- China

- /

- Food and Staples Retail

- /

- SZSE:000759

Improved Revenues Required Before Zhongbai Holdings Group Co.,Ltd. (SZSE:000759) Stock's 26% Jump Looks Justified

Zhongbai Holdings Group Co.,Ltd. (SZSE:000759) shares have continued their recent momentum with a 26% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

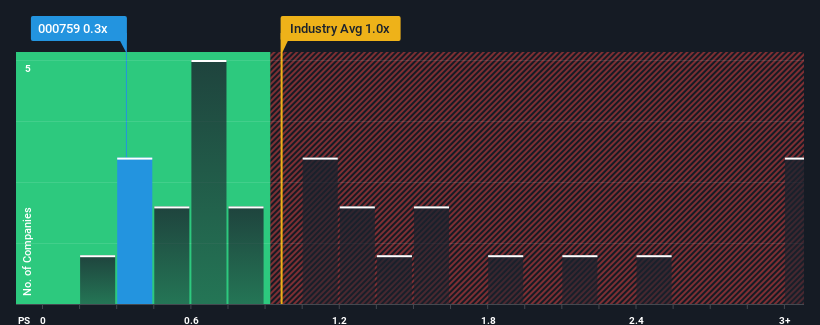

Although its price has surged higher, given about half the companies operating in China's Consumer Retailing industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Zhongbai Holdings GroupLtd as an attractive investment with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Zhongbai Holdings GroupLtd

What Does Zhongbai Holdings GroupLtd's P/S Mean For Shareholders?

Zhongbai Holdings GroupLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zhongbai Holdings GroupLtd.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Zhongbai Holdings GroupLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. This means it has also seen a slide in revenue over the longer-term as revenue is down 14% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue growth is heading into negative territory, declining 0.7% over the next year. With the industry predicted to deliver 11% growth, that's a disappointing outcome.

With this in consideration, we find it intriguing that Zhongbai Holdings GroupLtd's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Zhongbai Holdings GroupLtd's P/S

Despite Zhongbai Holdings GroupLtd's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Zhongbai Holdings GroupLtd's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Zhongbai Holdings GroupLtd with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zhongbai Holdings GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000759

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives