Discovering January 2025's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets navigate a turbulent start to 2025, with small-cap stocks underperforming and inflation concerns persisting, investors are keenly observing economic indicators and policy shifts that could impact future growth. In this environment of uncertainty, identifying promising small-cap stocks requires a focus on companies with robust fundamentals and the ability to adapt to shifting market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Advancetek EnterpriseLtd | 56.32% | 41.67% | 65.57% | ★★★★★☆ |

| AJIS | 0.79% | 1.12% | -12.92% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Beijing Haohua Energy Resource (SHSE:601101)

Simply Wall St Value Rating: ★★★★★☆

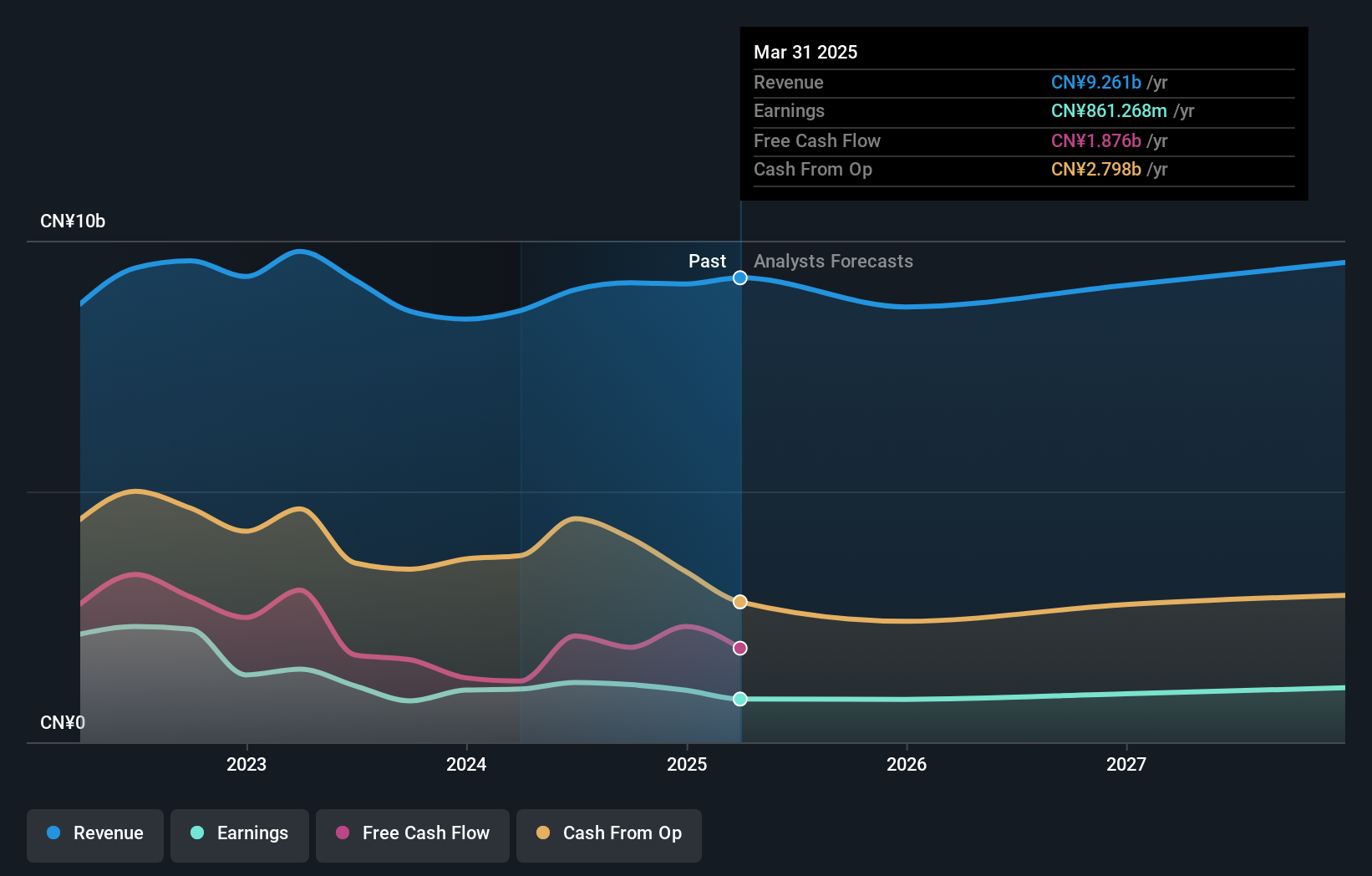

Overview: Beijing Haohua Energy Resource Co., Ltd. is involved in the mining, washing, processing, export, and sale of coal in China with a market capitalization of CN¥11.30 billion.

Operations: Haohua Energy's primary revenue stream is derived from the sale of coal, with significant activities in mining and processing. The company's net profit margin has shown fluctuations, reflecting the variability in operational costs and market conditions.

Beijing Haohua Energy Resource is making waves with its impressive financial performance. The company reported sales of CNY 6.84 billion for the first nine months of 2024, up from CNY 6.12 billion the previous year, highlighting robust growth. Net income also increased to CNY 1.12 billion from CNY 1.01 billion, showcasing profitability in a challenging industry landscape. With earnings growing by a remarkable 39% over the past year and trading at about half its estimated fair value, this energy player seems to offer good relative value compared to peers while maintaining satisfactory debt levels with a net debt-to-equity ratio of just 13%.

- Get an in-depth perspective on Beijing Haohua Energy Resource's performance by reading our health report here.

Understand Beijing Haohua Energy Resource's track record by examining our Past report.

Zhejiang Hailide New MaterialLtd (SZSE:002206)

Simply Wall St Value Rating: ★★★★★☆

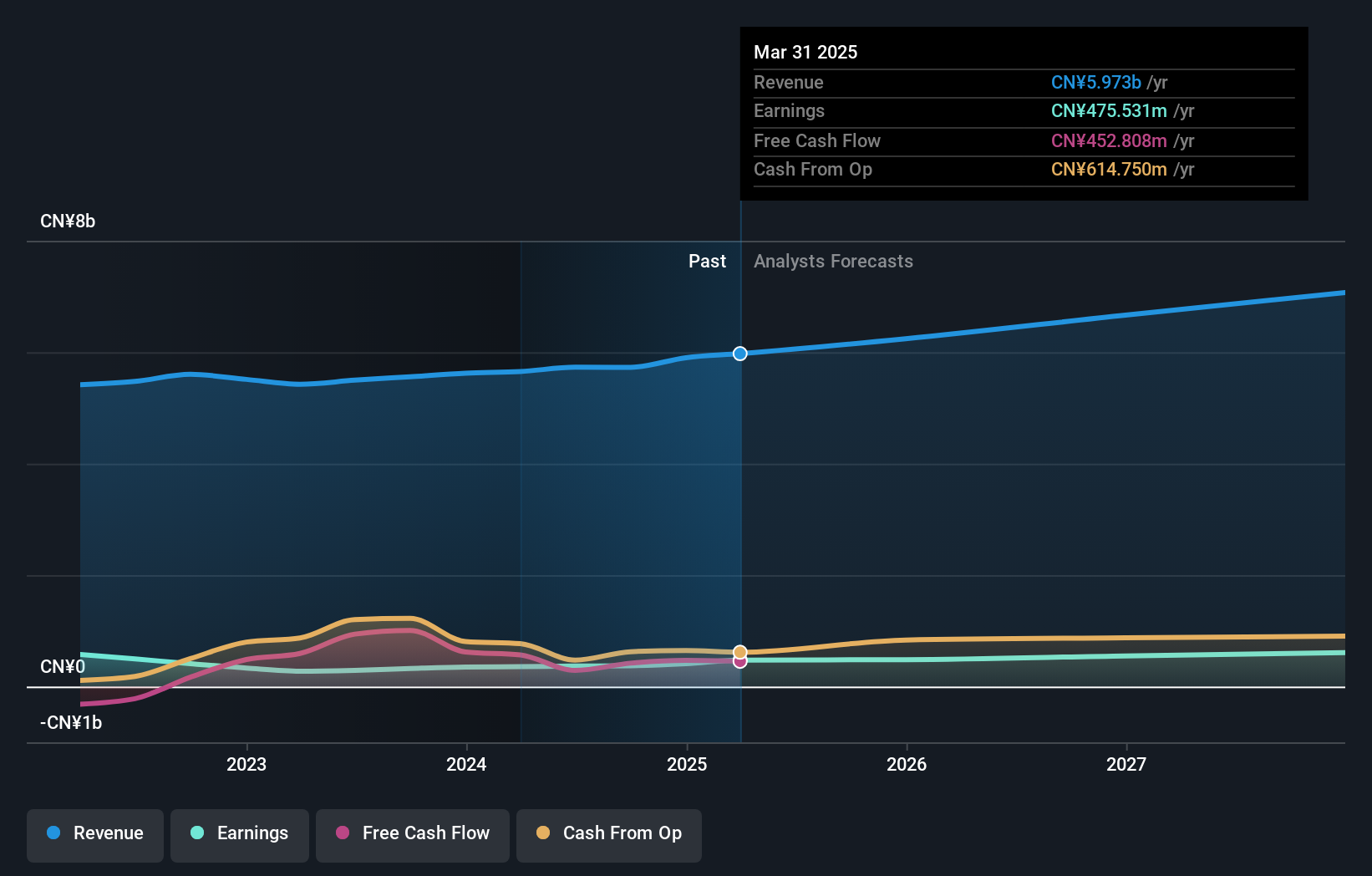

Overview: Zhejiang Hailide New Material Co., Ltd is involved in the research, development, production, and marketing of industrial polyester yarns, plastic materials, tire cord fabrics, and plastic floors both in China and internationally with a market cap of CN¥5.07 billion.

Operations: The company generates revenue primarily from industrial polyester yarns, plastic materials, tire cord fabrics, and plastic floors. It has a market cap of CN¥5.07 billion.

Zhejiang Hailide New Material, a smaller player in the chemicals sector, is making waves with its robust earnings growth of 15.5% over the past year, outpacing the industry's negative trend. The company's net income for nine months ending September 2024 was CNY 296.46 million, up from CNY 272.13 million previously, reflecting strong operational performance. With a price-to-earnings ratio of 13.6x below the market average and interest payments well covered at 13.6 times EBIT, it seems financially sound despite a slight increase in debt-to-equity ratio to 56.2% over five years. A recent share repurchase program worth up to CNY 300 million further underscores management's confidence in its future prospects and value creation potential for shareholders.

Shandong Boyuan Pharmaceutical & Chemical (SZSE:301617)

Simply Wall St Value Rating: ★★★★★★

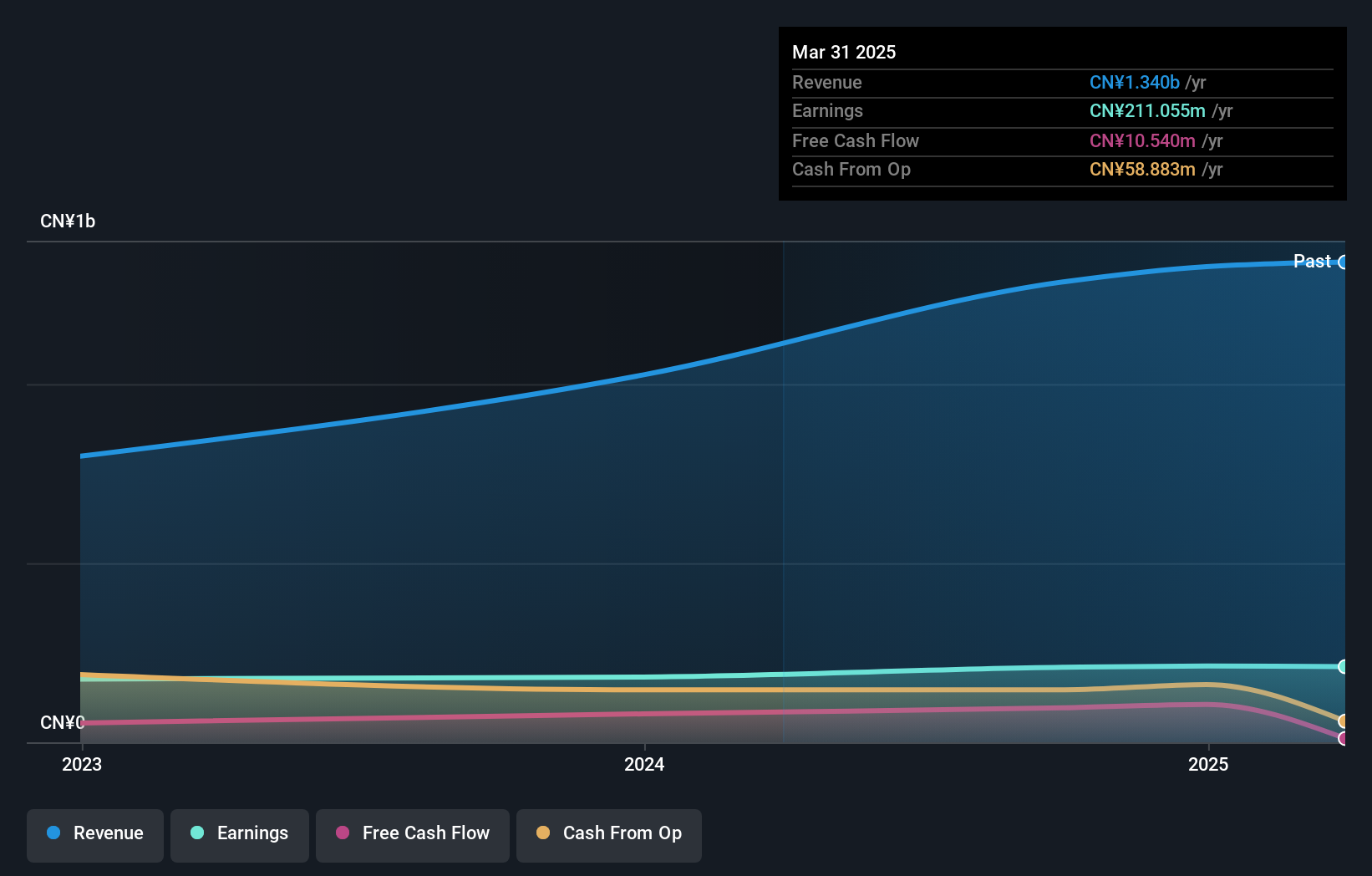

Overview: Shandong Boyuan Pharmaceutical & Chemical Co., Ltd. operates in the pharmaceutical and chemical industry with a market cap of CN¥5.09 billion.

Operations: Boyuan generates revenue from its pharmaceutical and chemical products. The company's net profit margin is 15%, indicating efficiency in converting revenue into profit.

Shandong Boyuan, a nimble player in the pharmaceutical and chemical sector, has shown impressive earnings growth of 16%, outpacing the broader chemicals industry. The company stands out with its debt-free status and a Price-To-Earnings ratio of 24.3x, which is attractive compared to the CN market average of 34.1x. Recently added to key stock indices, it completed an IPO raising CNY 713 million at CNY 27.76 per share, reflecting strong market interest despite its highly illiquid shares. With high-quality earnings and consistent profitability, Shandong Boyuan seems well-positioned for continued success in its niche market space.

- Click here to discover the nuances of Shandong Boyuan Pharmaceutical & Chemical with our detailed analytical health report.

Learn about Shandong Boyuan Pharmaceutical & Chemical's historical performance.

Next Steps

- Reveal the 4628 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301617

Shandong Boyuan Pharmaceutical & Chemical

Shandong Boyuan Pharmaceutical & Chemical Co., Ltd.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives