- China

- /

- Consumer Services

- /

- SZSE:300668

Don't Buy Shenzhen Jiang&Associates Creative Design Co., Ltd. (SZSE:300668) For Its Next Dividend Without Doing These Checks

Shenzhen Jiang&Associates Creative Design Co., Ltd. (SZSE:300668) stock is about to trade ex-dividend in 3 days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. In other words, investors can purchase Shenzhen Jiang&Associates Creative Design's shares before the 30th of May in order to be eligible for the dividend, which will be paid on the 30th of May.

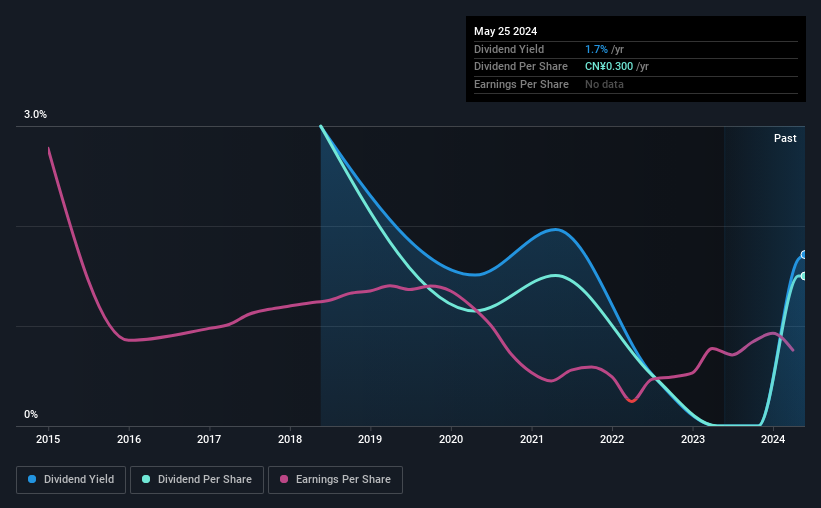

The company's next dividend payment will be CN¥0.30 per share, on the back of last year when the company paid a total of CN¥0.30 to shareholders. Calculating the last year's worth of payments shows that Shenzhen Jiang&Associates Creative Design has a trailing yield of 1.7% on the current share price of CN¥17.50. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Shenzhen Jiang&Associates Creative Design

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Shenzhen Jiang&Associates Creative Design paid out more than half (63%) of its earnings last year, which is a regular payout ratio for most companies. A useful secondary check can be to evaluate whether Shenzhen Jiang&Associates Creative Design generated enough free cash flow to afford its dividend.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Readers will understand then, why we're concerned to see Shenzhen Jiang&Associates Creative Design's earnings per share have dropped 15% a year over the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Shenzhen Jiang&Associates Creative Design has seen its dividend decline 11% per annum on average over the past six years, which is not great to see. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

To Sum It Up

Has Shenzhen Jiang&Associates Creative Design got what it takes to maintain its dividend payments? Shenzhen Jiang&Associates Creative Design had an average payout ratio, but its free cash flow was lower and earnings per share have been declining. It's not that we think Shenzhen Jiang&Associates Creative Design is a bad company, but these characteristics don't generally lead to outstanding dividend performance.

With that being said, if you're still considering Shenzhen Jiang&Associates Creative Design as an investment, you'll find it beneficial to know what risks this stock is facing. For instance, we've identified 4 warning signs for Shenzhen Jiang&Associates Creative Design (2 are a bit concerning) you should be aware of.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300668

Shenzhen Jiang&Associates Creative Design

Shenzhen Jiang&Associates Creative Design Co., Ltd.

Adequate balance sheet low.