- Japan

- /

- Tech Hardware

- /

- TSE:6676

Exploring Hunan Hualian China Industry And 2 Other Undiscovered Gems In Asia

Reviewed by Simply Wall St

In recent weeks, the Asian markets have experienced mixed performances, with China's economic indicators showing signs of slowing growth and Japan's stock markets seeing modest gains amid global sentiment shifts. As small-cap stocks face headwinds from interest rate sensitivities and broader market volatility, identifying promising opportunities requires a keen eye for companies that demonstrate resilience and potential for growth in this challenging environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AzureWave Technologies | 11.00% | -1.30% | 12.72% | ★★★★★★ |

| Xiamen Jiarong TechnologyLtd | 8.54% | -5.04% | -25.38% | ★★★★★★ |

| Hangzhou Hirisun Technology | NA | -9.43% | -21.49% | ★★★★★★ |

| Cota | NA | 3.97% | 1.24% | ★★★★★★ |

| OUG Holdings | 63.13% | 3.85% | 32.14% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 96.00% | 3.20% | 12.40% | ★★★★★☆ |

| Advancetek EnterpriseLtd | 57.48% | 28.66% | 48.38% | ★★★★★☆ |

| MNtech | 66.79% | 12.39% | -12.13% | ★★★★★☆ |

| Daewon Cable | 21.76% | 7.48% | 44.88% | ★★★★★☆ |

| Nippon Sharyo | 48.57% | -0.32% | -3.31% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Hunan Hualian China Industry (SZSE:001216)

Simply Wall St Value Rating: ★★★★★★

Overview: Hunan Hualian China Industry Co., Ltd. is a ceramic company involved in the research, development, production, and sale of ceramic products both domestically and internationally, with a market capitalization of CN¥4.72 billion.

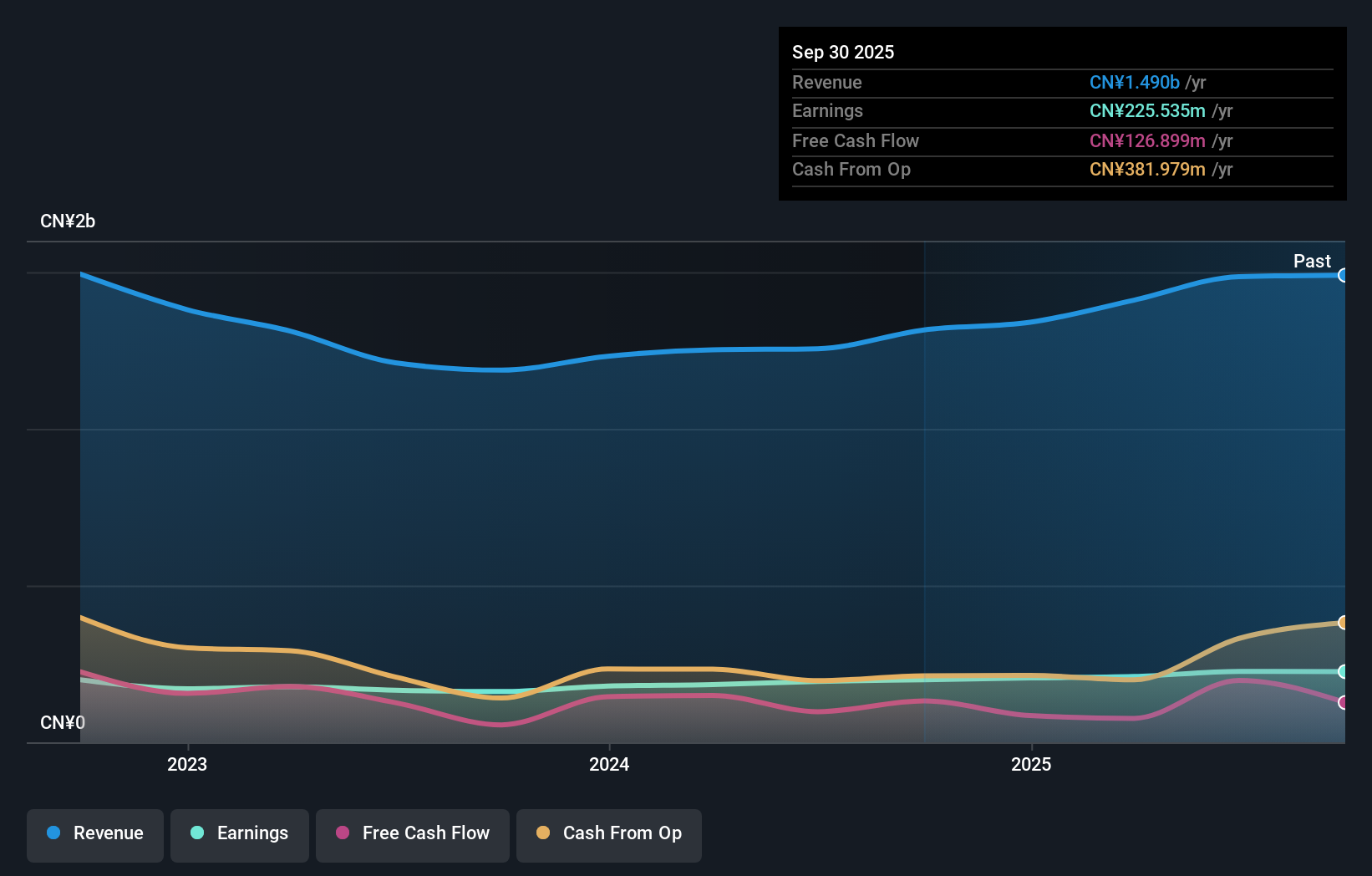

Operations: The company generates revenue through the sale of ceramic products, leveraging its research and development capabilities to serve both domestic and international markets. Its financial performance is characterized by a focus on optimizing production costs while expanding its market reach. The company's gross profit margin reflects its efficiency in managing production expenses relative to sales revenue.

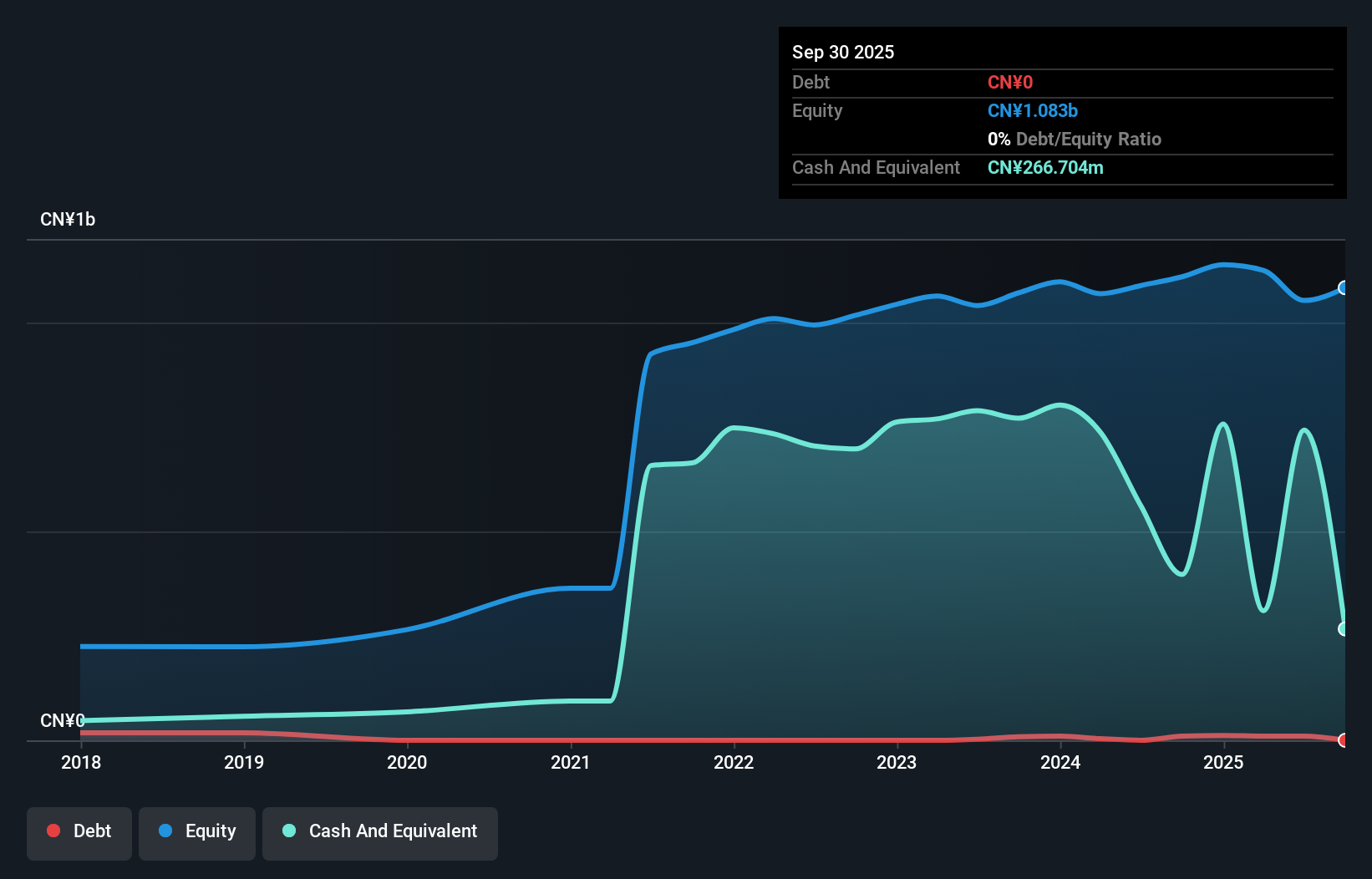

Hunan Hualian China Industry, a small player in the consumer durables sector, has shown resilience with earnings growth of 13.1% over the past year, outperforming its industry peers who saw a -3.4% change. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 1.2%. Recent earnings for the nine months ended September 2025 reveal sales at CNY 1.13 billion and net income of CNY 189 million, up from CNY 982 million and CNY 169 million respectively last year. Trading at roughly three-quarters below its estimated fair value suggests potential undervaluation in current market conditions.

Ningbo Color Master Batch (SZSE:301019)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningbo Color Master Batch Co., Ltd. is involved in the research, development, production, and sale of plastic coloring products both in China and internationally with a market cap of CN¥4.04 billion.

Operations: The primary revenue stream for Ningbo Color Master Batch Co., Ltd. is derived from the rubber and plastic products industry, generating CN¥471.34 million. The company's net profit margin reflects its financial efficiency in converting revenue into actual profit, but specific percentages or trends are not provided here for detailed analysis.

Ningbo Color Master Batch, a nimble player in the chemical industry, showcases resilience with its earnings growth of 13.1% over the past year, outpacing the sector's average of 6.8%. Despite a slight dip in sales to CNY 344.65 million for the first nine months of 2025 compared to last year's CNY 366.4 million, net income improved to CNY 82.51 million from CNY 71.67 million, reflecting robust operational efficiency and high-quality earnings. The company remains debt-free and boasts a favorable price-to-earnings ratio of 36x against China's market average of 45x, suggesting potential value for investors seeking growth opportunities within Asia's dynamic markets.

- Get an in-depth perspective on Ningbo Color Master Batch's performance by reading our health report here.

Gain insights into Ningbo Color Master Batch's past trends and performance with our Past report.

Buffalo (TSE:6676)

Simply Wall St Value Rating: ★★★★★★

Overview: Buffalo Inc. is engaged in the development, manufacturing, and sale of digital home appliances and computer peripherals both in Japan and internationally, with a market cap of ¥61.83 billion.

Operations: Buffalo generates revenue primarily from the sale of digital home appliances and computer peripherals. The company focuses on both domestic and international markets, contributing to its market cap of ¥61.83 billion.

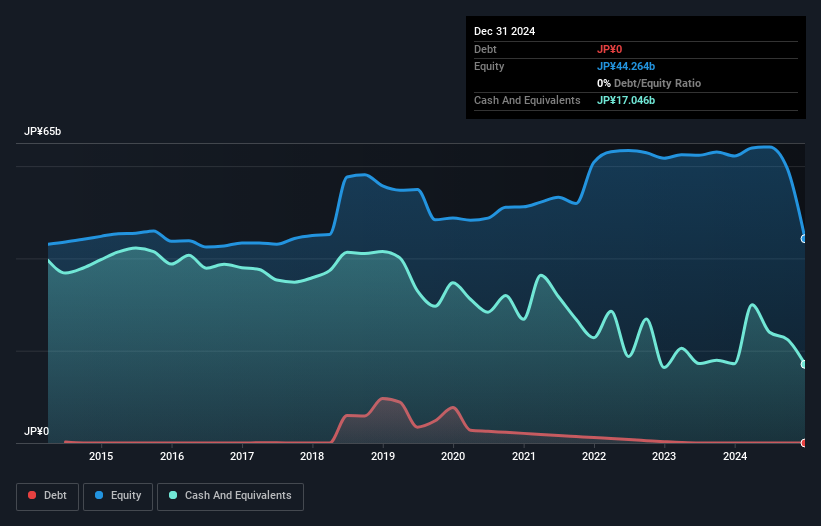

Buffalo, a nimble player in its sector, has showcased impressive earnings growth of 135.9% over the past year, outpacing the tech industry's 9.1%. Despite this surge, future projections indicate a potential decline in earnings by an average of 30.7% annually for the next three years. The company's debt-to-equity ratio has improved from 4.5 to 3.5 over five years, suggesting prudent financial management. Additionally, Buffalo's price-to-earnings ratio stands at a favorable 7.1x compared to Japan's market average of 14.1x, hinting at attractive valuation levels amidst industry peers and broader market conditions.

- Take a closer look at Buffalo's potential here in our health report.

Evaluate Buffalo's historical performance by accessing our past performance report.

Taking Advantage

- Navigate through the entire inventory of 2474 Asian Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Buffalo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6676

Buffalo

Through its subsidiaries, develops, manufactures, and sells digital home appliances and computer peripherals in Japan and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives