- China

- /

- Oil and Gas

- /

- SHSE:600508

Many Still Looking Away From Shanghai Datun Energy Resources Co., Ltd. (SHSE:600508)

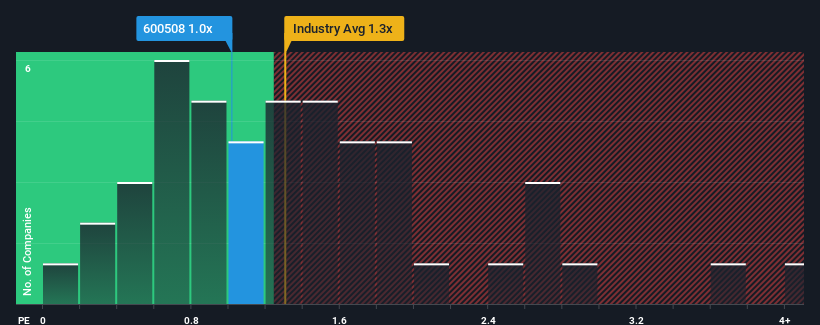

It's not a stretch to say that Shanghai Datun Energy Resources Co., Ltd.'s (SHSE:600508) price-to-sales (or "P/S") ratio of 1x right now seems quite "middle-of-the-road" for companies in the Oil and Gas industry in China, where the median P/S ratio is around 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Shanghai Datun Energy Resources

How Has Shanghai Datun Energy Resources Performed Recently?

Shanghai Datun Energy Resources has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai Datun Energy Resources will help you uncover what's on the horizon.How Is Shanghai Datun Energy Resources' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shanghai Datun Energy Resources' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 28% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 9.7% over the next year. That's shaping up to be materially higher than the 5.9% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Shanghai Datun Energy Resources' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Shanghai Datun Energy Resources' P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Shanghai Datun Energy Resources currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You always need to take note of risks, for example - Shanghai Datun Energy Resources has 2 warning signs we think you should be aware of.

If you're unsure about the strength of Shanghai Datun Energy Resources' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600508

Shanghai Datun Energy Resources

Shanghai Datun Energy Resources Co., Ltd.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives