Stock Analysis

Ningxia Zhongyin Cashmere Co., Ltd.'s (SZSE:000982) Popularity With Investors Under Threat As Stock Sinks 71%

The Ningxia Zhongyin Cashmere Co., Ltd. (SZSE:000982) share price has fared very poorly over the last month, falling by a substantial 71%. For any long-term shareholders, the last month ends a year to forget by locking in a 82% share price decline.

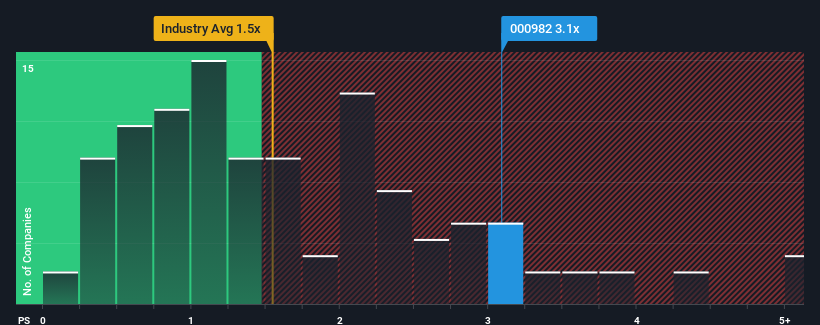

In spite of the heavy fall in price, you could still be forgiven for thinking Ningxia Zhongyin Cashmere is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.1x, considering almost half the companies in China's Luxury industry have P/S ratios below 1.5x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Ningxia Zhongyin Cashmere

What Does Ningxia Zhongyin Cashmere's Recent Performance Look Like?

For example, consider that Ningxia Zhongyin Cashmere's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Ningxia Zhongyin Cashmere, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Ningxia Zhongyin Cashmere's Revenue Growth Trending?

Ningxia Zhongyin Cashmere's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 43%. Even so, admirably revenue has lifted 63% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 16% shows it's about the same on an annualised basis.

With this in mind, we find it intriguing that Ningxia Zhongyin Cashmere's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Key Takeaway

Despite the recent share price weakness, Ningxia Zhongyin Cashmere's P/S remains higher than most other companies in the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Ningxia Zhongyin Cashmere has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Ningxia Zhongyin Cashmere you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Ningxia Zhongyin Cashmere is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Ningxia Zhongyin Cashmere is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000982

Ningxia Zhongyin Cashmere

Ningxia Zhongyin Cashmere Co., Ltd. purchases, produces, trades in, sells, and exports cashmere and related products in China.

Flawless balance sheet with weak fundamentals.