- China

- /

- Energy Services

- /

- SHSE:600583

Returns At Offshore Oil EngineeringLtd (SHSE:600583) Are On The Way Up

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So on that note, Offshore Oil EngineeringLtd (SHSE:600583) looks quite promising in regards to its trends of return on capital.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Offshore Oil EngineeringLtd:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.051 = CN¥1.4b ÷ (CN¥44b - CN¥16b) (Based on the trailing twelve months to March 2024).

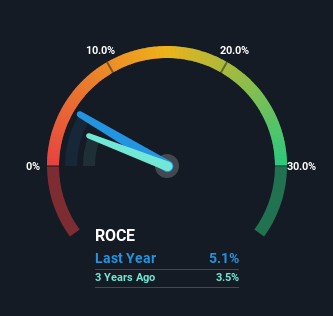

So, Offshore Oil EngineeringLtd has an ROCE of 5.1%. Ultimately, that's a low return and it under-performs the Energy Services industry average of 6.5%.

Check out our latest analysis for Offshore Oil EngineeringLtd

In the above chart we have measured Offshore Oil EngineeringLtd's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Offshore Oil EngineeringLtd for free.

What Can We Tell From Offshore Oil EngineeringLtd's ROCE Trend?

We're delighted to see that Offshore Oil EngineeringLtd is reaping rewards from its investments and is now generating some pre-tax profits. Shareholders would no doubt be pleased with this because the business was loss-making five years ago but is is now generating 5.1% on its capital. And unsurprisingly, like most companies trying to break into the black, Offshore Oil EngineeringLtd is utilizing 21% more capital than it was five years ago. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, both common traits of a multi-bagger.

For the record though, there was a noticeable increase in the company's current liabilities over the period, so we would attribute some of the ROCE growth to that. Effectively this means that suppliers or short-term creditors are now funding 37% of the business, which is more than it was five years ago. Keep an eye out for future increases because when the ratio of current liabilities to total assets gets particularly high, this can introduce some new risks for the business.

The Bottom Line

Overall, Offshore Oil EngineeringLtd gets a big tick from us thanks in most part to the fact that it is now profitable and is reinvesting in its business. Since the stock has only returned 18% to shareholders over the last five years, the promising fundamentals may not be recognized yet by investors. So exploring more about this stock could uncover a good opportunity, if the valuation and other metrics stack up.

On a final note, we've found 1 warning sign for Offshore Oil EngineeringLtd that we think you should be aware of.

While Offshore Oil EngineeringLtd may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600583

Offshore Oil EngineeringLtd

Engages in the design, procurement, construction, offshore installation, commissioning and maintenance of offshore oil and gas development projects in China and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026