- China

- /

- Entertainment

- /

- SZSE:002555

National Bank of Malawi And 2 Other Exceptional Dividend Stocks

Reviewed by Simply Wall St

In a week marked by significant economic data releases and a cooling U.S. labor market, global indices experienced notable declines, with the S&P 500 and Nasdaq Composite both pulling back sharply. Amid this volatility, investors are increasingly turning their attention to dividend stocks as a means of securing steady income in uncertain times. When evaluating dividend stocks, it's crucial to consider factors such as financial stability, consistent earnings growth, and a history of reliable dividend payments—qualities that become even more valuable during periods of market turbulence.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.62% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.11% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.22% | ★★★★★★ |

| Sonae SGPS (ENXTLS:SON) | 6.28% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.91% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.69% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.68% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.39% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.78% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

Click here to see the full list of 2104 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

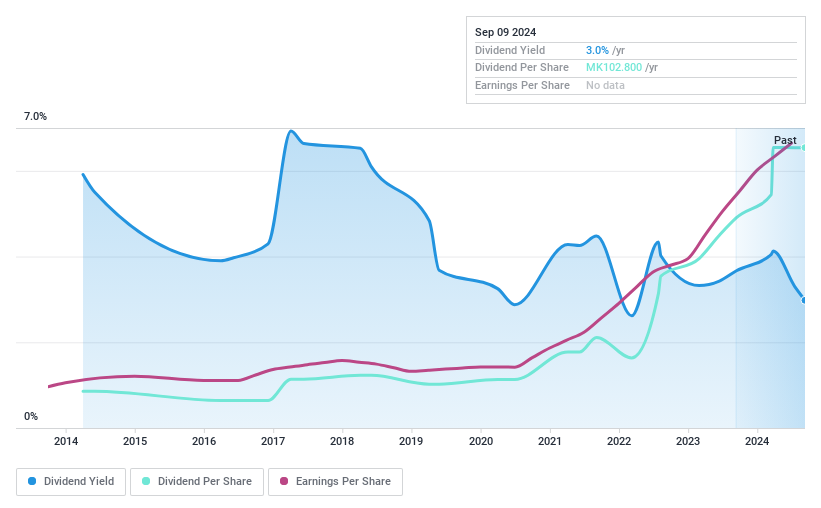

National Bank of Malawi (MAL:NBM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: National Bank of Malawi plc, with a market cap of MWK1.40 trillion, offers retail, SME, corporate, and investment banking services in Malawi through its subsidiaries.

Operations: National Bank of Malawi plc generates revenue through its diverse offerings in retail, SME, corporate, and investment banking services within Malawi.

Dividend Yield: 3.4%

National Bank of Malawi's dividend payments have been volatile over the past decade, with a high level of bad loans (12%) and a low allowance for these loans (16%). Despite this, it maintains a reasonable payout ratio of 66.5%, covering its dividends. The dividend yield stands at 3.43%, slightly above the market average. Earnings have grown by 33.3% annually over the past five years, although the dividend track record remains unstable.

- Navigate through the intricacies of National Bank of Malawi with our comprehensive dividend report here.

- Our valuation report unveils the possibility National Bank of Malawi's shares may be trading at a premium.

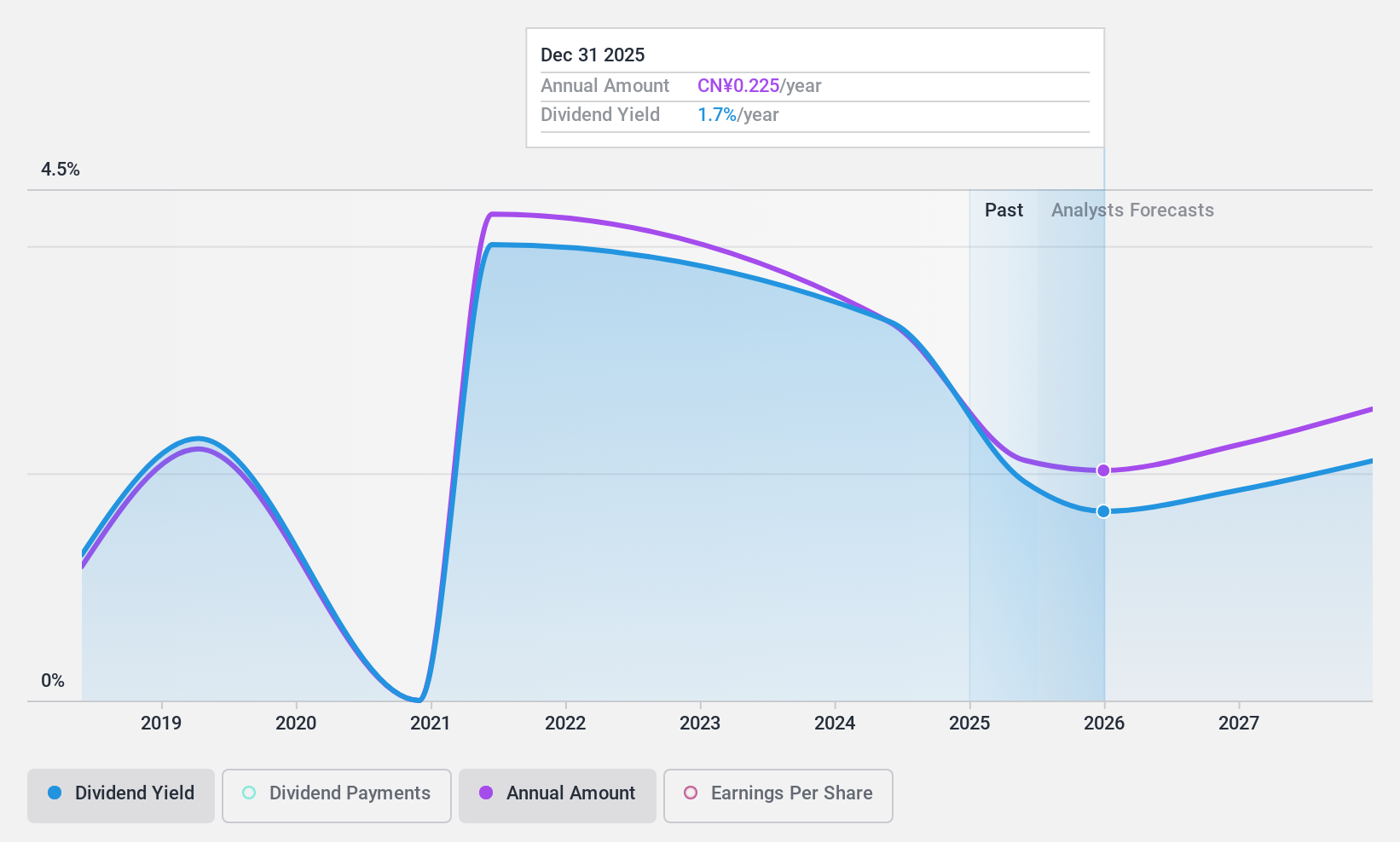

Jiangsu Tianmu Lake TourismLtd (SHSE:603136)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Tianmu Lake Tourism Co., Ltd. operates a tourism resort in China and has a market cap of CN¥2.75 billion.

Operations: Jiangsu Tianmu Lake Tourism Co., Ltd. generates revenue through its tourism resort operations in China, with total revenue segments amounting to CN¥2.75 billion.

Dividend Yield: 3.5%

Jiangsu Tianmu Lake Tourism Ltd.'s dividend payments have been volatile over the past 6 years, despite a reasonable payout ratio of 71% and strong earnings growth of 127.8% last year. The company offers a competitive dividend yield of 3.48%, among the top in the CN market, and its dividends are well-covered by cash flows (43.4%). However, its recent removal from the S&P Global BMI Index raises concerns about stability.

- Take a closer look at Jiangsu Tianmu Lake TourismLtd's potential here in our dividend report.

- Our expertly prepared valuation report Jiangsu Tianmu Lake TourismLtd implies its share price may be lower than expected.

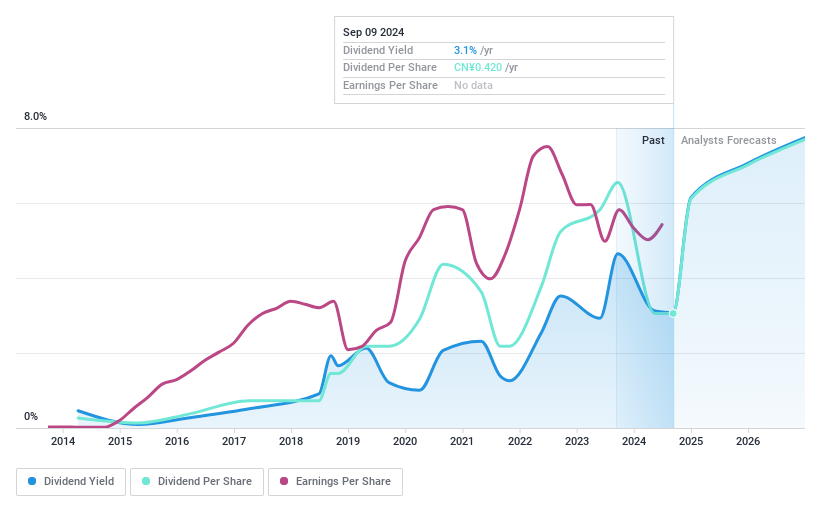

37 Interactive Entertainment Network Technology Group (SZSE:002555)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: 37 Interactive Entertainment Network Technology Group Co., Ltd. (SZSE:002555) operates in the online gaming industry and has a market cap of approximately CN¥28.95 billion.

Operations: 37 Interactive Entertainment Network Technology Group Co., Ltd. (SZSE:002555) generates its revenue primarily from the online gaming industry.

Dividend Yield: 5.9%

37 Interactive Entertainment Network Technology Group's dividend yield of 5.87% ranks in the top 25% of CN market payers but is not well-covered by free cash flows, with a high cash payout ratio of 115.8%. The company's dividends have been volatile over the past decade, despite a reasonable payout ratio of 72.6%. Recent events include a final cash dividend for 2023 and completion of a share buyback program worth CNY100.69 million.

- Get an in-depth perspective on 37 Interactive Entertainment Network Technology Group's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that 37 Interactive Entertainment Network Technology Group is priced lower than what may be justified by its financials.

Summing It All Up

- Gain an insight into the universe of 2104 Top Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 37 Interactive Entertainment Network Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002555

37 Interactive Entertainment Network Technology Group

37 Interactive Entertainment Network Technology Group Co., Ltd.

Excellent balance sheet, good value and pays a dividend.