- China

- /

- Consumer Durables

- /

- SZSE:002403

Revenues Tell The Story For Aishida Co., Ltd (SZSE:002403) As Its Stock Soars 30%

Aishida Co., Ltd (SZSE:002403) shares have continued their recent momentum with a 30% gain in the last month alone. The last month tops off a massive increase of 253% in the last year.

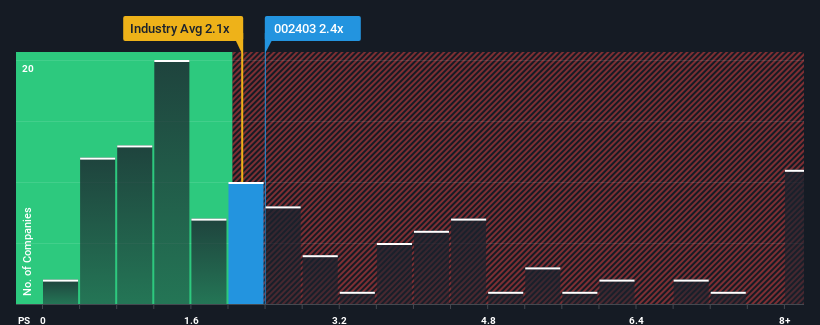

Even after such a large jump in price, it's still not a stretch to say that Aishida's price-to-sales (or "P/S") ratio of 2.4x right now seems quite "middle-of-the-road" compared to the Consumer Durables industry in China, where the median P/S ratio is around 2.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Aishida

How Has Aishida Performed Recently?

Recent times have been advantageous for Aishida as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Aishida will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Aishida would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.6% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 19% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the one analyst following the company. That's shaping up to be similar to the 11% growth forecast for the broader industry.

With this in mind, it makes sense that Aishida's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Aishida's P/S?

Aishida's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Aishida maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Before you take the next step, you should know about the 2 warning signs for Aishida that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002403

Aishida

Engages in the research, development, manufacture, and sale of cookware and kitchen electric appliances worldwide.

Good value with very low risk.

Market Insights

Community Narratives