- China

- /

- Food and Staples Retail

- /

- SZSE:301408

Three Undiscovered Gems in Asia with Promising Potential

Reviewed by Simply Wall St

As global markets experience fluctuations, with U.S. indices reaching all-time highs and Asian markets showing resilience amid easing trade tensions, investors are increasingly turning their attention to the dynamic landscape of small-cap stocks in Asia. In this environment, identifying promising stocks often involves looking for companies that demonstrate strong fundamentals and potential for growth within sectors poised to benefit from evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bonny Worldwide | 34.20% | 17.05% | 40.91% | ★★★★★★ |

| Taisun Enterprise | 0.15% | 6.44% | 13.50% | ★★★★★★ |

| Luyin Investment GroupLtd | 40.20% | 6.14% | 18.68% | ★★★★★★ |

| Zhejiang Haisen Pharmaceutical | NA | 4.06% | 9.83% | ★★★★★★ |

| Jih Lin Technology | 54.08% | 1.96% | 1.22% | ★★★★★★ |

| Shandong Sacred Sun Power SourcesLtd | 19.09% | 13.32% | 42.32% | ★★★★★★ |

| Triocean Industrial Corporation | 21.89% | 47.09% | 77.47% | ★★★★★★ |

| Kondotec | 13.45% | 7.00% | 9.12% | ★★★★★☆ |

| Ningbo Henghe Precision IndustryLtd | 66.02% | 5.50% | 23.91% | ★★★★☆☆ |

| Yuan Cheng CableLtd | 88.11% | 9.84% | 42.67% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Hangzhou Advance Gearbox Group (SHSE:601177)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hangzhou Advance Gearbox Group Co., Ltd. is involved in the production and sale of gearboxes and other related products both domestically in China and internationally, with a market capitalization of CN¥7.62 billion.

Operations: The primary revenue stream for Hangzhou Advance Gearbox Group comes from its General Equipment Manufacturing segment, which generated CN¥2.33 billion. The company's market capitalization stands at CN¥7.62 billion.

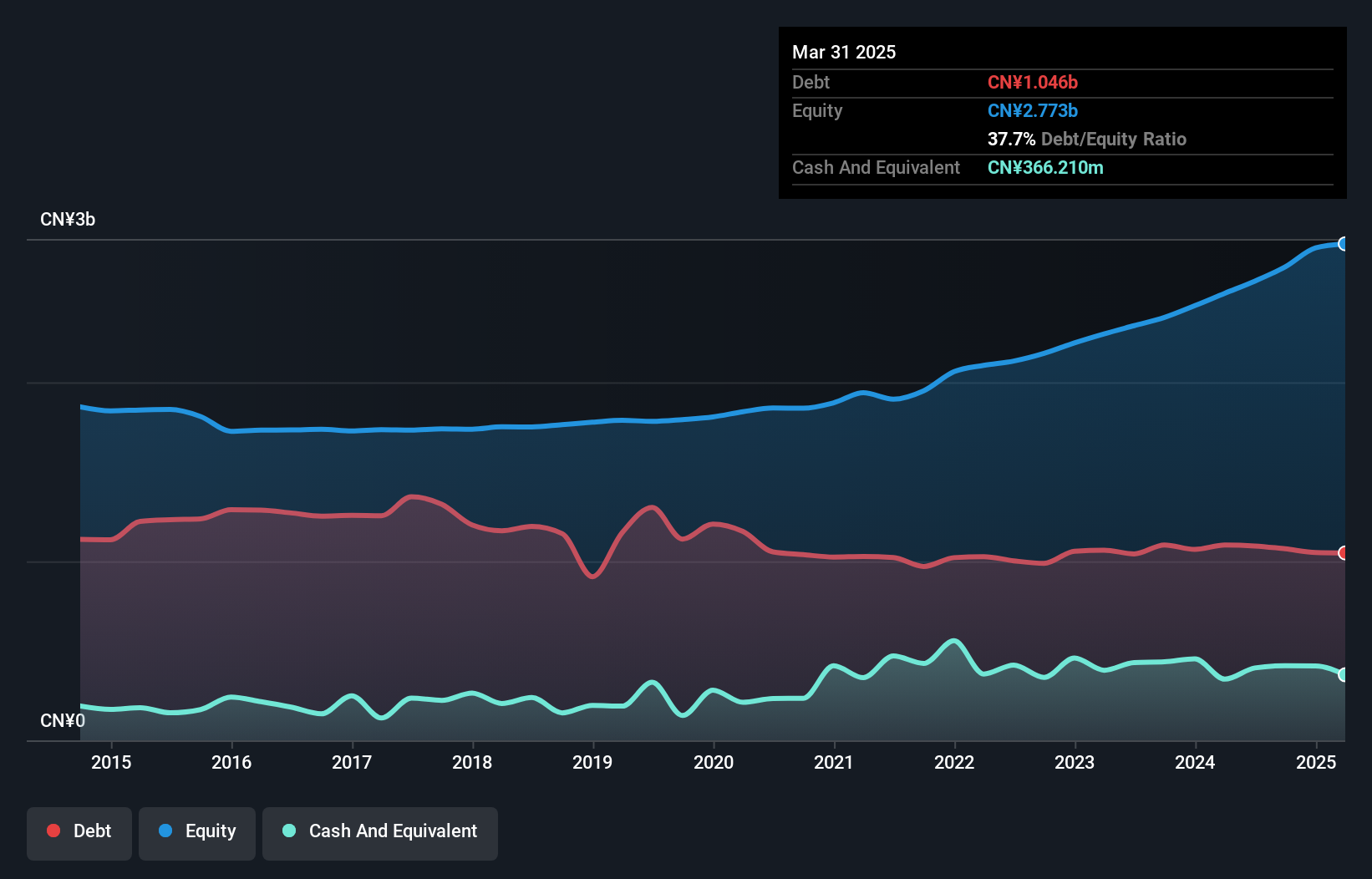

Hangzhou Advance Gearbox Group, a notable player in the machinery sector, has shown promising growth with a 22.1% earnings increase over the past year, outpacing industry averages. The company’s price-to-earnings ratio of 31.5x is attractively lower than the broader CN market at 38.9x, suggesting potential value for investors. Over five years, their debt to equity ratio improved from 63.6% to a satisfactory 37.7%, reflecting prudent financial management. Recent earnings reveal steady progress with Q1 sales rising to CNY 451 million from CNY 423 million last year and net income slightly up at CNY 53 million compared to CNY 52 million previously.

Xiamen Voke Mold & Plastic Engineering (SZSE:301196)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xiamen Voke Mold & Plastic Engineering Co., Ltd. specializes in the production and sales of high-precision molds, injection products, and health products, with a market cap of CN¥8.34 billion.

Operations: Voke Mold & Plastic Engineering generates its revenue primarily through the production and sales of high-precision molds, injection products, and health products, totaling CN¥2.03 billion.

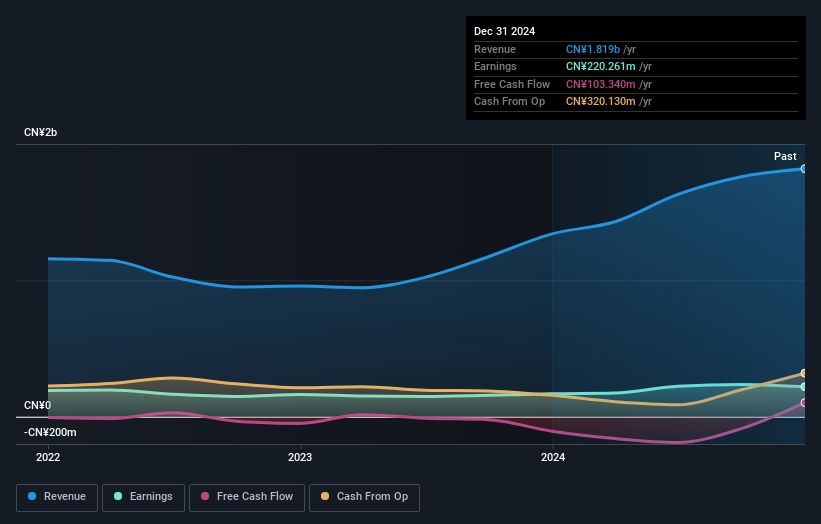

Xiamen Voke Mold & Plastic Engineering, a notable player in the machinery industry, showcases impressive growth with earnings surging 49.9% over the past year, outpacing its peers. The company's price-to-earnings ratio of 32.1x remains attractive compared to the broader CN market at 38.9x. Despite a volatile share price recently, Xiamen Voke's financial health is robust; it boasts more cash than total debt and covers interest payments comfortably. Recent earnings reports highlight significant revenue growth from CNY 328 million to CNY 539 million year-over-year for Q1 2025, with net income jumping from CNY 37 million to CNY 77 million during the same period.

- Click to explore a detailed breakdown of our findings in Xiamen Voke Mold & Plastic Engineering's health report.

Understand Xiamen Voke Mold & Plastic Engineering's track record by examining our Past report.

Anhui Huaren Health Pharmaceutical (SZSE:301408)

Simply Wall St Value Rating: ★★★★★☆

Overview: Anhui Huaren Health Pharmaceutical Co., Ltd. operates in the pharmaceutical industry, focusing on the development and distribution of health-related products, with a market cap of CN¥5.82 billion.

Operations: Anhui Huaren Health Pharmaceutical derives its revenue primarily from the development and distribution of health-related products. The company's net profit margin is 15%, reflecting its efficiency in converting revenue into actual profit.

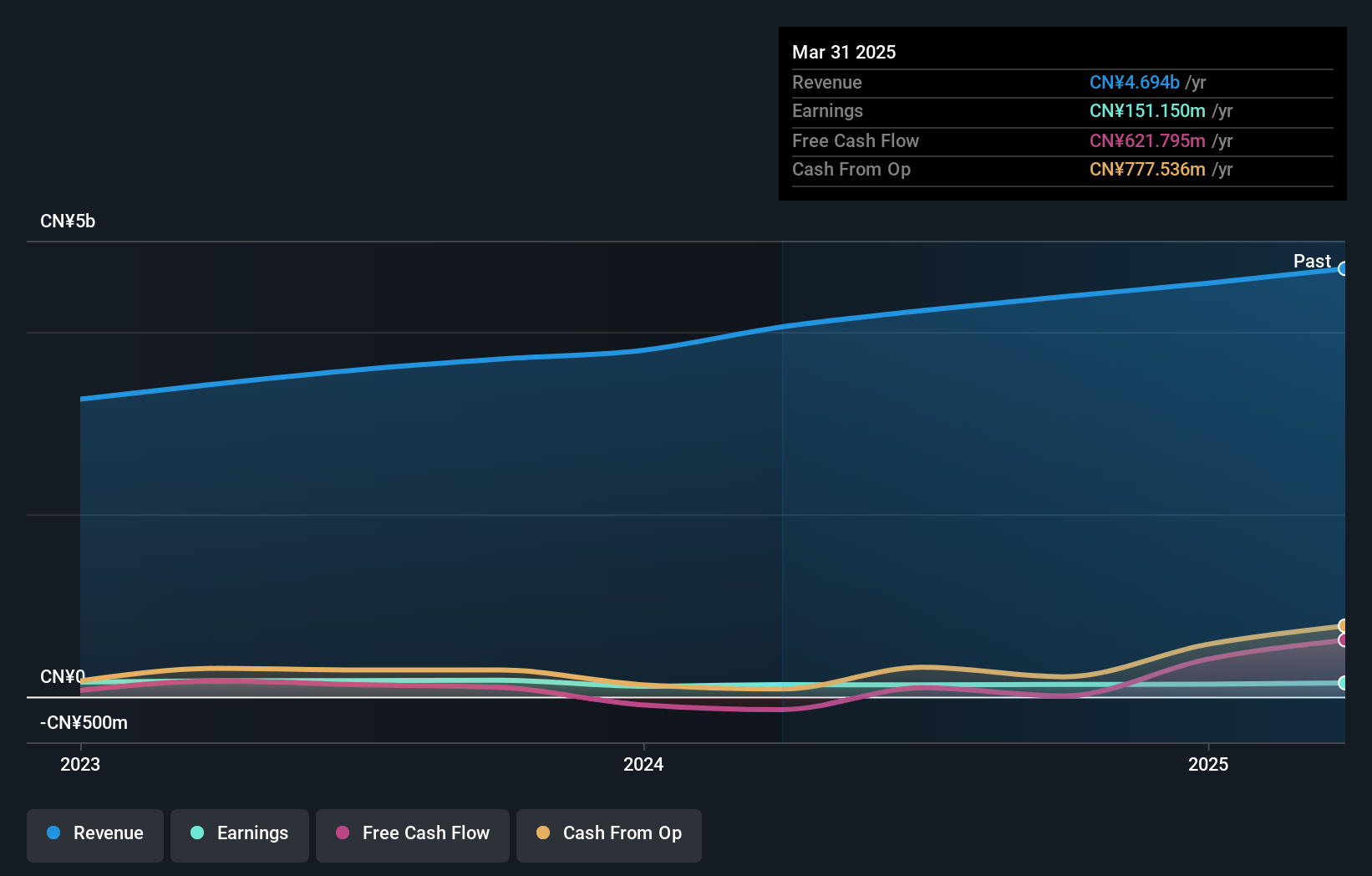

Anhui Huaren Health Pharmaceutical has been on a growth trajectory, with earnings rising by 13.7% over the past year, outpacing the Consumer Retailing industry. Trading at nearly 88% below its estimated fair value, it presents a compelling valuation for potential investors. The company's financial health seems robust; it covers interest payments comfortably with EBIT at 16 times interest expenses and holds more cash than total debt. Recent amendments to its articles of association suggest strategic shifts, while consistent dividend payouts indicate shareholder-friendly policies. Despite high share price volatility recently, these factors collectively highlight its investment appeal in Asia's pharmaceutical sector.

Make It Happen

- Reveal the 2618 hidden gems among our Asian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301408

Anhui Huaren Health Pharmaceutical

Anhui Huaren Health Pharmaceutical Co., Ltd.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives