As global markets navigate a complex landscape marked by resilient labor markets, inflation concerns, and fluctuating interest rates, investors are keenly observing how these factors impact equity performance. In such an environment, dividend stocks can offer a compelling option for those seeking income stability amidst market volatility. A good dividend stock typically combines a solid yield with strong fundamentals, providing potential resilience against economic uncertainties while generating regular income.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.07% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.07% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1999 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

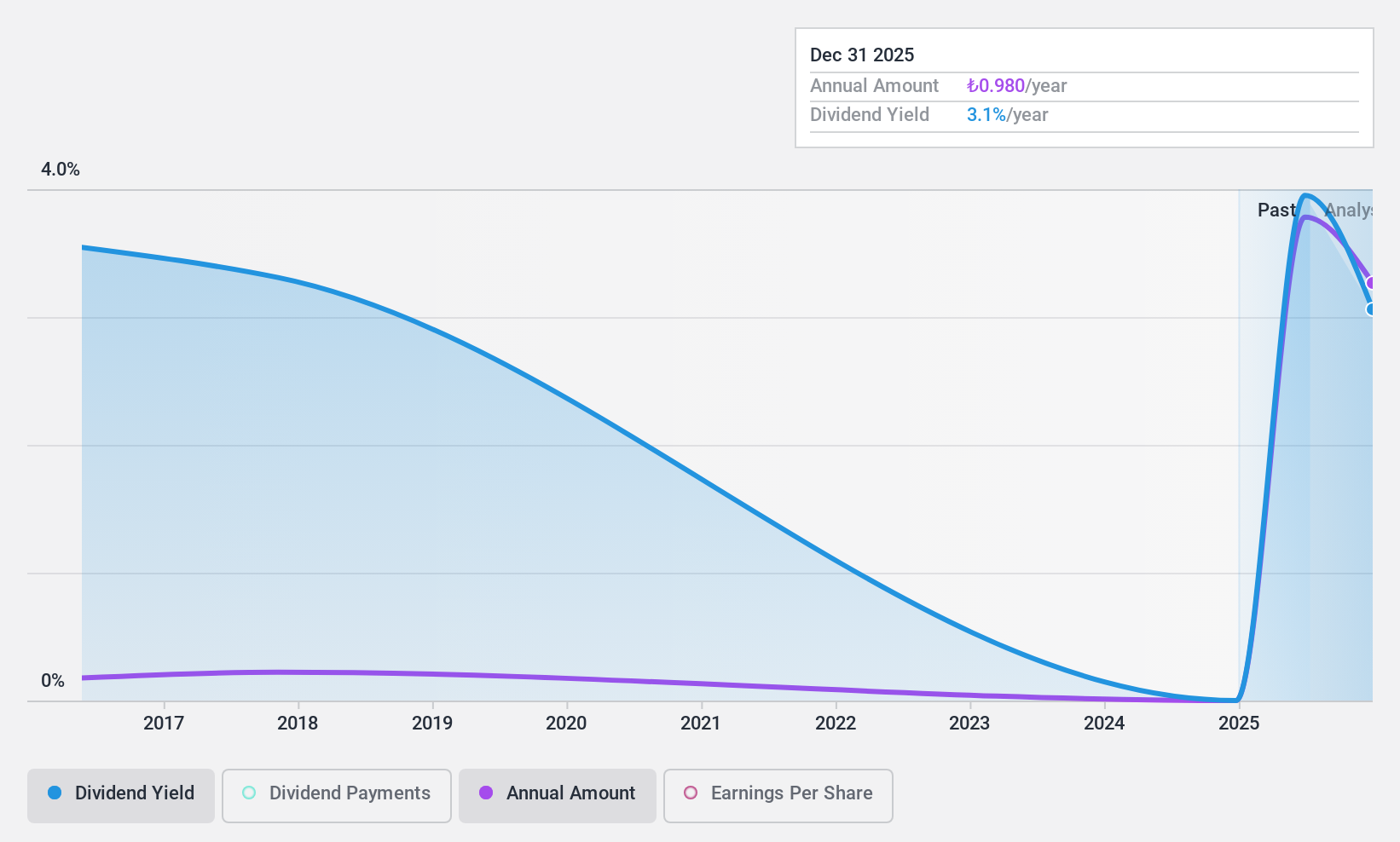

Turcas Petrol (IBSE:TRCAS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Turcas Petrol A.S. is an oil and energy-focused investment company based in Turkey with a market capitalization of TRY6.31 billion.

Operations: Turcas Petrol A.S. generates revenue through its operations in the oil and energy sectors within Turkey.

Dividend Yield: 4.2%

Turcas Petrol offers a dividend yield of 4.18%, ranking it in the top 25% of Turkish dividend payers, yet its sustainability is questionable due to inadequate free cash flow coverage. Despite a low payout ratio of 13.2%, cash payout issues persist with a high ratio of 134.5%. The company's dividends have grown over the past decade but remain volatile and unreliable. Turcas's P/E ratio at 6.3x suggests undervaluation compared to the market average.

- Dive into the specifics of Turcas Petrol here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Turcas Petrol is priced higher than what may be justified by its financials.

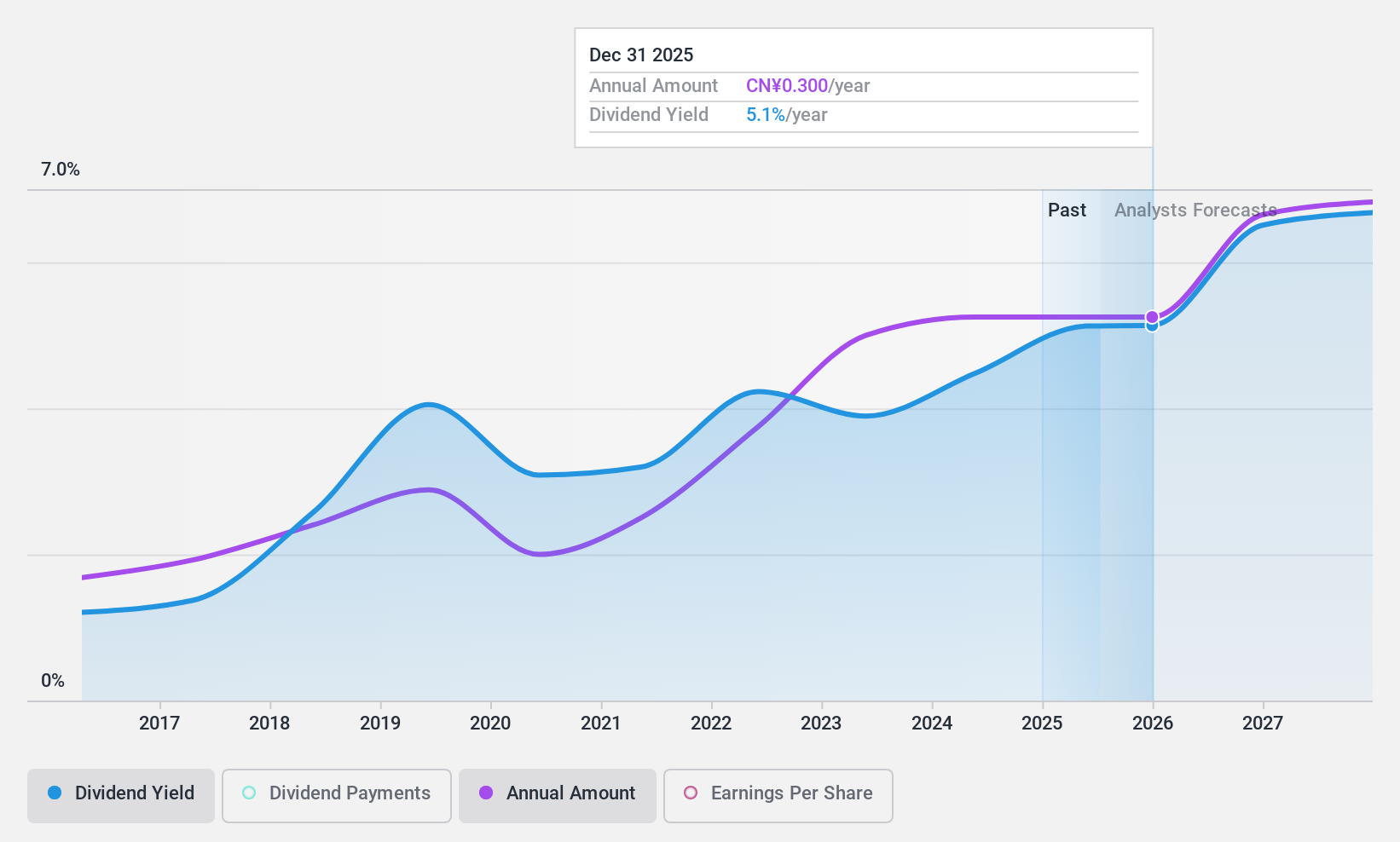

Zhejiang Xinao Textiles (SHSE:603889)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Xinao Textiles Inc. is involved in the research and development, production, and sale of wool yarn, wool tops, and cashmere yarn in China with a market cap of CN¥4.92 billion.

Operations: Zhejiang Xinao Textiles Inc.'s revenue primarily comes from its operations in the wool yarn, wool tops, and cashmere yarn sectors within China.

Dividend Yield: 4.5%

Zhejiang Xinao Textiles offers a 4.45% dividend yield, placing it in the top 25% of Chinese payers, but its sustainability is challenged by inadequate free cash flow coverage and volatility over the past decade. Despite a reasonable payout ratio of 50.9%, the high cash payout ratio undermines stability. Recent earnings showed growth with sales reaching CNY 3.87 billion for nine months ending September 2024, indicating potential for future profitability improvements despite current dividend concerns.

- Click here to discover the nuances of Zhejiang Xinao Textiles with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Zhejiang Xinao Textiles is trading behind its estimated value.

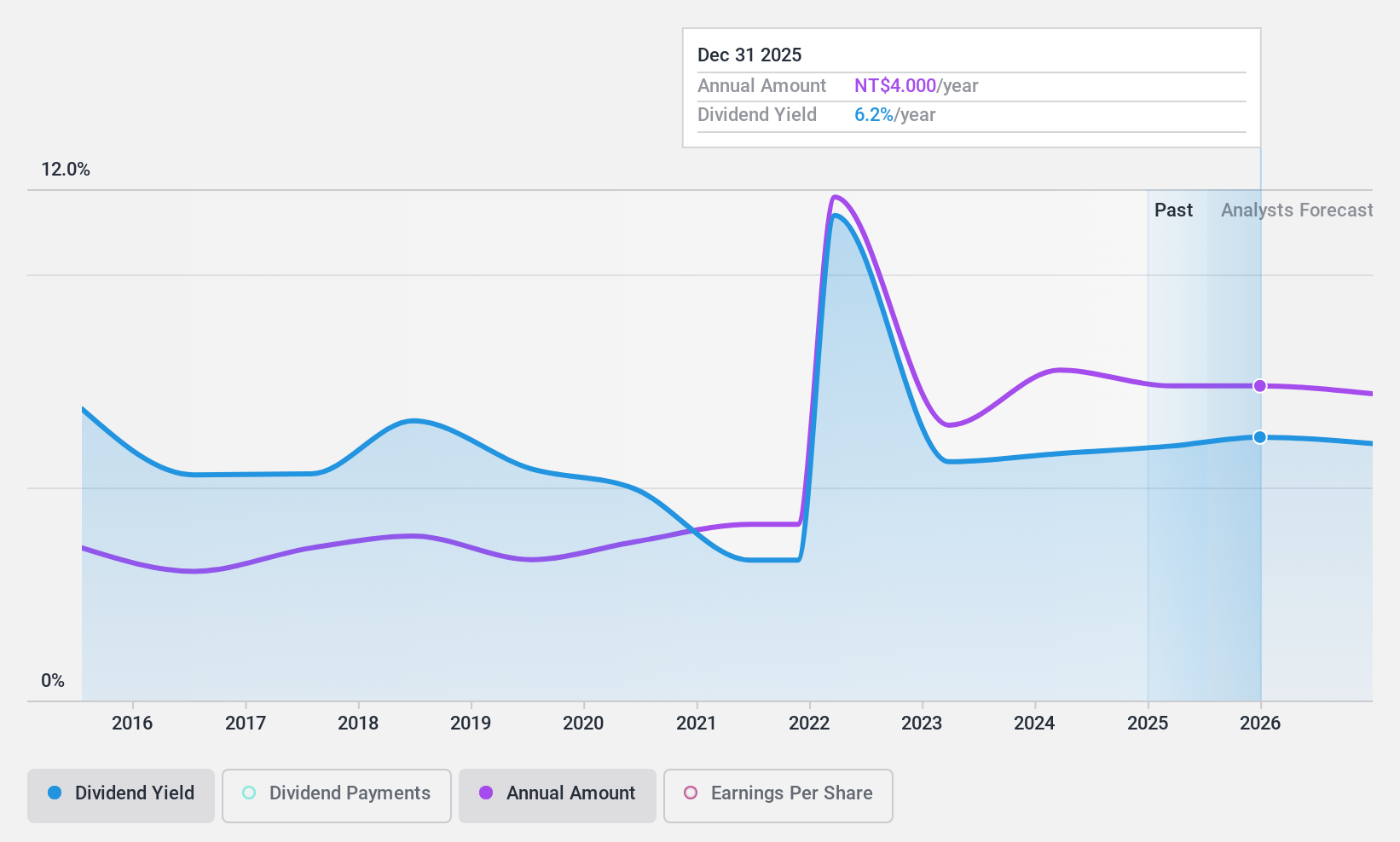

Tung Ho Steel Enterprise (TWSE:2006)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tung Ho Steel Enterprise Corporation, along with its subsidiaries, produces and sells steel products in Taiwan and has a market cap of NT$48.05 billion.

Operations: Tung Ho Steel Enterprise Corporation generates its revenue primarily from the Steel Department, which accounts for NT$55.50 billion, and the Steel Structure Department, contributing NT$13.85 billion.

Dividend Yield: 6.4%

Tung Ho Steel Enterprise's dividend yield of 6.36% ranks it among the top 25% in Taiwan, yet its dividend history is marked by volatility over the past decade. Despite this instability, dividends are covered by earnings and cash flows with payout ratios of 65.4% and 53.6%, respectively. Recent earnings reports show slight declines in sales and net income for Q3 2024 but overall growth in earnings over the past year, suggesting a mixed outlook for dividend reliability.

- Take a closer look at Tung Ho Steel Enterprise's potential here in our dividend report.

- The valuation report we've compiled suggests that Tung Ho Steel Enterprise's current price could be quite moderate.

Taking Advantage

- Click here to access our complete index of 1999 Top Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Xinao Textiles might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603889

Zhejiang Xinao Textiles

Engages in the research and development, production, and sale of wool yarn, wool tops, and cashmere yarn in China and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives