Why Investors Shouldn't Be Surprised By HL Corp (Shenzhen)'s (SZSE:002105) 27% Share Price Plunge

HL Corp (Shenzhen) (SZSE:002105) shares have had a horrible month, losing 27% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 39% in that time.

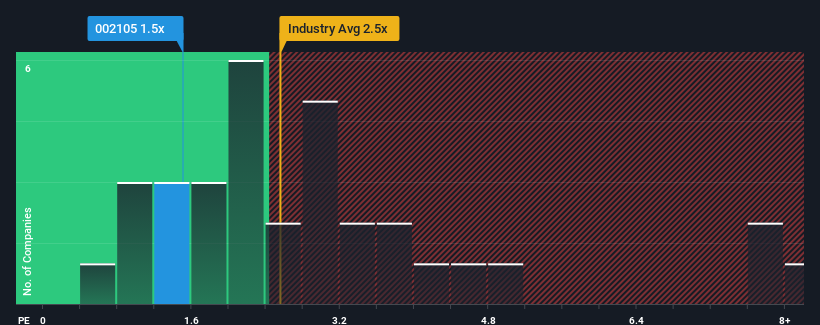

In spite of the heavy fall in price, considering around half the companies operating in China's Leisure industry have price-to-sales ratios (or "P/S") above 2.5x, you may still consider HL Corp (Shenzhen) as an solid investment opportunity with its 1.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for HL Corp (Shenzhen)

How HL Corp (Shenzhen) Has Been Performing

As an illustration, revenue has deteriorated at HL Corp (Shenzhen) over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on HL Corp (Shenzhen) will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For HL Corp (Shenzhen)?

In order to justify its P/S ratio, HL Corp (Shenzhen) would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 41%. The last three years don't look nice either as the company has shrunk revenue by 58% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 22% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's understandable that HL Corp (Shenzhen)'s P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

HL Corp (Shenzhen)'s recently weak share price has pulled its P/S back below other Leisure companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of HL Corp (Shenzhen) confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 4 warning signs for HL Corp (Shenzhen) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if HL Corp (Shenzhen) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002105

HL Corp (Shenzhen)

HL CORP (Shenzhen) engages in the research and development, manufacture, and marketing of bicycle parts, sports and fitness equipment, and rehabilitation equipment in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives