Undiscovered Gems And 2 Other Promising Stocks With Strong Potential

Reviewed by Simply Wall St

In a week marked by tariff uncertainties and mixed economic indicators, global markets experienced fluctuations with U.S. stocks ending lower and small-cap indices like the S&P MidCap 400 and Russell 2000 also seeing declines. Amidst these market dynamics, investors are increasingly focused on uncovering potential opportunities within smaller companies that may offer growth prospects despite broader economic challenges. Identifying promising stocks often involves looking for companies with strong fundamentals that can thrive even in uncertain environments, making them potential undiscovered gems in today's complex market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chilanga Cement | NA | 13.46% | 35.92% | ★★★★★★ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Conoil | 65.11% | 21.04% | 44.95% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

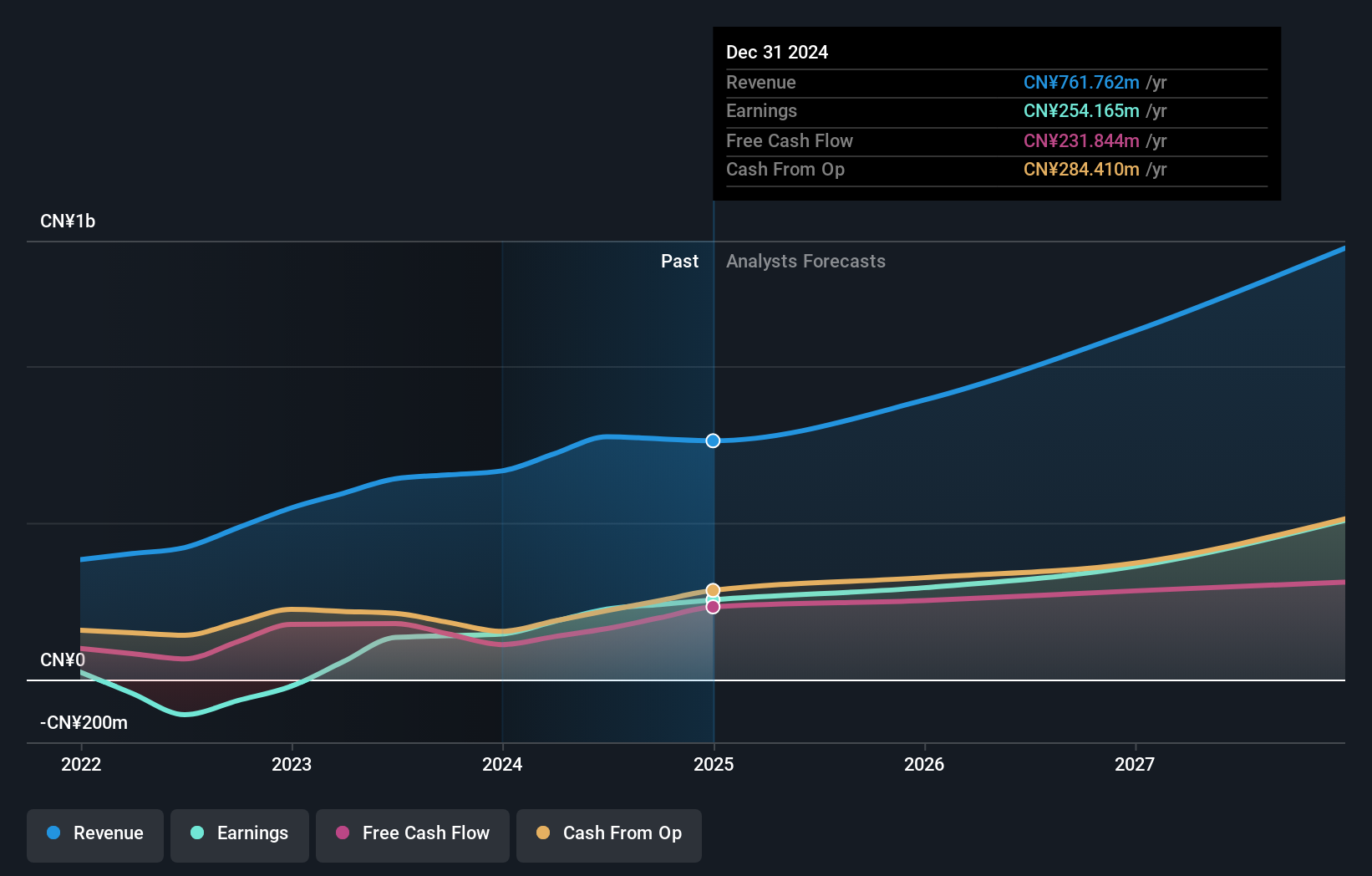

MicroPort NeuroScientific (SEHK:2172)

Simply Wall St Value Rating: ★★★★★★

Overview: MicroPort NeuroScientific Corporation focuses on the research, development, production, and sale of neuro-interventional medical devices both in China and internationally, with a market cap of HK$6.05 billion.

Operations: The company's primary revenue stream is from the surgical and medical equipment segment, generating CN¥774.66 million.

MicroPort NeuroScientific, a nimble player in the medical equipment sector, has showcased impressive growth with earnings surging 67.1% over the past year, outpacing the industry average of -4.3%. The company is debt-free and trades at 43.4% below its estimated fair value, highlighting potential undervaluation. Recent guidance anticipates net profit between RMB 236 million and RMB 270 million for 2024, marking a robust increase of up to 100% from last year. This growth is driven by expanded hospital coverage and overseas revenue doubling, alongside enhanced supply chain efficiency boosting profitability significantly.

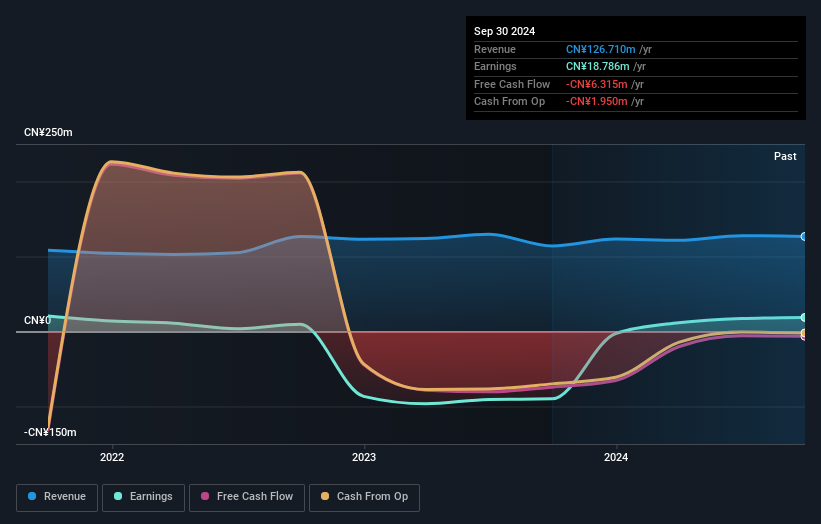

China Hi-Tech Group (SHSE:600730)

Simply Wall St Value Rating: ★★★★★★

Overview: China Hi-Tech Group Co., Ltd. operates in the education and real estate leasing sectors in China, with a market cap of CN¥4.06 billion.

Operations: The company generates revenue from its education and real estate leasing sectors. The net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

Emerging from its niche, China Hi-Tech Group has recently turned profitable, a significant milestone for this compact entity. With zero debt on its balance sheet both now and five years ago, the company stands out for its financial prudence. Despite not being free cash flow positive currently, it showcases high-quality earnings that bolster investor confidence. The absence of debt negates concerns about interest coverage, allowing the firm to focus on growth within the Consumer Services industry. As profitability is new territory for them, comparisons with industry peers remain challenging but promising in terms of potential future performance.

- Take a closer look at China Hi-Tech Group's potential here in our health report.

Assess China Hi-Tech Group's past performance with our detailed historical performance reports.

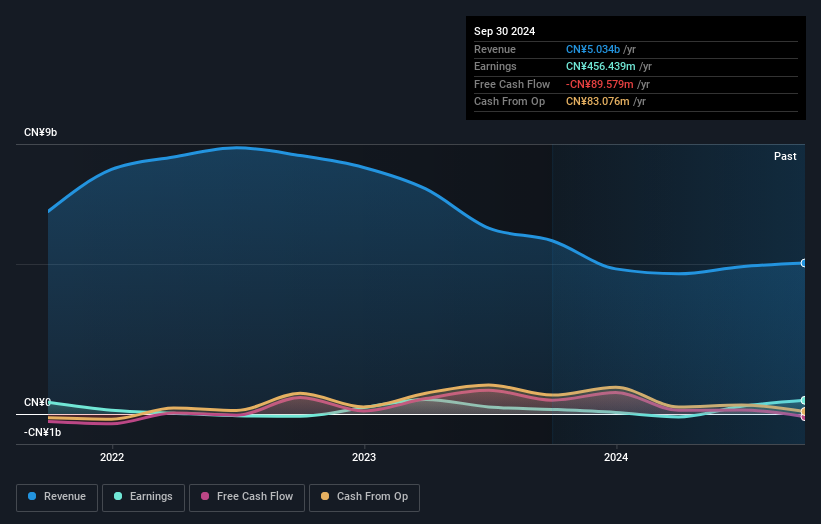

Yotrio Group (SZSE:002489)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yotrio Group Co., Ltd. engages in the research, development, manufacturing, and sale of outdoor furniture products across various global markets, with a market cap of CN¥7.61 billion.

Operations: Yotrio Group generates revenue primarily from the sale of outdoor furniture products across various international markets. The company's net profit margin has shown variability, reflecting changes in cost structures and market conditions.

Yotrio Group, a notable player in the leisure industry, has seen its earnings surge by 196% over the past year, outpacing the industry's -0.7% performance. The company's debt-to-equity ratio has improved significantly from 19.5% to 10.1% over five years, indicating effective debt management. With a price-to-earnings ratio of 16.7x, Yotrio appears undervalued compared to the broader CN market at 36.7x. Despite earnings declining by an average of 27.6% annually over five years, recent profitability and high non-cash earnings suggest potential for stability as interest payments are comfortably covered by profits.

- Dive into the specifics of Yotrio Group here with our thorough health report.

Evaluate Yotrio Group's historical performance by accessing our past performance report.

Next Steps

- Discover the full array of 4702 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002489

Yotrio Group

Researches, develops, manufactures, and sells outdoor furniture products in China, Europe, North and South America, Australia, Africa, and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives