- China

- /

- Oil and Gas

- /

- SHSE:600714

Qinghai Jinrui Mining Development And 2 Other Undiscovered Gems With Strong Fundamentals

Reviewed by Simply Wall St

As geopolitical tensions and trade uncertainties weigh heavily on global markets, small-cap indexes like the S&P MidCap 400 and Russell 2000 have experienced notable declines. Despite these challenges, certain stocks in Asia present compelling opportunities due to their robust fundamentals and potential for growth. In this article, we explore Qinghai Jinrui Mining Development alongside two other promising companies that stand out as undiscovered gems in the current market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ve Wong | 11.74% | 0.90% | 4.16% | ★★★★★★ |

| Advancetek EnterpriseLtd | 43.92% | 38.91% | 59.75% | ★★★★★★ |

| Donpon Precision | 45.58% | 2.76% | 46.41% | ★★★★★★ |

| Guangdong Lingxiao Pump IndustryLtd | NA | -0.13% | 3.94% | ★★★★★★ |

| Ampire | NA | -2.21% | 8.00% | ★★★★★★ |

| CHT Security | NA | 11.39% | 23.71% | ★★★★★★ |

| Pan Asian Microvent Tech (Jiangsu) | 25.44% | 15.19% | 13.48% | ★★★★★★ |

| Xiamen King Long Motor Group | 135.21% | 9.21% | 17.38% | ★★★★★☆ |

| Sing Investments & Finance | 0.29% | 9.07% | 12.24% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 27.20% | 20.30% | -23.01% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Qinghai Jinrui Mining Development (SHSE:600714)

Simply Wall St Value Rating: ★★★★★★

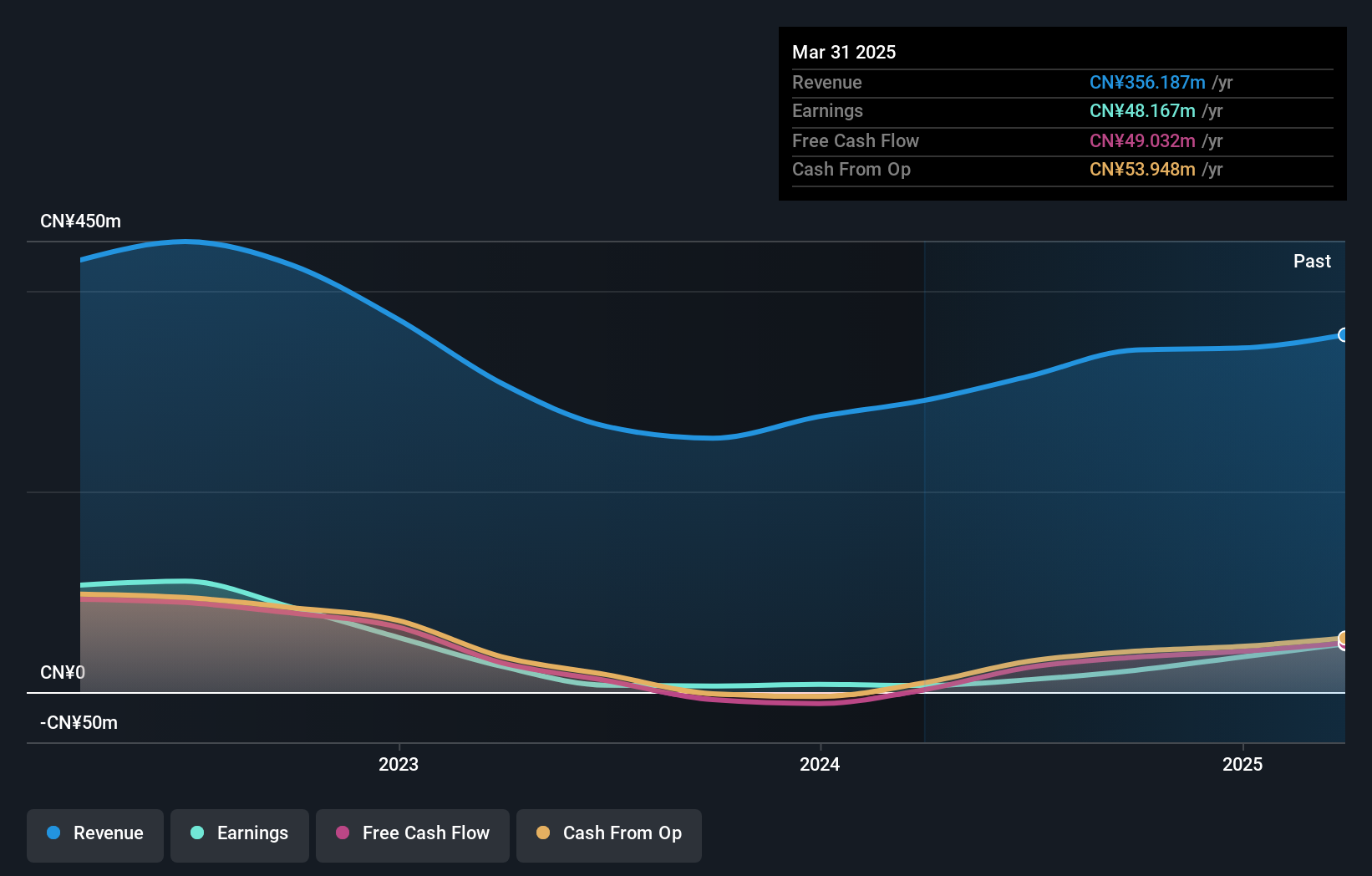

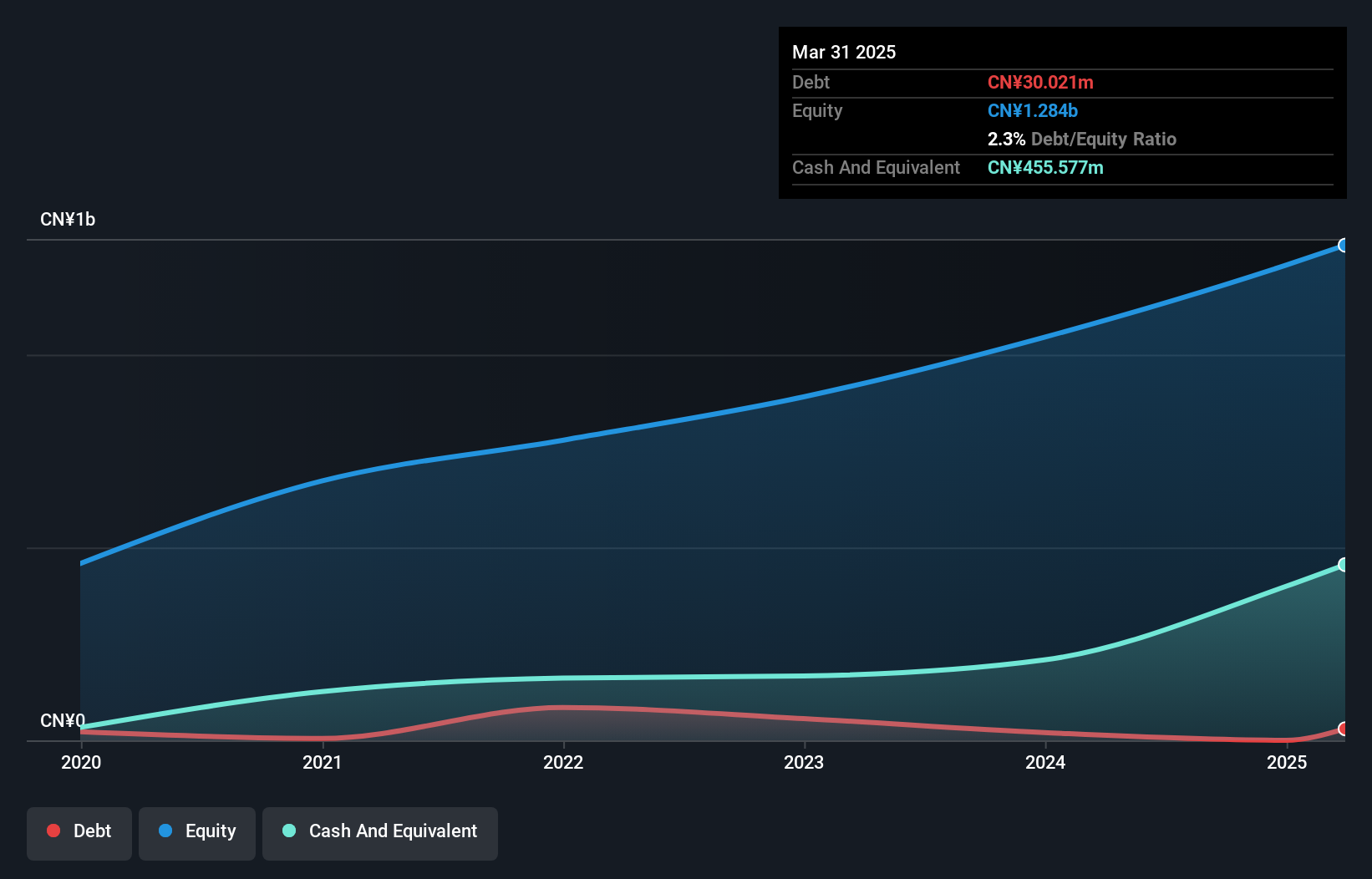

Overview: Qinghai Jinrui Mining Development Co., Ltd focuses on the production and sale of strontium salt products in China, with a market capitalization of approximately CN¥4.12 billion.

Operations: The company generates revenue primarily from the chemical industry, amounting to CN¥356.19 million.

Qinghai Jinrui Mining Development, a nimble player in the mining sector, has demonstrated impressive financial performance. Over the past year, earnings surged by 628.9%, far outpacing the Oil and Gas industry average of -7.7%. The company reported net income of CNY 15.28 million for Q1 2025, up from CNY 2.13 million a year earlier, with sales increasing to CNY 86.49 million from CNY 73.34 million previously. With no debt on its books compared to a debt-to-equity ratio of 0.07% five years ago, Qinghai Jinrui stands as a financially robust entity with high-quality earnings and positive free cash flow.

HENGHUI Technology (SZSE:301678)

Simply Wall St Value Rating: ★★★★★★

Overview: HENGHUI Technology Corporation Limited focuses on the research, development, manufacture, and sale of integrated circuit card packaging frames and module products primarily in China, with a market cap of approximately CN¥2.30 billion.

Operations: HENGHUI Technology derives its revenue primarily from the Semiconductor Equipment and Services segment, generating approximately CN¥889.74 million. The company's financial performance is influenced by its cost structure and market dynamics within this sector.

HENGHUI Technology, a promising player in the semiconductor space, recently completed an IPO raising CNY 766.58 million. The company reported sales of CNY 842.07 million for the full year ending December 2024, with net income at CNY 185.97 million and basic earnings per share of CNY 1.04. Its earnings growth over the past year outpaced the industry average by nearly double, reflecting robust performance despite a highly illiquid share price. Notably, HENGHUI's debt-to-equity ratio has improved from 3.5 to 2.3 over five years, indicating prudent financial management amidst its expansion efforts.

- Navigate through the intricacies of HENGHUI Technology with our comprehensive health report here.

Explore historical data to track HENGHUI Technology's performance over time in our Past section.

Johnson Health Tech .Co (TWSE:1736)

Simply Wall St Value Rating: ★★★★☆☆

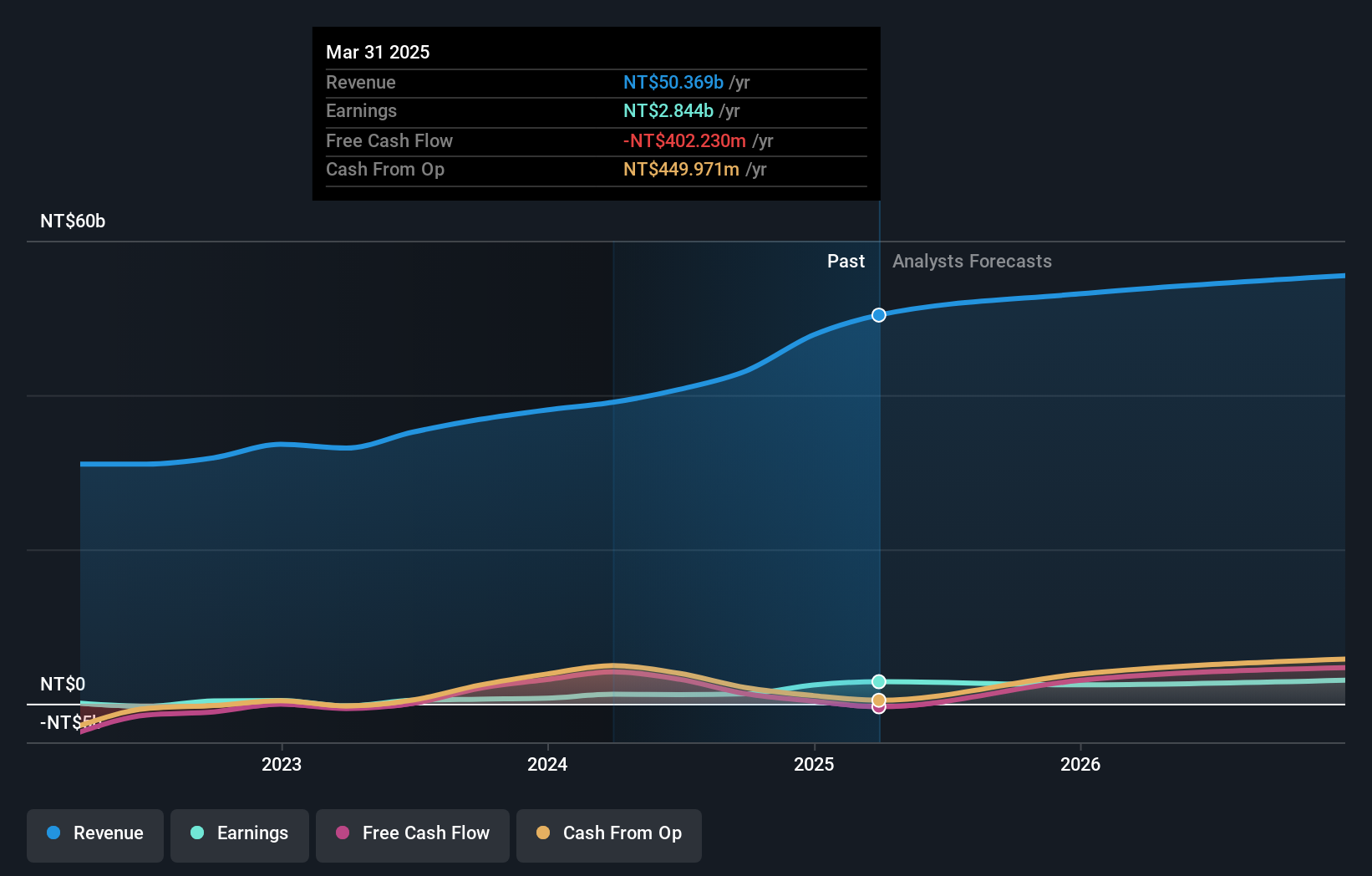

Overview: Johnson Health Tech. Co., Ltd. is involved in the manufacture and sale of sports and fitness equipment across the Americas, Europe, Asia, and other international markets, with a market cap of NT$47.16 billion.

Operations: Johnson Health Tech. Co., Ltd. generates revenue primarily from the sale of sports and fitness equipment, with significant contributions from Asia (NT$43.58 billion) and America (NT$26.31 billion).

Johnson Health Tech, a promising player in the fitness industry, is trading at 49.3% below its estimated fair value, presenting an intriguing opportunity. The company has demonstrated robust earnings growth of 133.4% over the past year, significantly outpacing the leisure industry's average of 53.1%. However, its net debt to equity ratio stands at a high 94%, which could pose challenges despite having well-covered interest payments with an EBIT coverage of 74.6 times. Recently, Johnson reported Q1 sales of TWD 10.61 billion and net income of TWD 276 million compared to a loss last year, underscoring its positive momentum in financial performance.

Make It Happen

- Discover the full array of 2617 Asian Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Qinghai Jinrui Mining Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600714

Qinghai Jinrui Mining Development

Produces and sells strontium salt products in China.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion