals that can thrive despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Saha-Union | 0.48% | -1.12% | 8.28% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Thai Steel Cable | NA | 2.46% | 16.55% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Beijing Haohua Energy Resource (SHSE:601101)

Simply Wall St Value Rating: ★★★★★☆

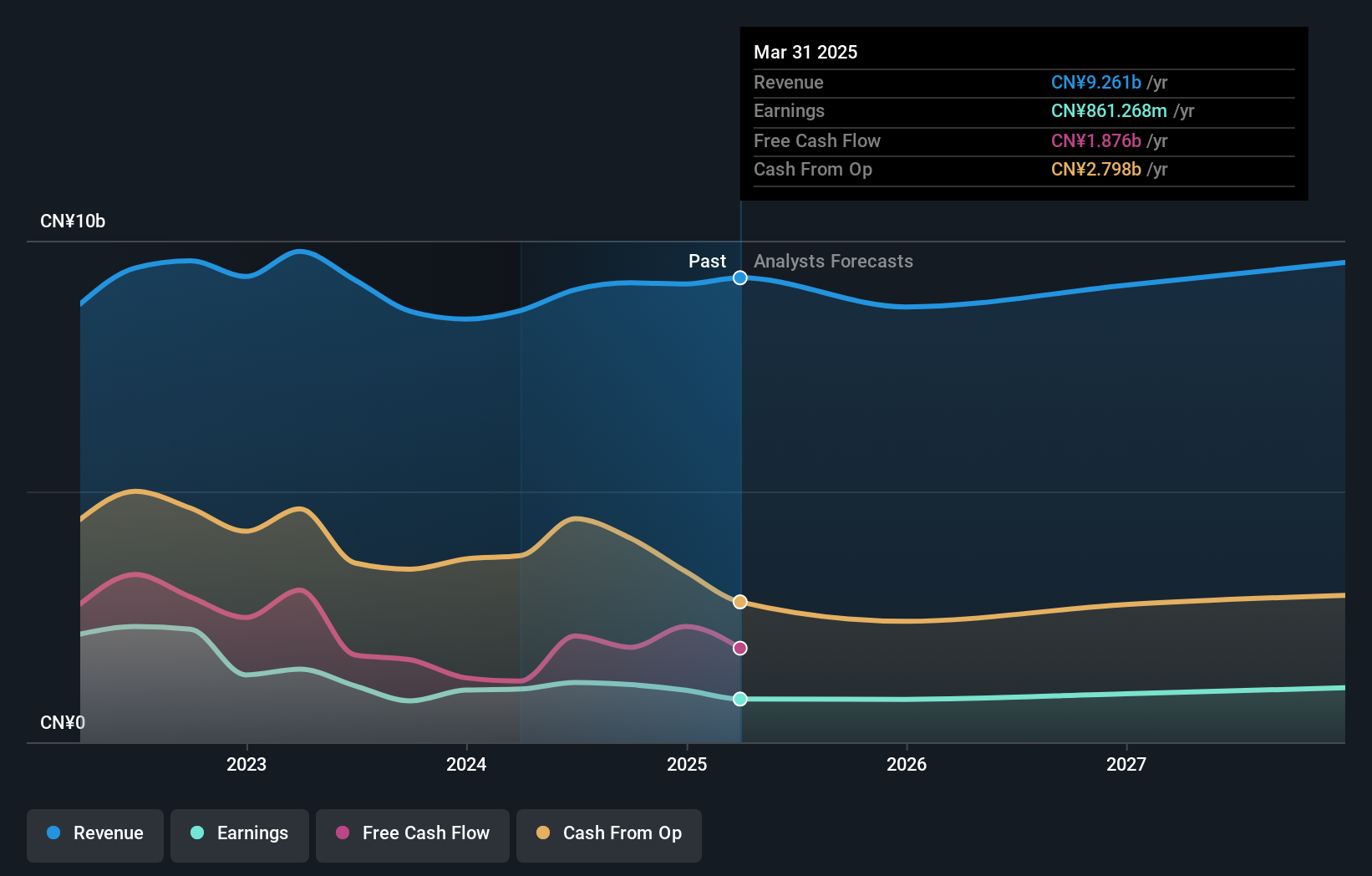

Overview: Beijing Haohua Energy Resource Co., Ltd. is involved in the mining, washing, processing, export, and sale of coal in China with a market capitalization of approximately CN¥13.02 billion.

Operations: Haohua Energy generates revenue primarily from coal mining, washing, processing, and sales activities. The company's cost structure includes expenses related to these operations.

Haohua Energy, a smaller player in the energy sector, has demonstrated strong financial health with high-quality earnings and a satisfactory net debt to equity ratio of 13.5%. Its earnings have grown by 39.1% over the past year, outpacing the oil and gas industry significantly. The company is trading at 47.2% below its estimated fair value, suggesting potential undervaluation compared to peers. Recent results show sales of CNY 6.84 billion for nine months ending September 2024, up from CNY 6.12 billion last year, while net income increased to CNY 1.12 billion from CNY 1.01 billion previously.

Jiangxi Huangshanghuang Group Food (SZSE:002695)

Simply Wall St Value Rating: ★★★★★★

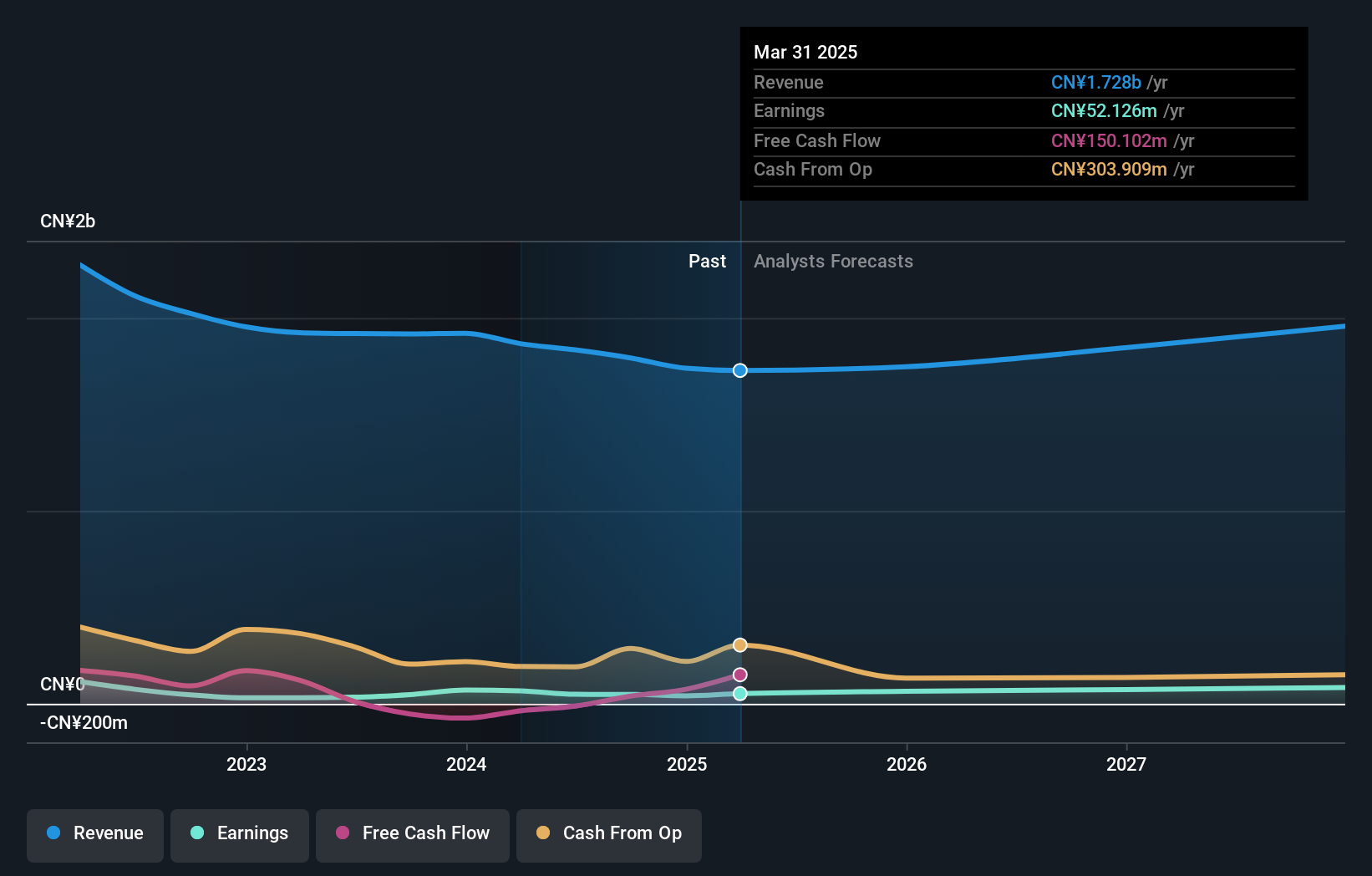

Overview: Jiangxi Huangshanghuang Group Food Co., Ltd. develops, produces, and sells braised meat products in China with a market cap of CN¥5.63 billion.

Operations: The company generates revenue primarily through the sale of braised meat products. It has a market cap of CN¥5.63 billion, reflecting its scale within the food industry in China.

Jiangxi Huangshanghuang Group Food, a smaller player in the food sector, is debt-free and has shown resilience with 2.2% earnings growth over the past year, outpacing the industry's -5.8%. Despite a notable CN¥24.8 million one-off gain impacting recent results, its financial health remains solid with free cash flow in positive territory. However, sales dropped to CN¥1.45 billion from CN¥1.58 billion last year, and net income decreased to CN¥78.56 million from CN¥100.88 million previously reported for similar periods—indicating some challenges ahead despite promising growth forecasts of 70% annually moving forward.

- Get an in-depth perspective on Jiangxi Huangshanghuang Group Food's performance by reading our health report here.

Learn about Jiangxi Huangshanghuang Group Food's historical performance.

AP Memory Technology (TWSE:6531)

Simply Wall St Value Rating: ★★★★★★

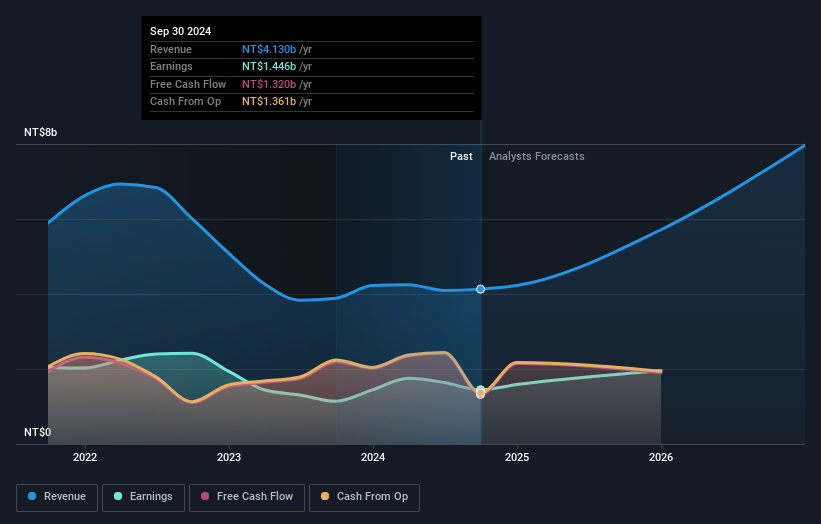

Overview: AP Memory Technology Corporation, with a market cap of approximately NT$51.68 billion, specializes in the design, development, licensing, manufacturing, and sale of customized memory-related integrated circuit (IC) chip products and technologies across various international markets including China, Japan, Taiwan, Europe, and America.

Operations: AP Memory Technology generates revenue primarily through its IoT Division, which accounts for NT$3.56 billion, and its AI Division, contributing NT$569.91 million.

AP Memory Technology, a semiconductor player, showcases notable traits with its earnings growth of 26.9% over the past year, outpacing the industry average of 5.9%. The company's debt to equity ratio impressively reduced from 11.7% to just 0.4% in five years, indicating robust financial health. Despite a one-off gain of NT$435.7M affecting recent results, it remains free cash flow positive with NT$1,319 million as of September 2024. Recent executive changes and stable net income for nine months at TWD1 billion reflect strategic shifts amidst steady operations in a competitive landscape.

- Unlock comprehensive insights into our analysis of AP Memory Technology stock in this health report.

Explore historical data to track AP Memory Technology's performance over time in our Past section.

Where To Now?

- Reveal the 4633 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002695

Jiangxi Huangshanghuang Group Food

Develops, produces, and sells braised meat products in China.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives