- China

- /

- Food and Staples Retail

- /

- SZSE:000061

Should You Be Adding Shenzhen Agricultural Power GroupLtd (SZSE:000061) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Shenzhen Agricultural Power GroupLtd (SZSE:000061). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Shenzhen Agricultural Power GroupLtd

How Fast Is Shenzhen Agricultural Power GroupLtd Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years Shenzhen Agricultural Power GroupLtd grew its EPS by 11% per year. That's a pretty good rate, if the company can sustain it.

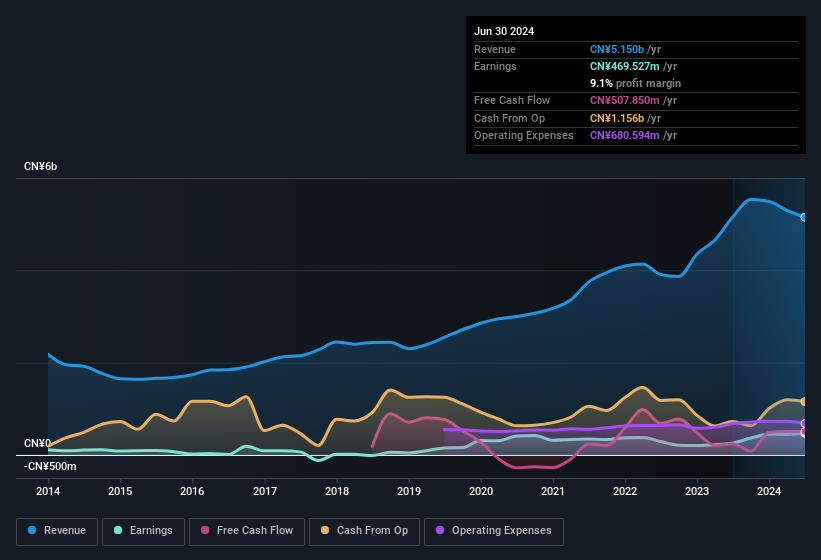

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While revenue is looking a bit flat, the good news is EBIT margins improved by 3.2 percentage points to 14%, in the last twelve months. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Shenzhen Agricultural Power GroupLtd Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Shenzhen Agricultural Power GroupLtd insiders have a significant amount of capital invested in the stock. To be specific, they have CN¥110m worth of shares. That's a lot of money, and no small incentive to work hard. Even though that's only about 1.0% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Shenzhen Agricultural Power GroupLtd To Your Watchlist?

One positive for Shenzhen Agricultural Power GroupLtd is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. These two factors are a huge highlight for the company which should be a strong contender your watchlists. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Shenzhen Agricultural Power GroupLtd (at least 1 which is a bit concerning) , and understanding these should be part of your investment process.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000061

Shenzhen Agricultural Power GroupLtd

Engages in development, construction, operation, and management of agricultural product wholesale markets in China.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives