- China

- /

- Consumer Durables

- /

- SZSE:300879

Ningbo Daye Garden Machinery Co.,Ltd.'s (SZSE:300879) Shares Climb 32% But Its Business Is Yet to Catch Up

Ningbo Daye Garden Machinery Co.,Ltd. (SZSE:300879) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 67% in the last year.

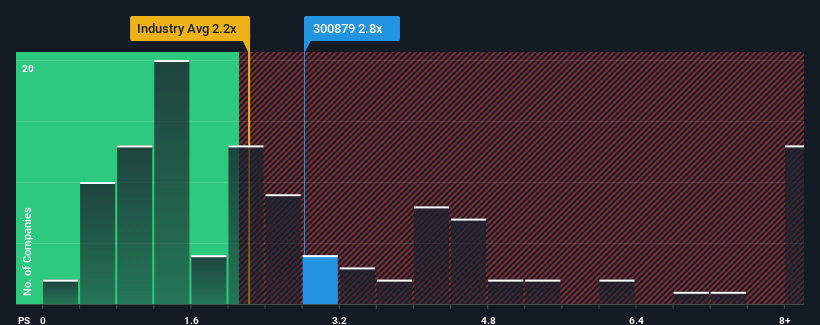

After such a large jump in price, when almost half of the companies in China's Consumer Durables industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Ningbo Daye Garden MachineryLtd as a stock probably not worth researching with its 2.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Ningbo Daye Garden MachineryLtd

What Does Ningbo Daye Garden MachineryLtd's P/S Mean For Shareholders?

Ningbo Daye Garden MachineryLtd certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Ningbo Daye Garden MachineryLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Ningbo Daye Garden MachineryLtd's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 58% last year. Revenue has also lifted 6.1% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that Ningbo Daye Garden MachineryLtd's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Ningbo Daye Garden MachineryLtd's P/S Mean For Investors?

The large bounce in Ningbo Daye Garden MachineryLtd's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Ningbo Daye Garden MachineryLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 4 warning signs we've spotted with Ningbo Daye Garden MachineryLtd (including 2 which are concerning).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Daye Garden MachineryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300879

Ningbo Daye Garden MachineryLtd

Engages in the manufacturing and selling of garden power tools and garden watering products in China and internationally.

Slight with mediocre balance sheet.

Market Insights

Community Narratives