- China

- /

- Consumer Durables

- /

- SZSE:002403

Aishida Co., Ltd's (SZSE:002403) P/S Is Still On The Mark Following 25% Share Price Bounce

Aishida Co., Ltd (SZSE:002403) shares have continued their recent momentum with a 25% gain in the last month alone. The last month tops off a massive increase of 109% in the last year.

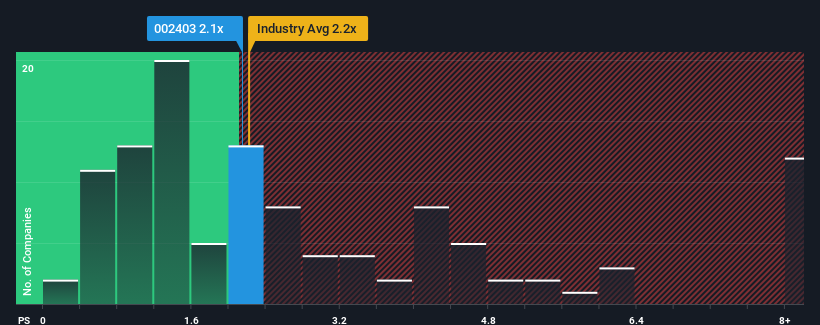

Even after such a large jump in price, there still wouldn't be many who think Aishida's price-to-sales (or "P/S") ratio of 2.1x is worth a mention when the median P/S in China's Consumer Durables industry is similar at about 2.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Aishida

How Aishida Has Been Performing

With revenue growth that's superior to most other companies of late, Aishida has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Aishida will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Aishida's to be considered reasonable.

Retrospectively, the last year delivered a decent 9.6% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 19% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 12% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 10%, which is not materially different.

With this information, we can see why Aishida is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Aishida's P/S

Aishida appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at Aishida's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Aishida that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002403

Aishida

Engages in the research, development, manufacture, and sale of cookware and kitchen electric appliances worldwide.

Good value with very low risk.

Market Insights

Community Narratives