- China

- /

- Consumer Durables

- /

- SZSE:301448

Risks To Shareholder Returns Are Elevated At These Prices For Keystone Electrical (Zhejiang) Co.,Ltd. (SZSE:301448)

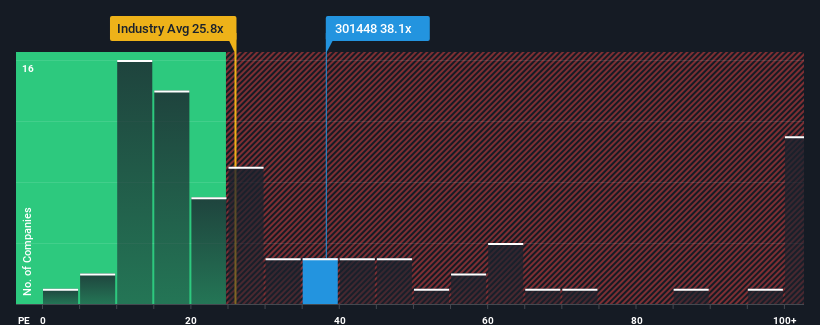

There wouldn't be many who think Keystone Electrical (Zhejiang) Co.,Ltd.'s (SZSE:301448) price-to-earnings (or "P/E") ratio of 38.1x is worth a mention when the median P/E in China is similar at about 38x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For example, consider that Keystone Electrical (Zhejiang)Ltd's financial performance has been pretty ordinary lately as earnings growth is non-existent. It might be that many expect the uninspiring earnings performance to only match most other companies at best over the coming period, which has kept the P/E from rising. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

See our latest analysis for Keystone Electrical (Zhejiang)Ltd

Is There Some Growth For Keystone Electrical (Zhejiang)Ltd?

Keystone Electrical (Zhejiang)Ltd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 26% drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 37% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Keystone Electrical (Zhejiang)Ltd is trading at a fairly similar P/E to the market. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

What We Can Learn From Keystone Electrical (Zhejiang)Ltd's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Keystone Electrical (Zhejiang)Ltd revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 3 warning signs for Keystone Electrical (Zhejiang)Ltd you should be aware of, and 2 of them make us uncomfortable.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Keystone Electrical (Zhejiang)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301448

Keystone Electrical (Zhejiang)Ltd

Develops and manufactures tools, and power tools and accessories in China.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives