- China

- /

- Consumer Durables

- /

- SHSE:603615

Despite shrinking by CN¥382m in the past week, Chahua Modern Housewares (SHSE:603615) shareholders are still up 25% over 1 year

Chahua Modern Housewares Co., Ltd. (SHSE:603615) shareholders might understandably be very concerned that the share price has dropped 45% in the last quarter. But that doesn't change the reality that over twelve months the stock has done really well. In that time we've seen the stock easily surpass the market return, with a gain of 23%.

While the stock has fallen 13% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Chahua Modern Housewares

While Chahua Modern Housewares made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Chahua Modern Housewares actually shrunk its revenue over the last year, with a reduction of 6.8%. The stock is up 23% in that time, a fine performance given the revenue drop. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

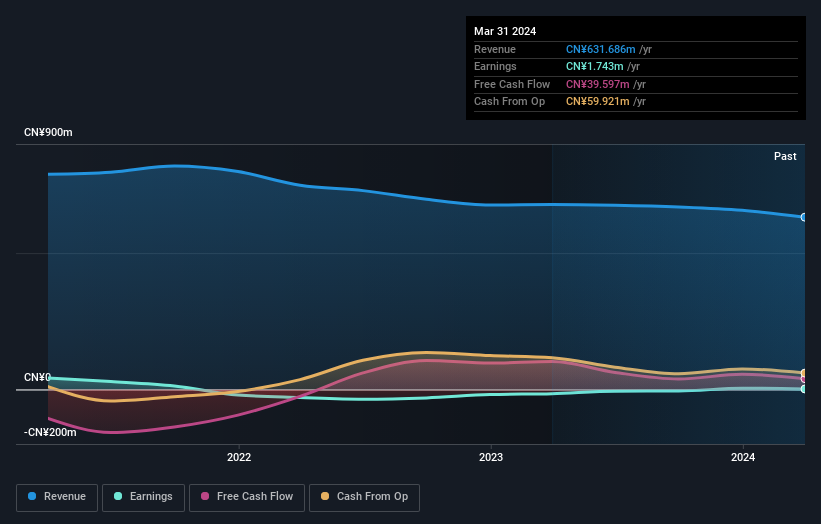

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Chahua Modern Housewares stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Chahua Modern Housewares has rewarded shareholders with a total shareholder return of 25% in the last twelve months. That's including the dividend. That gain is better than the annual TSR over five years, which is 4%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Chahua Modern Housewares better, we need to consider many other factors. For instance, we've identified 4 warning signs for Chahua Modern Housewares (2 are a bit concerning) that you should be aware of.

Of course Chahua Modern Housewares may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603615

Chahua Modern Housewares

Engages in the design, development, production, and sale of various plastic housewares in China.

Adequate balance sheet slight.