The Market Doesn't Like What It Sees From Impulse (Qingdao) Health Tech Co.,Ltd.'s (SZSE:002899) Earnings Yet

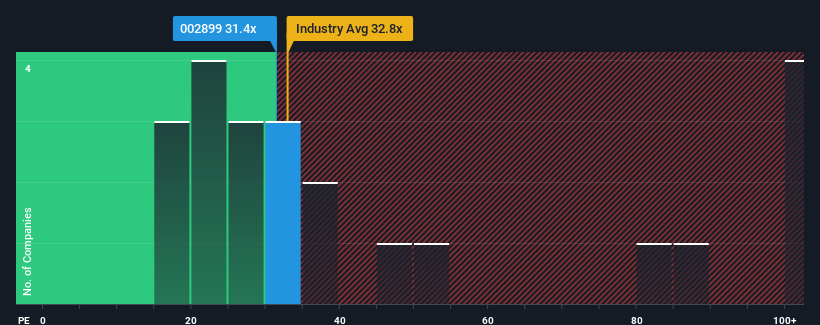

With a price-to-earnings (or "P/E") ratio of 31.4x Impulse (Qingdao) Health Tech Co.,Ltd. (SZSE:002899) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 38x and even P/E's higher than 75x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

For instance, Impulse (Qingdao) Health TechLtd's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Impulse (Qingdao) Health TechLtd

How Is Impulse (Qingdao) Health TechLtd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Impulse (Qingdao) Health TechLtd's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 14%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 113% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Impulse (Qingdao) Health TechLtd is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Impulse (Qingdao) Health TechLtd revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Impulse (Qingdao) Health TechLtd that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002899

Impulse (Qingdao) Health TechLtd

Engages in the research, development, production, and sale of sports fitness equipment in China and internationally.

Excellent balance sheet unattractive dividend payer.

Market Insights

Community Narratives