- China

- /

- Consumer Services

- /

- SZSE:002713

Improved Revenues Required Before Dong Yi Ri Sheng Home Decoration Group Co.,Ltd. (SZSE:002713) Stock's 26% Jump Looks Justified

Dong Yi Ri Sheng Home Decoration Group Co.,Ltd. (SZSE:002713) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 69% share price decline over the last year.

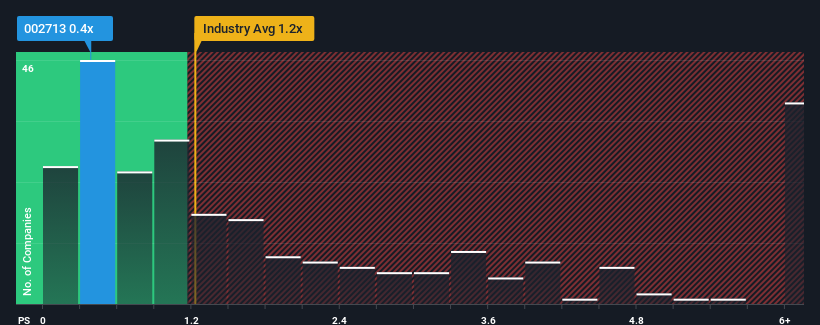

In spite of the firm bounce in price, Dong Yi Ri Sheng Home Decoration GroupLtd may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Consumer Services industry in China have P/S ratios greater than 3.1x and even P/S higher than 6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Dong Yi Ri Sheng Home Decoration GroupLtd

How Has Dong Yi Ri Sheng Home Decoration GroupLtd Performed Recently?

The recent revenue growth at Dong Yi Ri Sheng Home Decoration GroupLtd would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. Those who are bullish on Dong Yi Ri Sheng Home Decoration GroupLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Dong Yi Ri Sheng Home Decoration GroupLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

Dong Yi Ri Sheng Home Decoration GroupLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.3% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 25% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 32% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we understand why Dong Yi Ri Sheng Home Decoration GroupLtd's P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Dong Yi Ri Sheng Home Decoration GroupLtd's recent share price jump still sees fails to bring its P/S alongside the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Dong Yi Ri Sheng Home Decoration GroupLtd confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Dong Yi Ri Sheng Home Decoration GroupLtd, and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002713

Dong Yi Ri Sheng Home Decoration GroupLtd

Dong Yi Ri Sheng Home Decoration Group Co.,Ltd.

Imperfect balance sheet with very low risk.

Market Insights

Community Narratives