- China

- /

- Consumer Durables

- /

- SHSE:603657

A Piece Of The Puzzle Missing From Jinhua Chunguang Technology Co.,Ltd's (SHSE:603657) 34% Share Price Climb

Jinhua Chunguang Technology Co.,Ltd (SHSE:603657) shares have continued their recent momentum with a 34% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 2.7% over the last year.

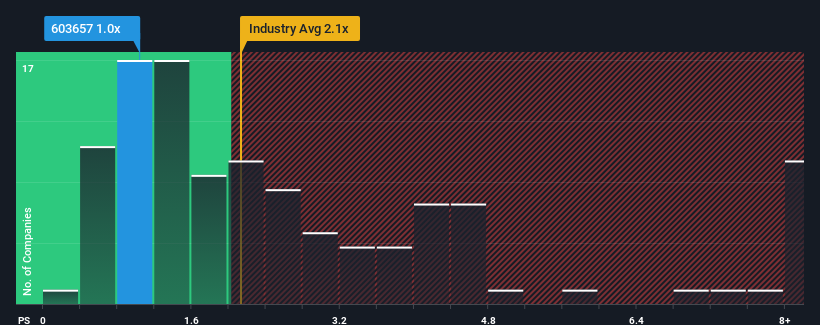

Although its price has surged higher, Jinhua Chunguang TechnologyLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1x, considering almost half of all companies in the Consumer Durables industry in China have P/S ratios greater than 2.1x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Jinhua Chunguang TechnologyLtd

What Does Jinhua Chunguang TechnologyLtd's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Jinhua Chunguang TechnologyLtd's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Jinhua Chunguang TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Jinhua Chunguang TechnologyLtd's Revenue Growth Trending?

Jinhua Chunguang TechnologyLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 4.3% decrease to the company's top line. Still, the latest three year period has seen an excellent 69% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 24% over the next year. That's shaping up to be materially higher than the 11% growth forecast for the broader industry.

In light of this, it's peculiar that Jinhua Chunguang TechnologyLtd's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Jinhua Chunguang TechnologyLtd's P/S?

Despite Jinhua Chunguang TechnologyLtd's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Jinhua Chunguang TechnologyLtd's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 1 warning sign for Jinhua Chunguang TechnologyLtd that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603657

Jinhua Chunguang TechnologyLtd

Engages in the research and development, production, and sales of cleaning appliance hoses accessories and complete machine ODM/OEM products in China and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives