- China

- /

- Consumer Services

- /

- SZSE:002713

Dong Yi Ri Sheng Home Decoration Group Co.,Ltd. (SZSE:002713) Screens Well But There Might Be A Catch

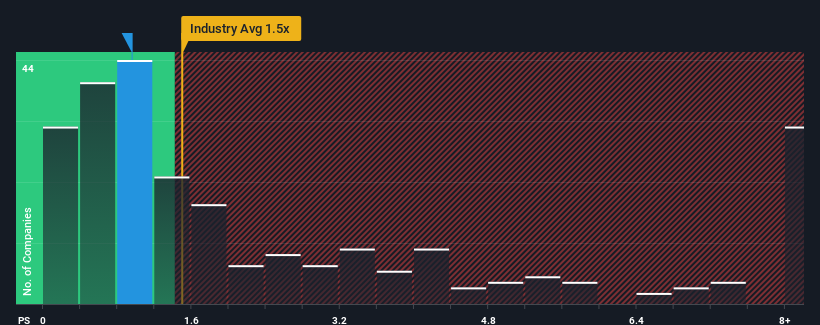

With a price-to-sales (or "P/S") ratio of 1x Dong Yi Ri Sheng Home Decoration Group Co.,Ltd. (SZSE:002713) may be sending very bullish signals at the moment, given that almost half of all the Consumer Services companies in China have P/S ratios greater than 3.9x and even P/S higher than 10x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Dong Yi Ri Sheng Home Decoration GroupLtd

What Does Dong Yi Ri Sheng Home Decoration GroupLtd's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Dong Yi Ri Sheng Home Decoration GroupLtd's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Dong Yi Ri Sheng Home Decoration GroupLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Dong Yi Ri Sheng Home Decoration GroupLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Dong Yi Ri Sheng Home Decoration GroupLtd would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 40% during the coming year according to the dual analysts following the company. With the industry only predicted to deliver 28%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Dong Yi Ri Sheng Home Decoration GroupLtd's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Dong Yi Ri Sheng Home Decoration GroupLtd currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Dong Yi Ri Sheng Home Decoration GroupLtd with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002713

Dong Yi Ri Sheng Home Decoration GroupLtd

Dong Yi Ri Sheng Home Decoration Group Co.,Ltd.

Imperfect balance sheet with very low risk.

Market Insights

Community Narratives